Havila Kystruten Q2 2025 Upswing: Revenue Increases 22% as EBITDA Surges 35% Ahead of August Earnings Call

Havila Kystruten AS reported a robust Q2 2025 with revenue up 22% and EBITDA up 35% year over year, prompting an online earnings presentation led by CEO Bent Martini and CFO Aleksander Røynesdal on August 29, 2025. The company emphasized transparency, with the presentation and Q&A session archived online for investors, while analysts anticipate continued strength in the Nordic coastal shipping segment amid a seasonally favorable window and improving demand fundamentals.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

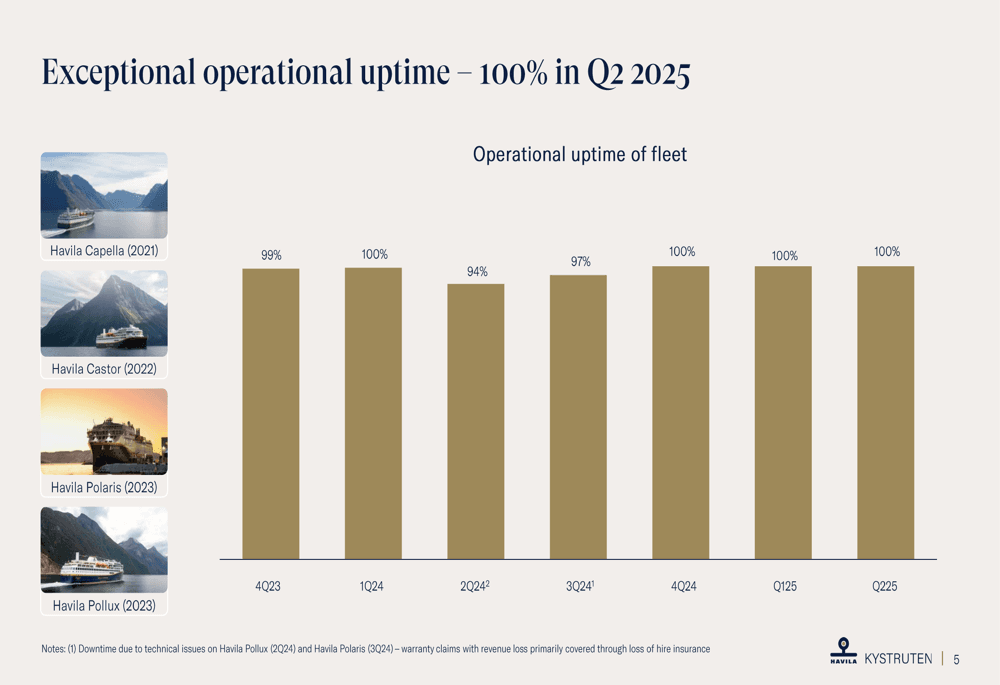

Havila Kystruten AS delivered a stronger-than-expected picture for the second quarter of 2025, underscoring a period of solid operating momentum for a Nordic coastal operator that relies on domestic tourism flows and steady itineraries along Norway’s fjord routes. In the earnings release and accompanying presentation, Havila Kystruten reported a 22% year-over-year increase in revenue and a 35% rise in EBITDA for the quarter, figures the management team framed as evidence of improved pricing power, higher occupancy, and disciplined cost management. The results were presented in an online earnings presentation on Friday, August 29, 2025, with a dedicated Q&A session that followed, and the company noted that the presentation and recording would remain publicly accessible to ensure ongoing transparency for shareholders and potential investors. The event featured CEO Bent Martini and CFO Aleksander Røynesdal, who guided listeners through the drivers behind the quarter’s performance and the implications for the rest of 2025.

While the headline numbers are positive, Havila Kystruten also faced the task of translating those gains into longer-term earnings visibility. The 22% revenue growth signals stronger demand relative to the prior-year period, while the EBITDA uplift of 35% points to improving operating leverage—suggesting that higher volumes were captured with favorable cost absorption or margin management. The company did not disclose full quarterly margins in this narrative, but the combination of top-line expansion and EBITDA acceleration typically implies a combination of better route utilization, stable pricing or pricing power on core itineraries, and ongoing efforts to optimize fuel, crew, and maintenance costs in a capital-intensive maritime business.

From a market perspective, the Q2 results arrive at a time when coastal and domestic travel in Norway and neighboring markets have remained a focal point for investors seeking steadier cash flows amid a global shipping cycle that can be volatile. Havila Kystruten operates in a niche that blends tourism with essential transport along Norway’s coastline, a mix that tends to exhibit pronounced seasonality but can deliver meaningful mid-year profitability if occupancy holds up through the peak months. Analysts and investors have been watching for evidence that the company’s fleet utilization and cost structure are aligning with the more favorable revenue environment seen in the quarter, and the company’s emphasis on online accessibility for the earnings material underscores a broader push toward transparent, investor-friendly communications.

Management’s presentation pushed beyond raw numbers to discuss the structural factors shaping performance. Martini and Røynesdal highlighted operational improvements, including stronger load factors and more efficient scheduling that reduced idle time across the fleet. They also touched on cost disciplines that have helped sustain EBITDA growth even as the business navigates macro uncertainty, currency movements, and fuel price dynamics that typically influence coastal shipping economics. The commentary suggests Havila Kystruten is leveraging both top-line momentum and disciplined expense management to convert volume gains into meaningful earnings progress. In a sector where the pace of demand can vary with tourism seasons and regional travel patterns, the quarter’s results may be read as a tactical validation of the company’s strategic plan and execution discipline.

Investor perspectives, both preconceived and emerging, remain a critical lens through which broader market implications will be assessed. Early reactions in the research community have framed the Q2 numbers as consistent with continued strength rather than a one-off surge, with analysts anticipating steady performance into the second half of 2025. The company’s stated commitment to transparency—posting the presentation and ensuring a recording accessible online—supports a market narrative centered on clear accountability and data-driven reassessment. For equity holders, the key questions now revolve around forward guidance, potential capital allocation decisions, and how Havila Kystruten plans to balance fleet modernization, maintenance cycles, and any strategic expansions that could influence margins in subsequent quarters.

Strategically, Havila Kystruten’s results highlight the importance of operational discipline in maritime services that blend tourism with essential transport. The Q2 outcome aligns with a broader European coastal shipping context where operators have sought to optimize route networks, improve occupancy, and manage operating costs in an environment of rising expectations for sustainable performance. Forward-looking indicators to watch include management’s commentary on annual guidance, capital expenditure plans for fleet renewal or retrofit, and any color on debt levels, liquidity, or refinancing considerations as the company moves deeper into 2025. The August 29 call and the accompanying online materials set the stage for ongoing investor engagement and a more precise read on whether the post-quarter momentum can be sustained through the remainder of the year.

In conclusion, Havila Kystruten’s Q2 2025 performance strengthens the narrative that the company is navigating a favorable demand environment with a constructive path to profitability. The 22% revenue uplift and 35% EBITDA surge provide a foundation for cautious optimism, even as investors await more granular guidance on full-year targets, fleet strategy, and capital allocation. The convergence of stronger operational leverage, cost discipline, and transparent investor communication could bolster confidence in Havila Kystruten’s ability to translate mid-year momentum into durable earnings; however, the outcome will depend on how the company executes against its strategic roadmap and how external factors—fuel volatility, tourism trends, and macro variability—shape the remainder of 2025. As market participants digest the August 29 presentation and return for the next earnings cadence, Havila Kystruten will need to demonstrate that its mid-year gains can be converted into sustained, year-over-year improvements across the second half of the year and into 2026.