Investors Rotate Into Energy Stocks as Tech Loses Favor

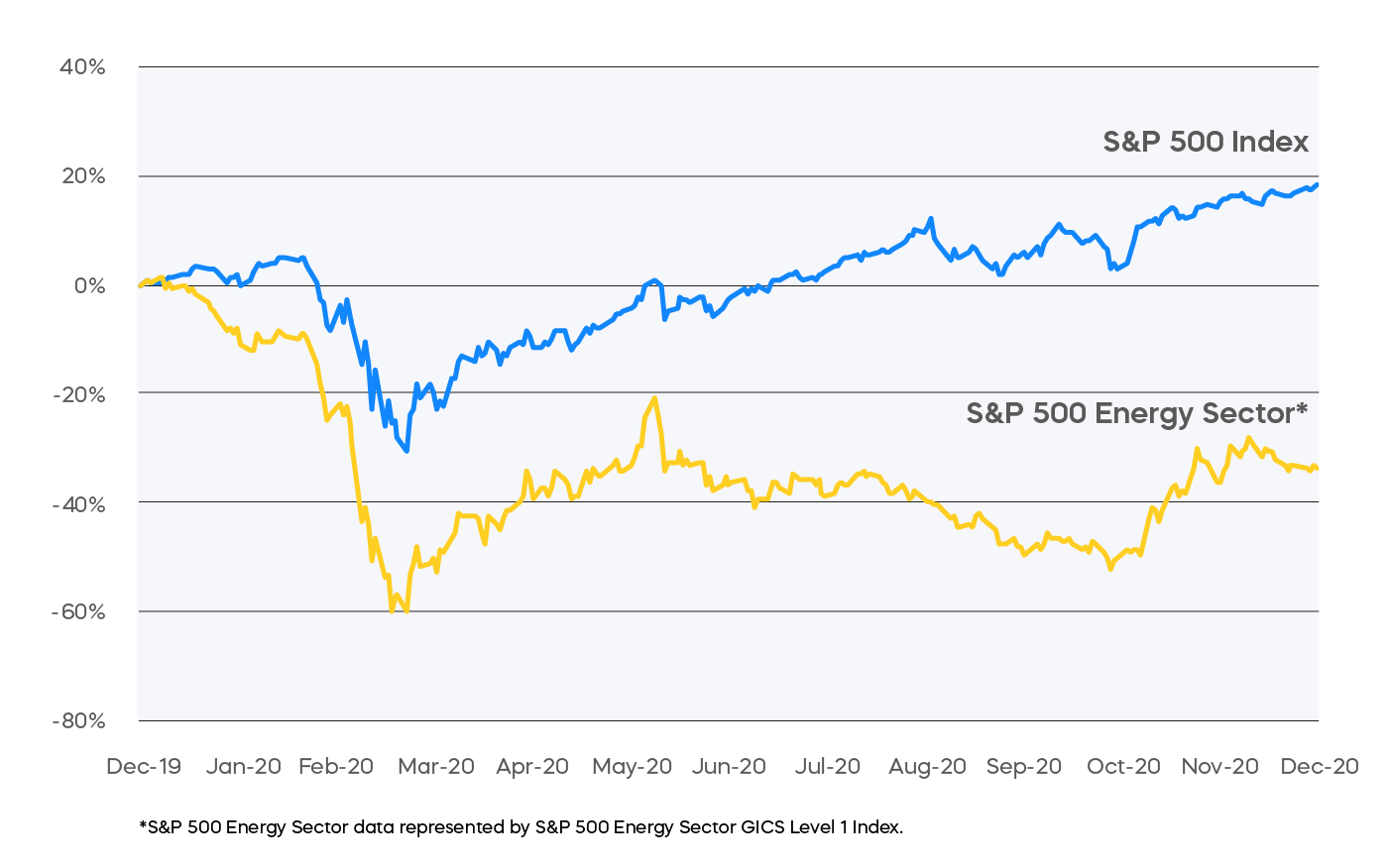

Investors are reallocating capital into energy producers after a prolonged period of underweighting, signaling a shift from richly valued technology names amid softer central bank signals. The move matters because it could reshape sector leadership, influence dividend income strategies, and test whether the recovery in energy is cyclical or a more lasting revaluation.

Money managers and institutional investors accelerated purchases of energy companies on Thursday as the market cooled on richly valued technology stocks and responded to central banks suggesting a less aggressive interest rate posture. The shift has brought fresh attention to producers and midstream infrastructure firms that spent much of the past several years trailing the broader market.

Market participants said the rotation is being driven by a combination of relative valuation gaps, reliable cash returns, and a clearer policy backdrop. After years of underweighting the sector, several portfolio managers have increased exposure to energy names because they trade at lower multiples than growth oriented tech peers, and because many energy companies offer dividend yields that look attractive in a low yield shock environment. Softer signals from central banks have reduced the premium on faster growing, rate sensitive equities and made dividend paying stocks more competitive in total return terms.

Flow data reported by market outlets showed a notable uptick in capital moving into energy focused exchange traded funds and active strategies over the past several weeks, reversing a long trend of outflows from the sector. That movement has coincided with a broader rebalancing inside diversified funds, where managers trimmed some high valuation technology positions to free up risk budget for value and cyclicals.

Analysts cited in market coverage pointed to favorable policy tailwinds for energy infrastructure and producers. Investment in pipelines, storage and export capacity has gained political tolerance as countries balance energy security with climate goals, supporting stable cash flows for regulated and contract based businesses. On the producer side, higher returns on capital driven by disciplined supply management have improved free cash flow profiles, enabling dividends and buybacks that appeal to income oriented investors.

The central question for investors is whether the interest in energy is cyclical, driven by short term rotation and commodity price moves, or structural, reflecting a lasting reappraisal of the sector. Those who view the shift as cyclical warn that commodity volatility, technological advances in renewables, and longer term decarbonization policies could cap gains. Those who argue for a structural change cite sustained capital discipline in oil and gas, expanding role for liquefied natural gas in global markets, and durable earnings for midstream assets as reasons the sector can sustain higher multiples than it has carried in recent years.

Market implications extend beyond sector performance. A durable move into energy could lower volatility in income oriented corners of the market while pressuring momentum driven tech valuations. It could also influence inflation dynamics if renewed energy investment alters supply in ways that affect commodity prices. Policymakers and regulators will watch investment shifts closely since changes in capital allocation affect energy security, emissions trajectories, and infrastructure financing.

For now the rotation remains under way and closely watched. How long it lasts will depend on corporate capital allocation decisions, oil and gas market fundamentals, and whether central banks maintain a more benign interest rate outlook into next year.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip