Wall Street Pulls Back as Broadcom, Oracle Renew AI Concerns

U.S. stocks slid on December 12 as investors rotated away from a narrow group of technology leaders after Broadcom flagged margin pressure from a growing mix of lower margin AI products, and Oracle’s heavy AI infrastructure spending continued to unsettle sentiment. The move matters because it highlights growing scrutiny of profit quality in the AI rally, and could reshape where investors allocate capital into 2026.

U.S. equities fell on Friday as the market reassessed the profit dynamics behind the technology sector’s long rally, with Broadcom’s cautionary outlook and Oracle’s elevated AI spending prompting a broad rotation into less richly valued areas. The S&P 500 closed lower, led by sharper losses in the Nasdaq as investors pared back exposure to a handful of chip makers and software firms that have driven much of this year’s gains.

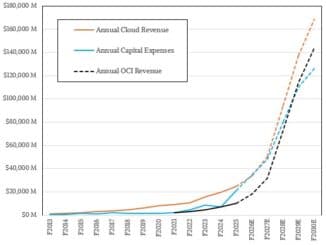

Broadcom’s warning that a rising share of revenue tied to lower margin AI products could compress future profitability reverberated through the semiconductor sector and among suppliers. Shares of Broadcom were among the worst performers on the day, underscoring how quickly concerns about margin mix can hit investor sentiment when a stock has become a market bellwether for the AI boom. Oracle’s ongoing, large scale investments in AI infrastructure likewise weighed on its stock and on broader software names, as investors questioned the near term return on capital for heavy spending cycles.

The market reaction reflects an intensifying focus on earnings quality rather than raw top line growth. Analysts and portfolio managers said they were reexamining earnings per share trajectories and free cash flow projections for companies whose AI revenues are scaling but where unit economics remain opaque. That shift helped value and cyclicals outperform relative to momentum and growth oriented benchmarks during Friday’s session.

The rotation comes against a backdrop of concentrated index performance this year, where a small number of large cap technology firms accounted for a disproportionate share of index returns. The episode serves as a reminder that concentration can magnify index volatility when investor expectations for profitability change. For index investors and passive funds, even modest reweighting by active managers or retail flows can produce outsized moves in headline benchmarks.

Policy makers and fixed income markets are likely to monitor whether profit margin deterioration in technology translates into weaker corporate capex or hiring next year. If AI spending proves more front loaded and margins fall short of expectations, economists say that could cool investment and dampen growth impulses that have supported equity valuations. Conversely, if companies can translate AI investments into sustained pricing power and productivity gains, longer term earnings prospects would remain intact.

For investors, the near term implication is a recalibration of risk premiums assigned to AI exposed names. Portfolio decisions will increasingly hinge on margin disclosure and unit economics from both hardware and software providers. In the longer run, the episode spotlights a structural tension in the AI era, where fast revenue growth can coexist with margin compression if product mixes shift, and where market leadership will depend as much on profitability as on innovation.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip