Investors Shift Into Equities, Positioning for Anticipated Fed Rate Cuts

Global equity funds recorded their largest weekly inflow in five weeks as investors repositioned for expected Federal Reserve easing, with flows concentrated in European and U.S. vehicles and a notable rotation into cyclicals and gold. The move highlights a market balancing act between optimism on policy stimulus and concerns about stretched technology valuations and heavy AI related spending.

Global equity funds drew net inflows of $12.9 billion in the week to December 10, according to Reuters reporting on LSEG Lipper data released December 12, the biggest weekly intake since early November. Reuters attributed the flows to investor positioning ahead of anticipated Federal Reserve interest rate cuts, even as market participants continued to weigh lofty technology valuations and heavy AI related corporate spending.

Regional patterns in the December 10 reporting showed European funds leading the buying, with U.S. equity funds receiving $3.3 billion and Asian funds $1.3 billion in the same week, Reuters said. Emerging market equity funds extended a buying streak with $2.78 billion of inflows based on a Lipper sample of 28,720 funds. Bond funds posted a modest $68 million weekly inflow in that sample, indicating a tentative reengagement with fixed income concurrent with the equity move.

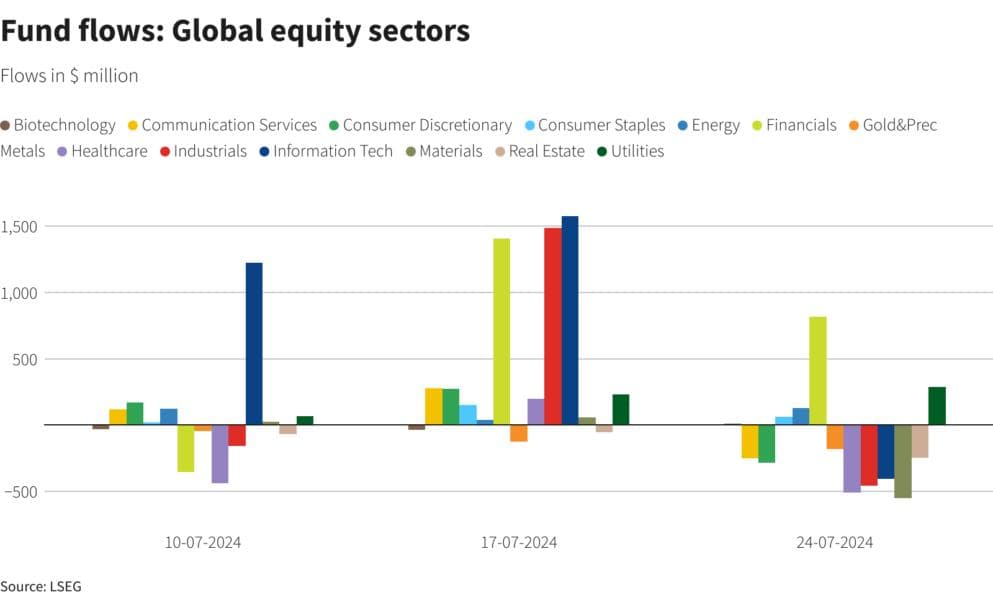

Sector rotation was evident. Global equity sector funds attracted $2.13 billion for the week to December 10, the largest sector flow since mid November by Reuters account. Metals and mining funds saw roughly $889 million of net buying, utilities $824 million and industrials $405 million. Precious metals and commodity funds also registered demand, with gold and related funds in their fifth successive week of inflows totaling $1.9 billion for the reporting cycle, Reuters noted.

The December flows stand in contrast with a stronger week in early November. LSEG Lipper data for the week to November 5 showed global equity funds taking in $22.37 billion, led by a $12.6 billion surge into U.S. equity funds and $5.95 billion into Asian funds. That Nov 5 reporting highlighted heavy technology sector appetite, with technology funds drawing about $4.29 billion and emerging market equity funds collecting $1.61 billion. In that earlier week investors withdrew $554 million from gold and precious metals funds and bond funds experienced $1.73 billion of outflows in a slightly different Lipper sample of 28,806 funds.

ETF level snapshots add granularity. A Seeking Alpha ETF flows summary for the week ending December 5 showed the SPDR S&P 500 Trust gaining $6.17 billion, industrial sector ETFs up $537.6 million, health care $309.1 million, while a gold ETF drew $692.4 million and a silver ETF $571.8 million. Bitcoin ETF IBIT had outflows of $130.2 million in that frame.

The pattern of flows underscores two concurrent market dynamics. First, investors are front running expected Fed easing by increasing equity exposure and rotating into cyclicals and defensive yield sensitive sectors, while also allocating to traditional hedges such as gold. Second, flows remain sensitive to shifting narratives, with technology and AI related enthusiasm driving heavy inflows in early November but prompting caution about valuation stretch thereafter.

For policymakers the mix matters. Growing equity demand and easing expectations can compress term premia and weaken safe asset bids, complicating the Fed response if inflation reaccelerates. For investors the message is a renewed balance between chasing rate linked upside and guarding against sector specific excesses. Data caveats apply because reporting periods and fund samples vary across weekly snapshots, so each figure should be read with its cited date and provider in mind.

Know something we missed? Have a correction or additional information?

Submit a Tip