Island County Approves Sales Tax Increase for Criminal Justice

Island County commissioners adopted a one tenth of one percent sales tax for criminal justice in a two to one vote, a change that will slightly raise local sales tax rates beginning in April. The revenue is intended to shore up law and justice budgets, but commissioners debated whether it creates new funding or simply replaces other county dollars.

Island County commissioners voted on December 2, 2025 to impose a one tenth of one percent sales tax dedicated to criminal justice, approving the county budget in the same two to one vote. The tax is expected to generate nearly two million dollars annually, though the county estimates it will receive about 1.4 million dollars next year because the tax will begin partway through the fiscal year. Commissioners said the new revenue stream is critical to balancing the county budget.

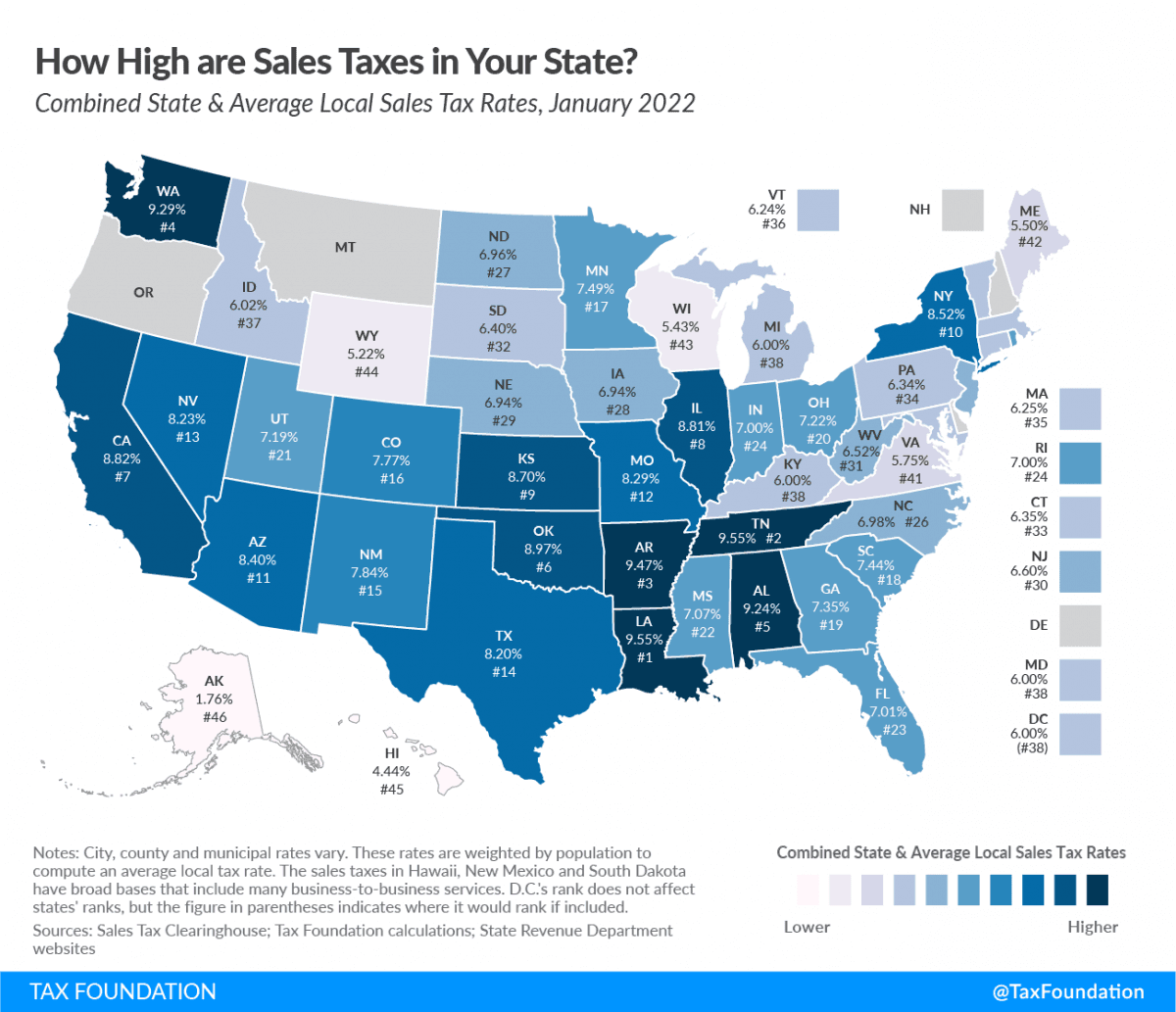

Under the change, the sales tax rate in unincorporated parts of Island County will rise to 8.9 percent in April, while Oak Harbor will see a rate of 9.1 percent. The total county budget adopted totals 164.7 million dollars, a figure larger than typical because of a change in accounting treatment for real estate excise taxes. The budget shows 507.64 full time equivalent employees, a net decrease of 6.41 positions from 2025.

Supporters framed the tax as a way to create a dedicated funding source for law and justice functions after erosion of revenues in current expense funds. Commissioners pointed to a recent state Supreme Court decision affecting public defense caseloads that will drive up costs for indigent defense, creating pressure on county finances. The county allocated one million dollars toward ongoing efforts to build a new jail and another one million dollars to move the Elections Office as part of the adopted spending plan.

Opponents of the timing and structure of the plan argued the sales tax would largely supplant existing revenue rather than add new criminal justice capacity. One commissioner noted that only 200,000 dollars of the new receipts would fund new criminal justice spending immediately, and urged that revenues be banked to face future public defense cost increases instead of funding new positions now.

For residents, the increase means slightly higher costs on taxable purchases starting in April, and it signals county priorities for criminal justice infrastructure and election administration. The decision narrows the gap between projected costs and available funding, but it leaves open questions about long term fiscal resilience, the pace of jail planning, and how the county will absorb projected public defense obligations. Commissioners and county staff will oversee implementation and budget adjustments as the tax comes into effect.