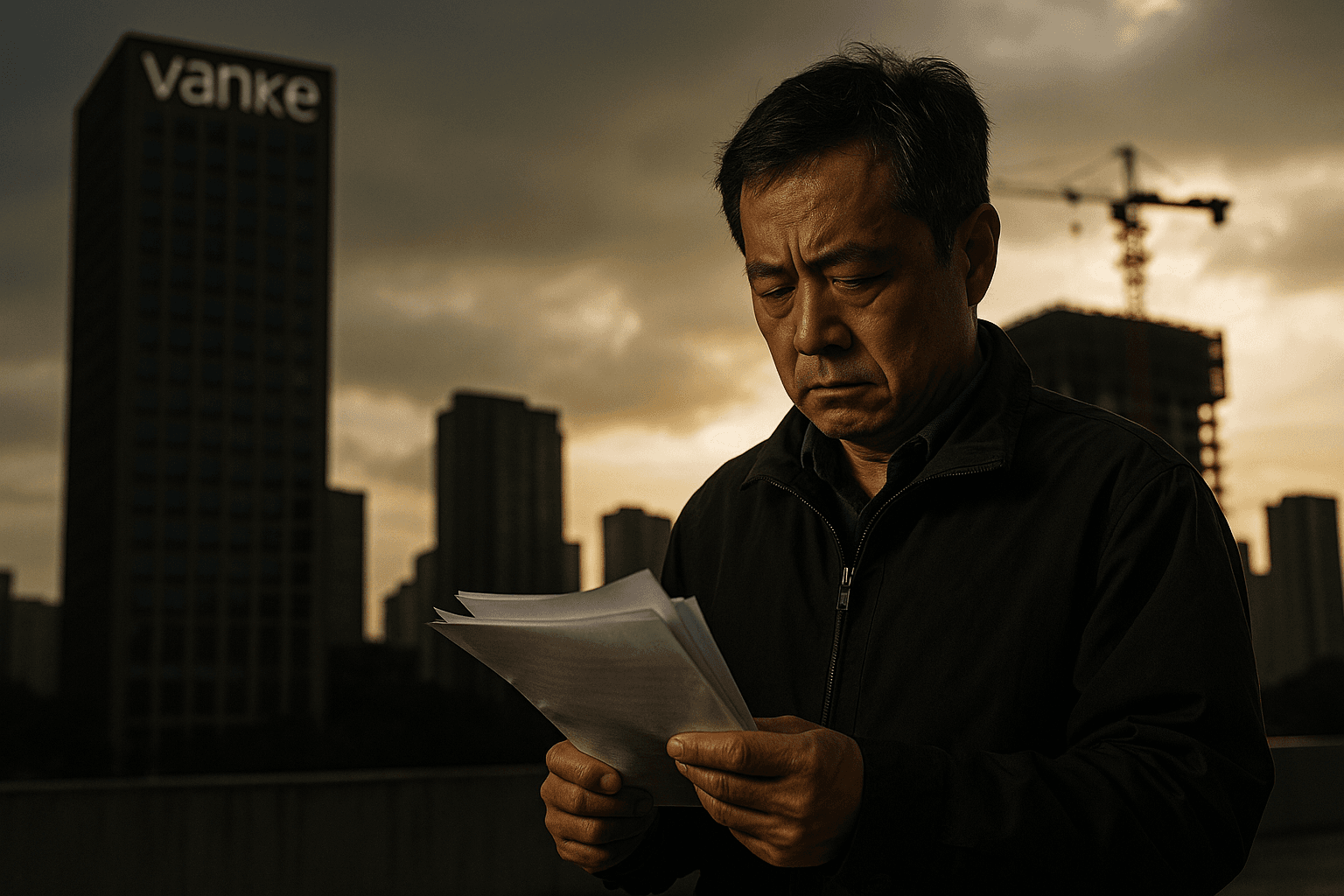

Vanke Bondholders Reject Extension, Developer Faces Possible Default

Bondholders of China Vanke rejected a request to push back repayment by one year, leaving the state backed developer with a five business day grace period to meet a 2 billion yuan obligation. The outcome raises the immediate prospect of a formal default and has revived market concerns about liquidity across China’s fragile property sector.

Bondholders of China Vanke Co Ltd rejected a proposal to extend the repayment of an onshore bond by one year, a public filing showed, leaving the developer facing a narrow window to make a 2 billion yuan payment due on December 15, 2025. Under the bond’s terms, Vanke now has a five business day grace period to complete the scheduled payment, after which failure to pay would constitute a potential repayment default.

A filing to the National Association of Financial Market Institutional Investors indicated the extension proposal did not secure sufficient support from holders. People with knowledge of the matter said the decisive vote took place late on Friday and declined to be identified. The outstanding payment equals roughly $280 million based on an exchange rate of $1 to 7.0548 yuan.

The extension would have kept the bond’s coupon at 3 percent during the additional year, according to market accounts. Separately, Vanke recently chose not to exercise an issuer right that would have allowed early redemption of a separate 1.1 billion yuan bond, a decision market participants interpreted as an indication of mounting liquidity strain.

Vanke is one of China’s largest developers with projects across major cities, and its state backing makes it a high profile name in the industry. Still, the company did not provide public comment on the vote or lay out a contingency financing plan. The failure to obtain bondholder approval removes one planned option for easing near term cash pressure and intensifies scrutiny of how Vanke will meet short term obligations.

The immediate market question is whether the company can source the funds to settle the 2 billion yuan within the five business day grace period or secure alternative creditor arrangements. If Vanke is unable to pay on time, the event could trigger formal default declarations and potentially activate cross default clauses in other contracts, putting additional liabilities at risk and complicating ongoing creditor negotiations.

The rejection has broader implications for investor sentiment in China’s onshore property debt market. The sector has weathered a prolonged crisis that included a string of high profile defaults earlier in the decade, and lenders and bond investors remain cautious about developers’ liquidity profiles. A default by a firm with Vanke’s scale would sharpen concerns about contagion in onshore markets and could increase funding costs for other issuers.

Policy makers have in recent years walked a delicate line between stabilizing housing markets and enforcing financial discipline. How authorities and creditors respond to any missed payment by Vanke will be closely watched by domestic and international investors as a test of that balancing act. In the near term, market participants will monitor daily for confirmation of payment, emergency financing moves, or new creditor agreements as the grace period unfolds.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip