Musk Confirms SpaceX Preparing for IPO, Targeting 2026 Window

Elon Musk signaled that SpaceX is preparing for a public offering targeted for 2026 by endorsing an Ars Technica analysis on X, a development that validates weeks of reporting about the company moving toward a massive stock sale. The confirmation sharpens questions about valuation, potential fundraising that could top thirty billion dollars, and the broader market and policy implications of a likely planetary sized listing.

Elon Musk on December 11 and 12 signaled that SpaceX is preparing for an initial public offering targeted for 2026 when he replied on X to Ars Technica senior space editor Eric Berger, writing, "As usual, Eric is accurate." The endorsement followed Berger’s analysis arguing that the timing is ripe for a public listing in part because of rapid growth in Starlink, advances in Starship, expanding spectrum opportunities, and possible demand for space based data center services linked to artificial intelligence.

The public exchange crystallizes reporting from multiple outlets in recent weeks. The Wall Street Journal and Bloomberg have documented private market activity and IPO planning. The Journal cited secondary share transactions that implied a near term private valuation of roughly eight hundred billion dollars, up from about four hundred billion in a July secondary sale. Bloomberg reported that SpaceX is pressing forward with plans to raise significantly more than thirty billion dollars and is targeting a valuation near one and a half trillion dollars at the listing, while noting that a public offering could occur around mid to late 2026 or possibly slip into 2027.

Company comments have been limited but consequential. Bloomberg and other outlets reported that Chief Financial Officer Bret Johnsen told investors the company was considering a 2026 offering. Musk also posted on X on December 6 that SpaceX "has been cash flow positive for many years and does periodic stock buybacks twice a year to provide liquidity for employees and investors," a disclosure that frames the firm’s ability to meet internal liquidity needs before a public sale.

Market implications are large. An offering that raised more than thirty billion dollars would rival or exceed the largest IPOs in history and could rearrange allocations among institutional investors and sovereign wealth funds. Valuation discrepancies across reports create meaningful uncertainty for price discovery. A move from a private secondary valuation near eight hundred billion dollars to a public valuation at or above one and a half trillion dollars would represent a roughly 90 percent premium and mark SpaceX as one of the largest companies by market capitalization at debut.

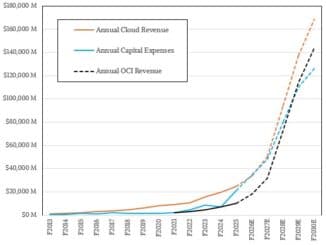

Strategic drivers underlying the reported targets include Starlink revenue growth, with regional reports citing roughly fifteen billion dollars in revenue for the current year, progress in heavy lift and reusable launch capability through Starship, and the monetization of spectrum for communications and data services. Analysts have also linked the potential IPO to emerging demand for space based compute and data capabilities that could service artificial intelligence workloads, a market that could attract strategic corporate investors from the cloud and semiconductor sectors.

Policy and regulatory questions will move to the fore if the company files. Spectrum allocation, export controls, national security reviews, and overseas sales by a newly public SpaceX will draw scrutiny from regulators and lawmakers. Locally, reports said the IPO news buoyed regional aerospace suppliers, underscoring the economic ripple effects for Texas manufacturing hubs.

Even as the confirmation narrows speculation, multiple unresolved items remain, including exact timing, final valuation, the financial structure of the offering, and how Tesla shareholder participation might be arranged. Investors and policymakers will watch filings and regulator filings closely in the months ahead for firmer answers.

Know something we missed? Have a correction or additional information?

Submit a Tip