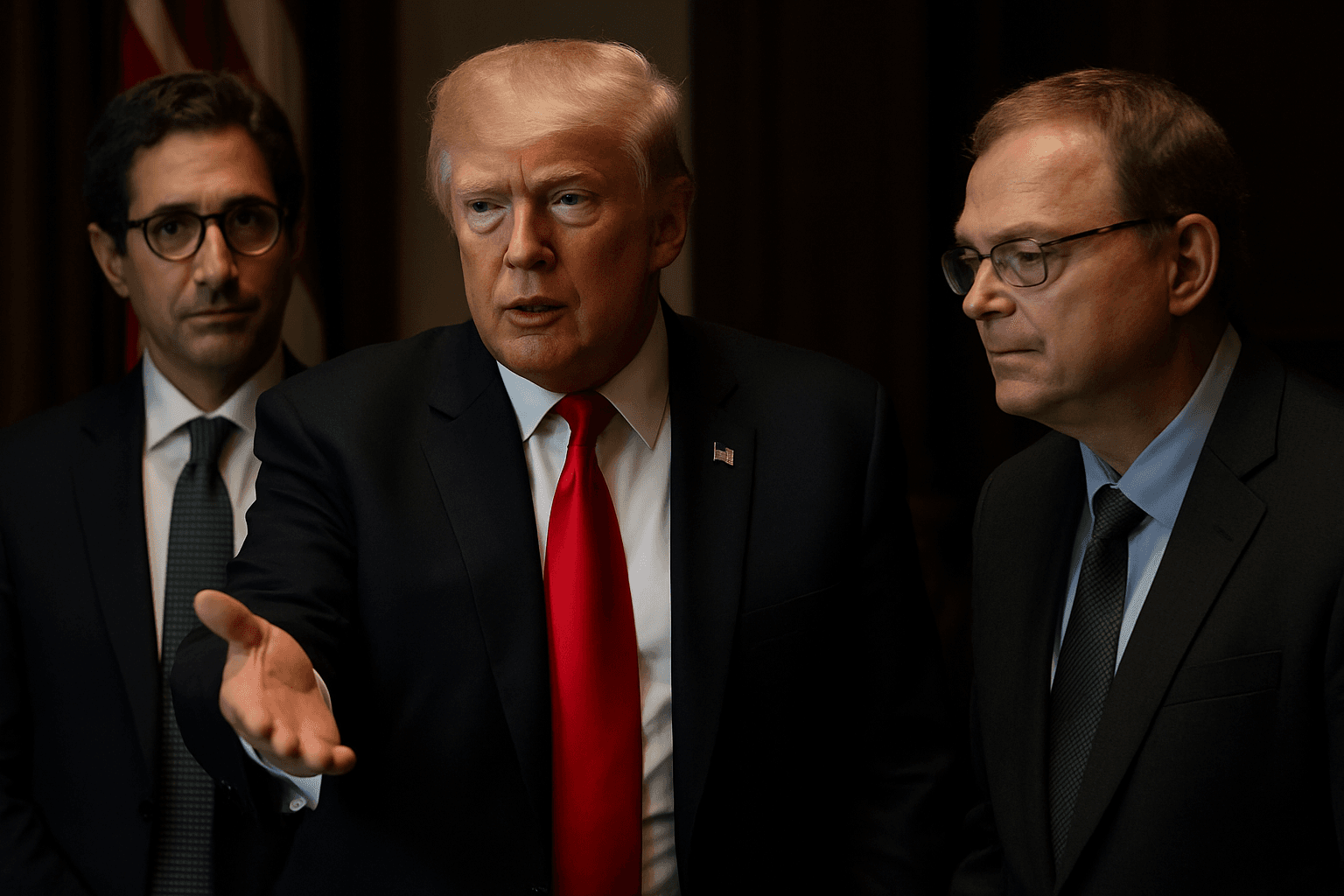

Trump Signals Kevin Warsh and Kevin Hassett as Top Fed Chair Choices

President Donald Trump identified Kevin Warsh and Kevin Hassett as his leading contenders to chair the Federal Reserve, and said the eventual nominee should consult with the White House on interest rate policy. The comments shifted prediction market odds and reignited debate about central bank independence, with market participants watching for formal nomination and Senate confirmation.

President Donald Trump told the Wall Street Journal that his top contenders for Federal Reserve chair are “Kevin and Kevin,” identifying White House National Economic Council Director Kevin Hassett and former Fed governor Kevin Warsh as his leading choices. The interview, reported Friday and widely re reported on December 13, contained several additional remarks in which Mr. Trump said he had “several good candidates” and that “I think I have somebody that I like the best,” while adding that he wanted to be careful because “I was given a bad recommendation” with a prior nomination.

Bloomberg and other outlets reported that the president expects the next Fed chair to consult with the White House on interest rate decisions, a stance that would represent a more interventionist approach to central bank governance than recent practice. The suggestion of closer coordination immediately raised questions among investors and policy watchers about the future of the Fed’s independence at a time when markets remain sensitive to shifts in rate expectations.

Prediction markets reacted quickly to the reporting. CNBC cited Kalshi data showing market implied probability for Hassett slipped from about 71 percent to roughly 62 percent after the Wall Street Journal account, while Warsh’s odds rose to roughly 36 percent. Those moves illustrate how quickly private markets repriced the odds of a politically connected NEC director being tapped versus a former Fed governor with institutional experience.

The two men would offer distinct governance profiles for the central bank. Hassett currently runs the administration’s economic council, giving him day to day proximity to White House priorities and a record in political economic messaging. Warsh served previously as a Fed governor, bringing direct Central Bank experience and familiarity with the institution’s policy apparatus. Neither selection had been finalized as of the weekend, and Mr. Trump left open the possibility of other candidates.

Markets and policymakers are likely to focus on three immediate implications. First, any explicit expectation that the Fed chair consult with the White House on interest rate policy could increase volatility in Treasury yields and risk assets, as investors price in political considerations alongside macroeconomic data. Second, the nomination process itself, and a likely Senate confirmation fight, could create short term uncertainty about monetary policy direction. Third, an appointment of a politically close candidate would test long term norms of central bank independence that have underpinned U.S. inflation fighting efforts since the 1980s.

Economists and market participants will watch for a formal White House announcement and subsequent Senate hearings, where the nominees’ views on inflation, the labor market, and the Fed’s balance sheet will be scrutinized. For now the story remains a developing combination of presidential preference, market repositioning, and institutional risk, with the outcome likely to shape U.S. monetary policy and financial market functioning for years.

Know something we missed? Have a correction or additional information?

Submit a Tip