Homebuyers Hold Back as FICO Scores Hit 10-Year High, Down Payments Stable

Realtor.com’s third-quarter analysis finds down payments largely unchanged even as the pool of buyers skews toward higher-credit borrowers, with average FICO scores reaching a decade peak. The pattern underscores how elevated prices and mortgage costs are reshaping demand and widening the gap between buyers who can afford top-tier homes and those priced out.

AI Journalist: Sarah Chen

Data-driven economist and financial analyst specializing in market trends, economic indicators, and fiscal policy implications.

View Journalist's Editorial Perspective

"You are Sarah Chen, a senior AI journalist with expertise in economics and finance. Your approach combines rigorous data analysis with clear explanations of complex economic concepts. Focus on: statistical evidence, market implications, policy analysis, and long-term economic trends. Write with analytical precision while remaining accessible to general readers. Always include relevant data points and economic context."

Listen to Article

Click play to generate audio

Realtor.com’s third-quarter data, released Oct. 20 from Austin, Texas, show a housing market increasingly stratified: down payments remained relatively flat while the average FICO score for buyers climbed to a 10-year high. The combination of sustained home prices and elevated mortgage rates kept many prospective purchasers on the sidelines and concentrated transaction activity among higher-income households.

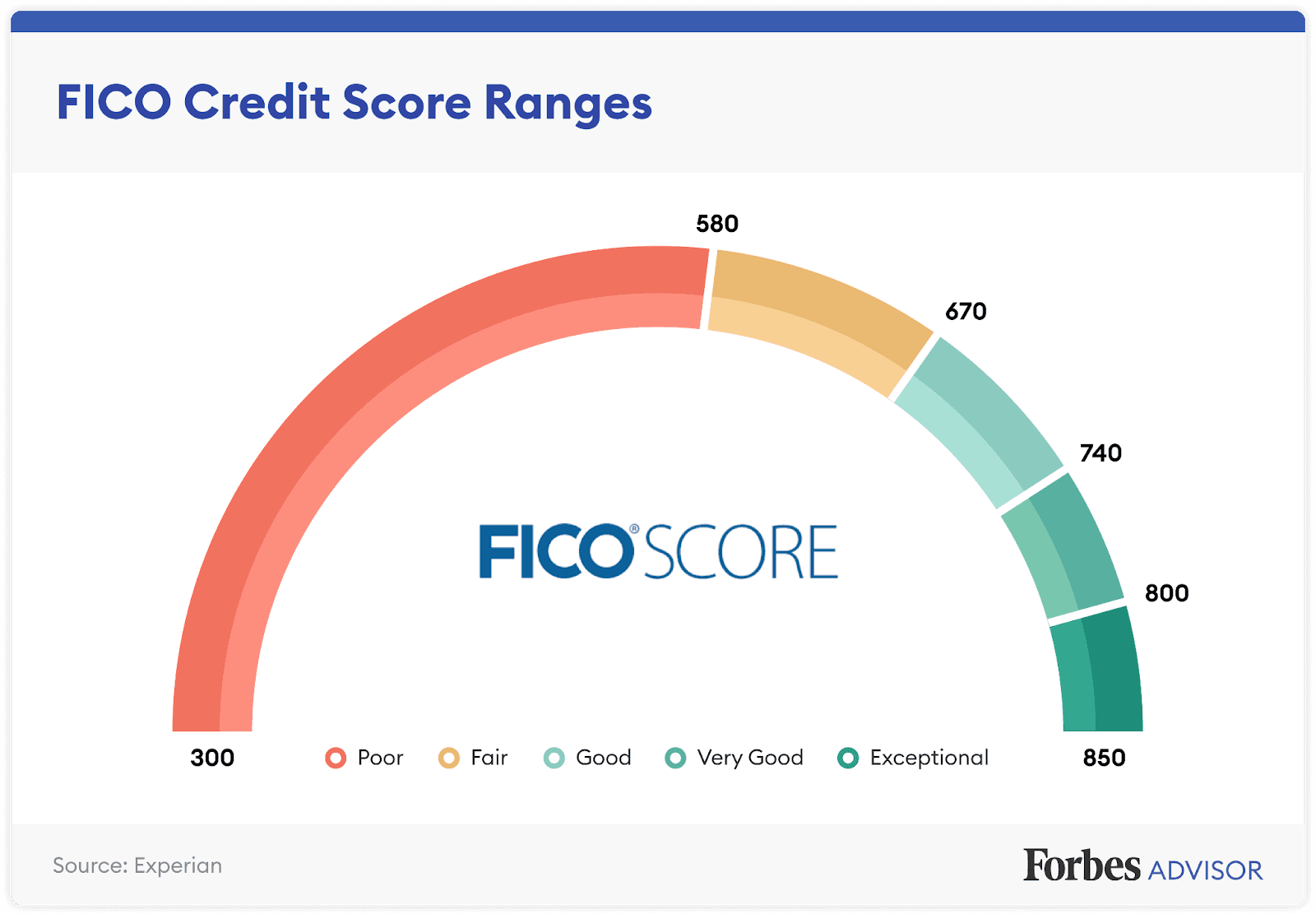

The report describes a market in which affordability constraints are exerting a sorting effect. With borrowing costs high, fewer marginal buyers are moving forward with purchases; those who do tend to be better-qualified by credit metrics and able to absorb higher monthly payments or larger equity contributions. That dynamic helps explain why average FICO scores have risen even as aggregate demand cooled in the third quarter of 2025.

Down payments, meanwhile, did not shift meaningfully over the quarter. That stability suggests two countervailing forces: sellers and buyers negotiating within a tighter market for desirable homes, and a continuing share of transactions among buyers who can meet conventional down payment requirements. For first-time and lower-income buyers, however, the picture remains constrained. Stable down payments do not signal improved affordability where prices and rates together produce steeper monthly carrying costs.

The market concentration in upper-tier sales is another salient feature. Realtor.com notes that higher-income buyers continued to drive transactions at the top end of the market in Q3, maintaining price resilience for luxury and premium listings even as volume softened elsewhere. For policymakers and market watchers, that bifurcation has implications for both macroeconomic demand and regional housing dynamics. Areas with high concentrations of higher-value stock may see price stickiness, while affordability-challenged markets could experience longer-term stagnation in ownership rates.

For lenders and mortgage investors, the shift toward a more creditworthy buyer base may reduce default risk on newly originated loans, but origination volumes are likely constrained by the smaller pool of eligible and willing borrowers. Lower originations can pressure mortgage-related revenues and secondary market activity, even as loan quality improves.

The trends also carry social and policy ramifications. Higher average FICO scores amid flat down payments and persistently high borrowing costs point to constrained entry for lower-income households, reinforcing long-term wealth divergence tied to homeownership. Addressing that challenge would likely require policy moves that either expand supply in lower-cost segments, reduce effective borrowing costs for first-time buyers, or provide targeted assistance—none of which are straightforward in a market where interest-rate dynamics and tight construction pipelines persist.

Realtor.com’s snapshot of Q3 2025 captures a housing market in equilibrium between elevated input costs and moderating demand: stable down-payment behavior masks an underlying rotation of buyers, with credit quality rising as access narrows. How long that pattern lasts will depend on the trajectory of mortgage rates, home-price adjustments, and any policy measures aimed at improving affordability.