Judge Clears Additional Epstein Grand Jury Materials for Public Release

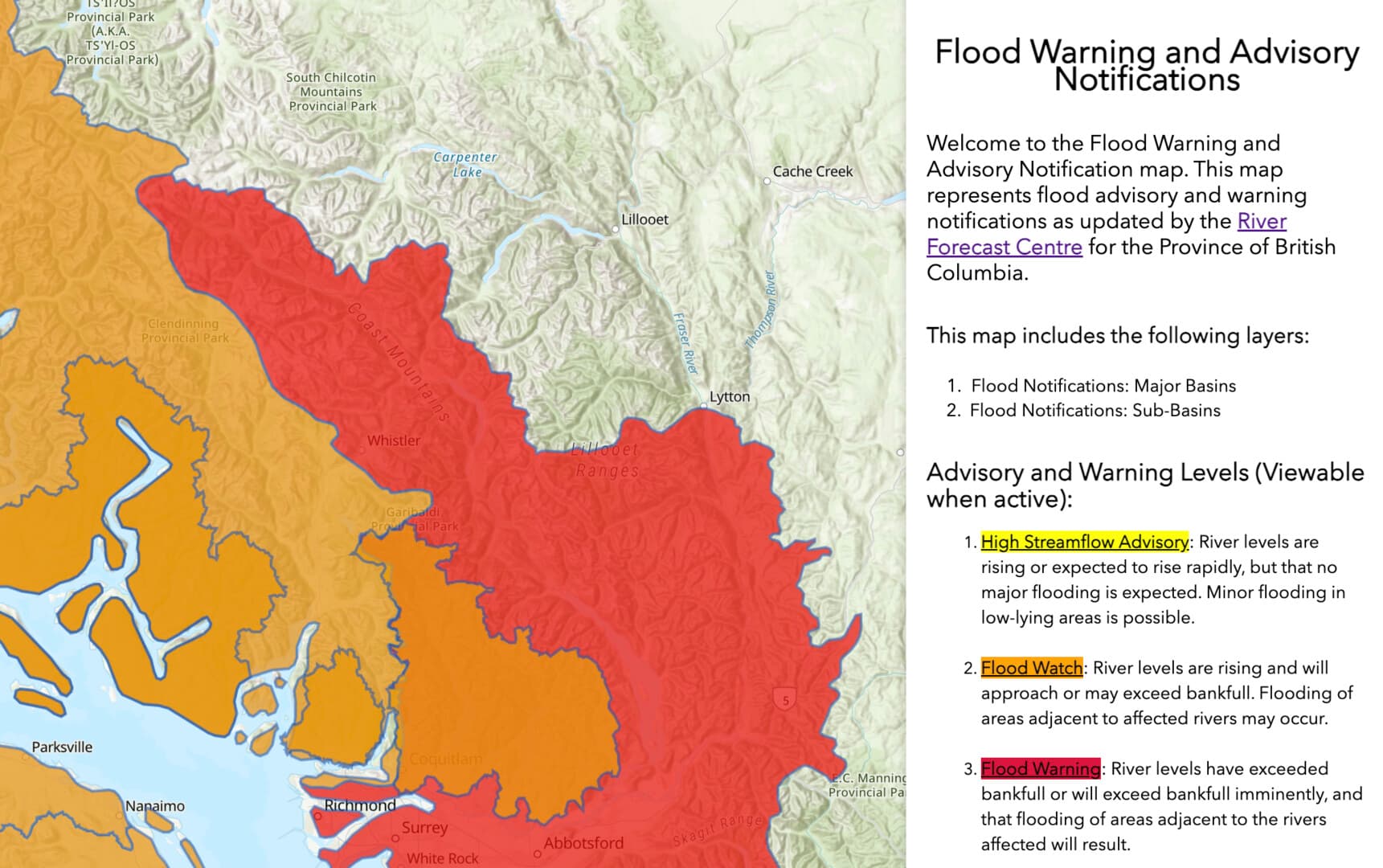

A Manhattan federal judge granted the Justice Department permission to unseal further grand jury materials from the Jeffrey Epstein investigation, a move driven by newly enacted federal law that requires disclosure of files tied to Epstein and Ghislaine Maxwell. The decision could intensify scrutiny of people and institutions mentioned in the records while raising fresh questions about victim privacy and the limits of grand jury secrecy.

U.S. District Judge Richard Berman on December 10 granted the Justice Department’s request to make additional grand jury transcripts and related materials from the Jeffrey Epstein investigation available to the public, subject to redactions to protect victims’ identities. The order reverses prior secrecy in light of recently enacted federal legislation known as the Epstein Files Transparency Act, which mandates the release of government materials tied to Epstein and Ghislaine Maxwell by mid December.

Judge Berman directed that certain grand jury transcripts and associated documents be unsealed with redactions designed to shield the names and identifying details of alleged victims. The court and government emphasized that the statutory obligation to disclose superseded traditional grand jury secrecy norms, even as judges in related cases cautioned that the newly unsealed materials were unlikely to include substantial new allegations. Reuters and the Associated Press reported on the order.

The decision follows a string of similar unsealing orders in separate Epstein related matters since the passage of the Transparency Act. Together they represent a significant legal shift, interrupting the long standing practice of keeping grand jury proceedings confidential unless a narrow exception applies. Legal scholars and court observers say the aggregation of disclosures will alter how prosecutors, defense lawyers, and civil litigants assess evidence and settlement risk in high profile cases.

For the public and markets the immediate effects are likely to be uneven. Analysts and lawyers will scan the newly available records for names, patterns of conduct, and references to financial transfers or assets. Any substantive revelations tied to corporations, trusts, or financial intermediaries could prompt reputational fallout and legal exposure, with attendant costs for litigation, compliance, and public relations. At the same time judges have warned that much of what is released may be procedural or duplicative, which would tend to limit downstream market disruptions.

The policy implications are broader. The Transparency Act imposes a statutory override on a procedural rule meant to protect the integrity of grand juries and the privacy of witnesses. That trade off raises constitutional and practical questions about whether statutory mandates will reshape prosecutorial strategy and grand jury usage going forward. Lawmakers who backed the legislation framed it as corrective, responding to public outrage after Epstein’s crimes became widely known. Opponents cautioned that compelled disclosure could chill witness cooperation and complicate future investigations.

Looking further ahead, the unsealing wave could accelerate legislative and regulatory scrutiny of offshore finance, philanthropy, and the gatekeepers who manage complex asset structures. Even if the new materials yield few blockbuster revelations, they will add to an expanding public record that may inform civil suits and congressional inquiries for years. As the Decembers deadline approaches, courts will have to balance victims’ privacy against demands for transparency, and markets will calibrate risk around any concrete ties that emerge from the documents.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip