House Overrides Leadership, Extends ACA Premium Tax Credits Three Years

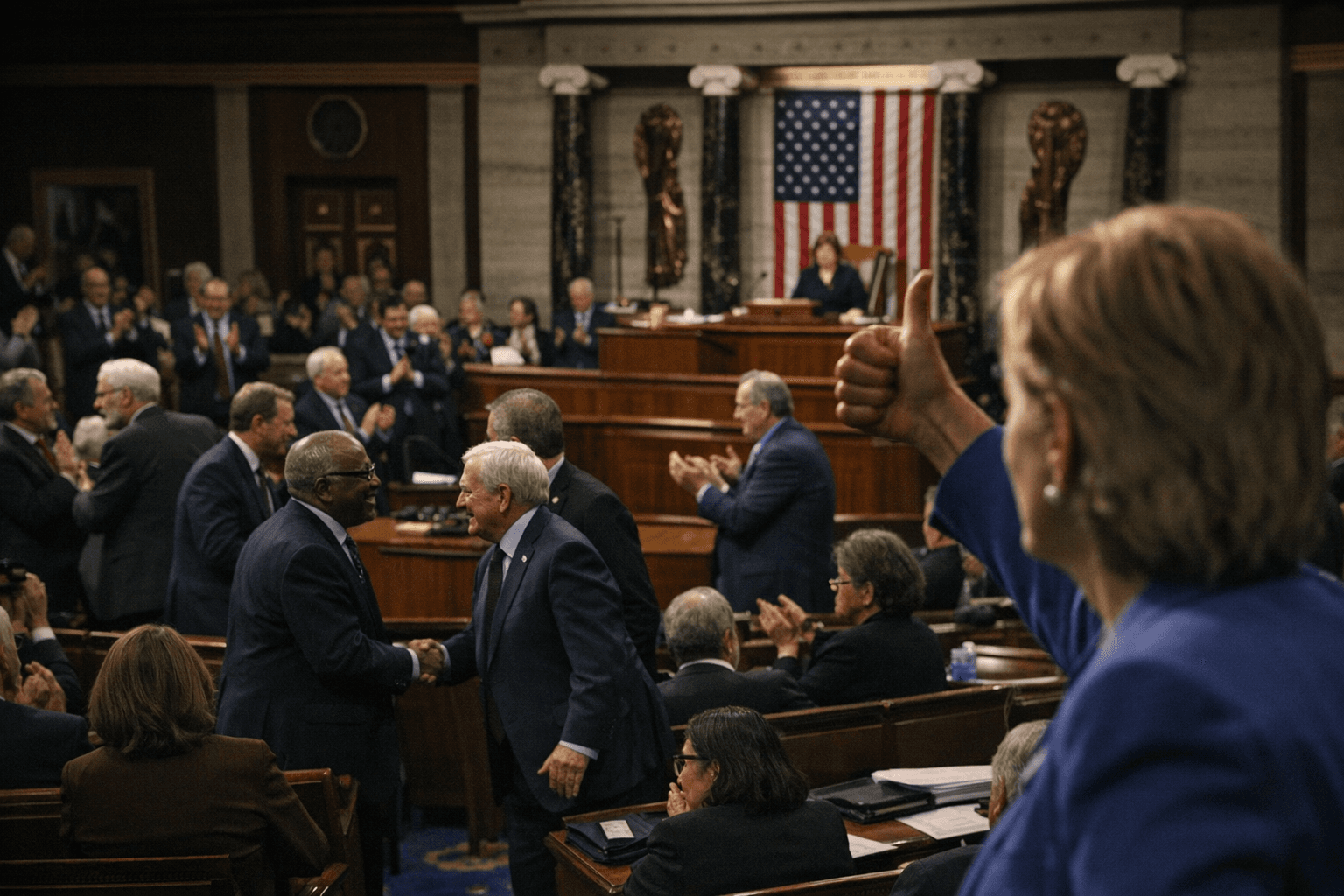

The House voted 230-196 on Jan. 8 to extend enhanced Affordable Care Act premium tax credits for three years, a move that could blunt steep premium increases and expand coverage for millions. The rare bipartisan coalition that forced the vote marks a significant rebuke of House Republican leadership and shifts the pressure to the Senate, where resistance and demands for reforms remain.

The House of Representatives passed legislation on Jan. 8 that would reinstate enhanced Affordable Care Act premium tax credits for three years, voting 230-196 to override objections from Republican leadership. The measure drew an unusual coalition when 17 House Republicans joined essentially all House Democrats to secure passage, after Democrats used a discharge petition to force consideration of the bill.

The discharge petition bypassed Speaker Mike Johnson, who had worked to prevent the measure from reaching the floor and urged Republicans to oppose it. A procedural motion earlier in the week had set the stage by passing 221-205, after nine Republicans crossed the aisle to join Democrats, allowing debate and the final vote to proceed.

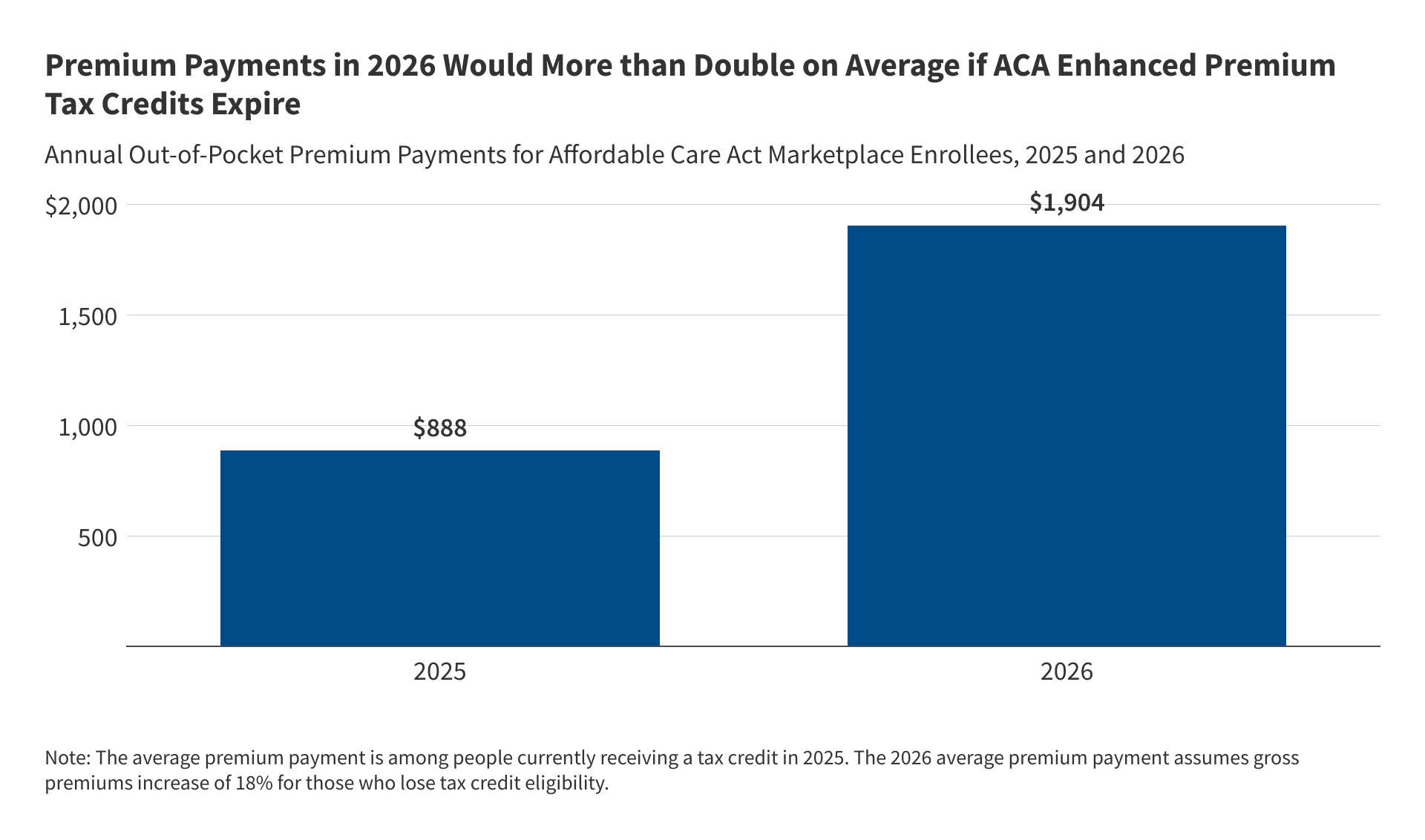

Supporters framed the package as an urgent response to an affordability crisis that has left many marketplace enrollees facing sudden premium spikes after enhanced credits expired late in 2025. House Democratic Leader Hakeem Jeffries, who pushed for passage, said "the affordability crisis is not a 'hoax,' it is very real — despite what Donald Trump has had to say," and argued the extension would provide immediate relief to families grappling with rising costs.

The nonpartisan Congressional Budget Office estimated that a three-year extension would increase the federal deficit by about $80.6 billion over the next decade, while projecting gains in coverage. The CBO forecast that the bill would increase the number of people with health insurance by roughly 100,000 this year, by 3 million in 2027, by 4 million in 2028 and by 1.1 million in 2029. Those gains reflect both expanded eligibility and reductions in out-of-pocket burdens that make plans affordable to lower-income and middle-income households.

Public health advocates and some members emphasized the uneven harm already occurring since the credits expired, noting that working families, parents and children are particularly vulnerable to losing coverage or facing unaffordable premiums. Rep. Jimmy Gomez said the extension would help protect millions from sharp premium increases and highlighted warnings from the Dads Caucus that parents and children would be hit hardest by higher costs.

The vote constituted a high-profile rebuke of GOP leadership, with news accounts calling the coalition rare and characterizing the Republicans who broke ranks as renegades. House passage sends the bill to the Senate, where leaders signaled a tougher path. Senate Majority Leader John Thune said there is "no appetite" for an extension there as written, pointing to ongoing bipartisan discussions among senators and House members and indicating lawmakers are waiting to see if a working group can produce a proposal that includes reforms. Senate action could include amendments or alternative compromise language.

For patients and community clinics, the outcome in the Senate will determine whether families see immediate relief from premium shocks or face another period of uncertainty. Advocates say the policy choices ahead will shape access to care for millions and expose broader tensions between short-term affordability measures and longer-term concerns about program integrity and federal spending.

Know something we missed? Have a correction or additional information?

Submit a Tip