Insurers Raise Black Sea War Risk Premiums, Shipping Costs Set to Rise

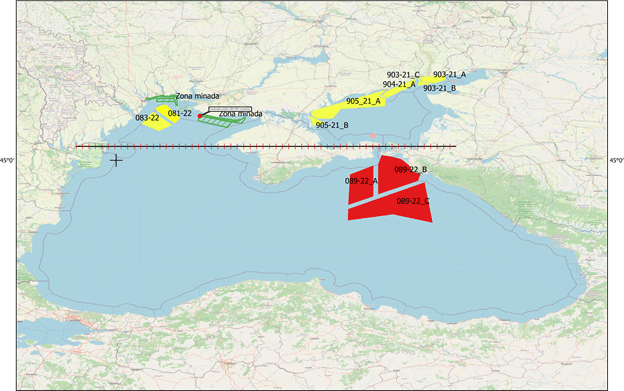

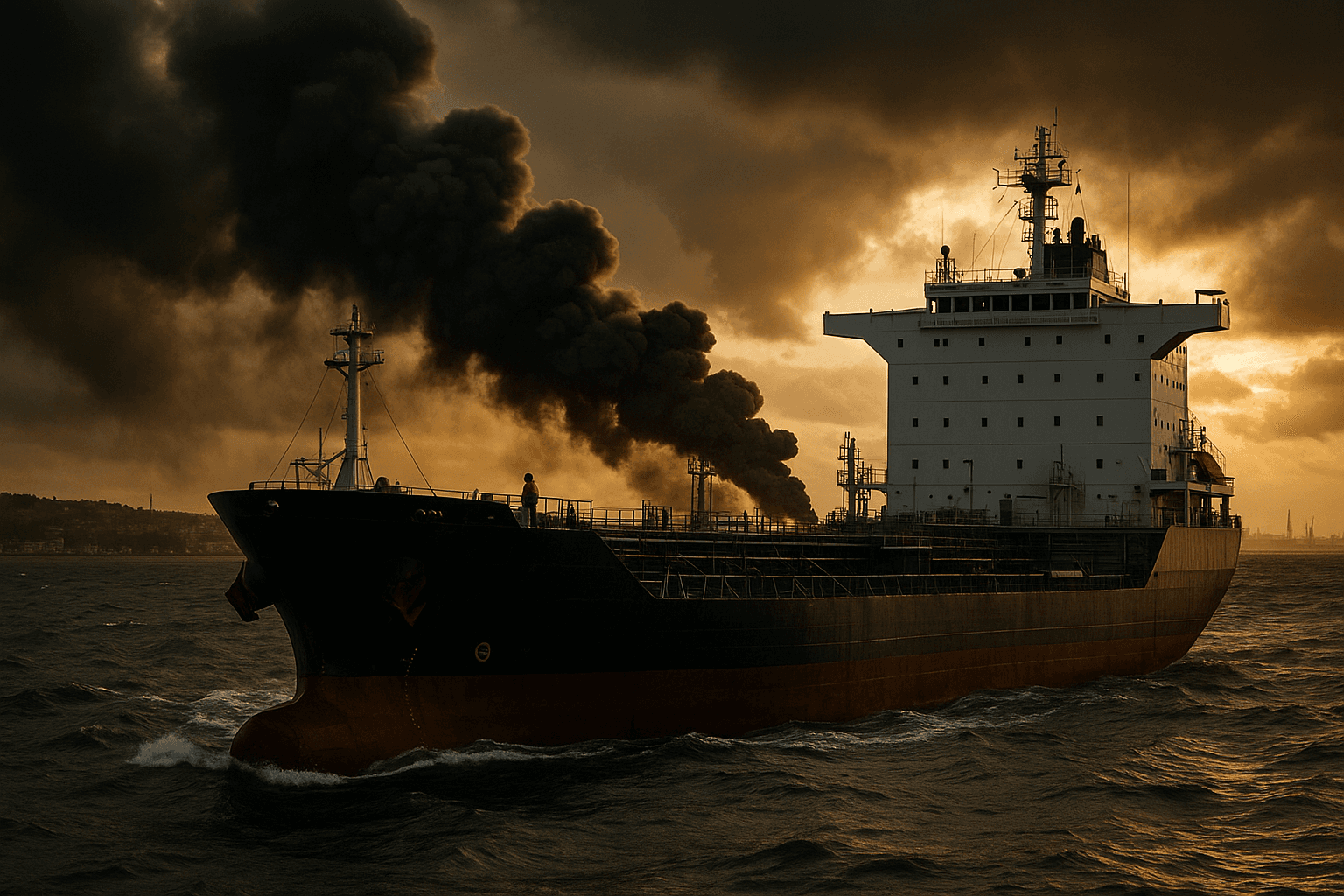

Maritime insurers and shipping firms raised Black Sea war risk premiums and reappraised coverage after a string of tanker strikes on Dec. 10, marking a fresh escalation for vessels linked to Russia’s "shadow fleet" including the Dashan. The move threatens higher freight rates, tighter insurance capacity and longer reroute costs for oil shipments tied to Russia, with broader implications for energy markets and maritime underwriting.

Insurers and shipping analysts moved swiftly on Dec. 10 to raise war risk premiums and reassess cover for vessels operating in and near the Black Sea after a series of strikes that targeted tankers associated with Russia’s "shadow fleet," among them the vessel Dashan. Underwriters said they were reviewing cover terms on a daily basis and that some carriers had already begun avoiding Black Sea transits, a shift that industry experts said would ripple through freight markets and trade flows for Russian linked oil shipments.

The immediate insurance response tightened available cover in a region that serves as a key maritime corridor for a range of energy cargoes. Reappraised risk assessments cited a higher likelihood of drone attacks and limpet style devices on commercial vessels, prompting brokers to impose additional surcharges and, in some cases, seek alternative insurers for specific transits. The faster underwriting repricing reflects a growing tendency among major insurers to limit exposure in active conflict areas to protect reinsurance capacity and capital ratios.

Market participants expect the insurance repricing to translate quickly into higher freight costs. When carriers avoid the Black Sea, voyages lengthen as ships reroute, driving up voyage times and bunker fuel consumption. That pattern increases spot freight rates and can widen differentials between benchmark crudes and barrels that rely on Black Sea loading. For charterers and refiners, those added costs are likely to show up in higher delivery premiums and reduced scheduling flexibility, especially for cargoes connected to Russian seaborne exports.

Availability of cover is equally consequential. A reduction in willing underwriters constrains capacity and forces more cargoes into the spot market where short term freight can be volatile. Smaller owners that operate older tonnage often used to obscure trade ties through the so called "shadow fleet" may find themselves unable to secure reliable cover, increasing the likelihood that owners will idle vessels or seek to reflag and reroute cargoes through longer pipeline or overland corridors where feasible.

Policy responses could follow commercial moves. Governments that rely on uninterrupted energy flows from the region face a choice between diplomatic escalation, bolstered naval patrols, or temporary corridors supported by states to protect merchant shipping. Historically, state provided assurances or naval escorts have helped reduce premiums but carry fiscal and geopolitical costs. At the same time, sanctions and regulatory scrutiny around vessel ownership add complexity for insurers trying to identify permissible cover.

Long term trends in the maritime insurance market point to a structural shift. Underwriters have become more rigorous about excluding regions perceived as high risk and more willing to apply rapid surcharge adjustments to preserve solvency. For global energy markets, persistent Black Sea insecurity would accelerate diversification of routes and buyers, shore up demand for pipeline capacity where available, and sustain higher insurance premia as a new normal.

The Dec. 10 strikes underscore a broader lesson for trade resilience. Short term market dislocations may be manageable, but repeated attacks would impose sustained economic costs through higher freight and insurance expenditures, greater logistical complexity and amplified price volatility for consumers and industrial users alike.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip