Kaiser affiliates to pay $556M over Medicare Advantage coding claims

Kaiser affiliates will pay $556 million to resolve False Claims Act suits alleging improper Medicare Advantage coding. This explains the allegations, relators, enforcement details, and policy implications.

1. $556 million settlement

Kaiser Foundation Health Plan affiliates agreed to pay $556 million to resolve allegations they submitted improper diagnosis codes to inflate Medicare Advantage payments. The payment is a civil resolution; the settling entities did not admit liability and said they chose to settle “to avoid the delay, uncertainty and cost of prolonged litigation.”

2. Settling entities named

The agreement covers five entities collectively referred to as Kaiser: Kaiser Foundation Health Plan, Inc.; Kaiser Foundation Health Plan of Colorado; The Permanente Medical Group, Inc.; Southern California Permanente Medical Group; and Colorado Permanente Medical Group P.C. Naming both health plans and physician groups underscores how risk‑adjustment and coding practices can involve multiple organizational layers.

3. Relators and whistleblowers

The suits were brought under the False Claims Act by relators Ronda Osinek and James M. Taylor, M.D., both former Kaiser employees who filed qui tam lawsuits on the government’s behalf. Osinek worked as a medical coder, and Dr. Taylor oversaw risk‑adjustment programs and coding governance, illustrating that internal clinicians and coders are often the source of enforcement leads.

4. Case captions and dockets

The civil resolutions resolve claims in United States ex rel. Osinek v. Kaiser Permanente, et al., No. 3:13-cv-03891 (N.D. Cal.) and United States ex rel. Taylor v. Kaiser Permanente, et al., No. 3:21-cv-03894 (N.D. Cal.). These dockets and the DOJ press materials provide the procedural record and are the official sources for the government’s allegations and settlement terms.

5. Relator share and distribution

Under the qui tam provisions of the False Claims Act, private relators receive a portion of recoveries; the relators in these cases will receive approximately $95 million from the $556 million recovery. That allocation reflects the statutory incentive structure designed to encourage insiders to report alleged fraud while compensating private parties for prosecuting complex cases.

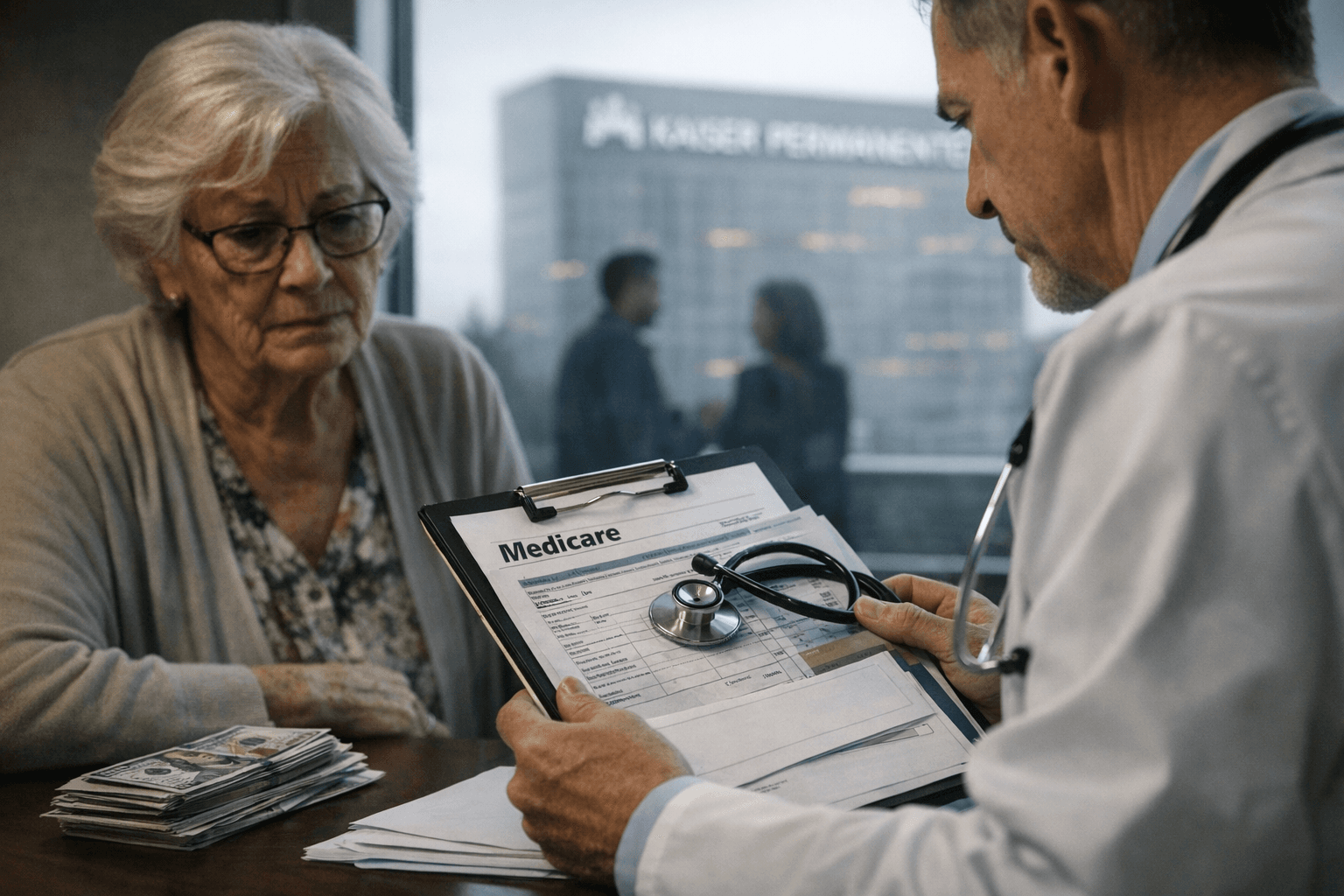

6. Core allegations and mechanics

DOJ alleged the Kaiser affiliates submitted invalid or improper diagnosis codes for Medicare Advantage enrollees to increase risk‑adjusted payments from Medicare. The government’s theory includes claims that the conduct involved retrospectively inflating risk scores for enrollees in California and Colorado by adding diagnoses that were not validly documented or clinically considered at the time of care.

7. Pressure to add codes

Authorities alleged that physicians were pressured to add diagnosis codes “they never considered,” and that the conduct represented a structured effort to boost payments. Those kinds of allegations spotlight how organizational incentives, performance metrics, or revenue pressures can distort clinical documentation and coding practices.

8. DOJ framing and public quote

Prosecutors stressed the harm to beneficiaries and taxpayers from false Medicare claims. As Craig Missakian, U.S. Attorney for the Northern District of California, said: “Fraud on Medicare costs the public billions annually, so when a health plan knowingly submits false information to obtain higher payments, everyone — from beneficiaries to taxpayers — loses.”

9. Kaiser’s response and industry context

Kaiser maintained the settlement was not an admission of liability and characterized the issues as reflecting “industrywide challenges” in applying Medicare Advantage risk‑adjustment standards. The company framed the resolution as a pragmatic choice to avoid protracted litigation, while regulators emphasized enforcement to protect program integrity.

10. Enforcement team and publicity

DOJ materials identified the enforcement team and credited staff across the Fraud Section and U.S. Attorney’s Offices, naming attorneys involved in the investigation and litigation. The release lists Fraud Section attorneys Braden Civins, Edward Crooke, Gary Dyal, Michael R. Fishman, Martha Glover, Seth W. Greene, Rachel Karpoff, Laurie Oberembt, and Jonathan Thrope, as well as Assistant U.S. Attorneys Michelle Lo (N.D. Cal.) and Kevin Traskos (D. Colo.)—detail that signals the resources devoted to complex Medicare Advantage enforcement.

11. Scale and significance

PR materials described the recovery as “the largest recovery of this nature to date” involving alleged Medicare Advantage risk‑adjustment misconduct. The settlement comes amid heightened scrutiny of Medicare Advantage, which now covers more than half of all Medicare beneficiaries, making accurate coding central to both beneficiary care and federal spending integrity.

12. Broader health and equity implications

Improper inflation of risk scores can distort payments without improving patient care, shifting costs to taxpayers and potentially diverting resources from needed services. For communities served by Medicare Advantage—often older adults and those with chronic conditions—misaligned incentives in coding and risk adjustment can undermine trust and access to equitable care; robust compliance and responsiveness to internal warnings are therefore public‑health priorities.

13. What the settlement resolves

The agreement resolves certain False Claims Act claims in the two named qui tam lawsuits and related government investigations, without admission of liability by the settling Kaiser affiliates. The relators’ approximately $95 million share and the civil payment to the government complete the monetary resolution for covered claims identified in the filings.

14. Related DOJ action noted

The DOJ release also noted a separate, unrelated settlement: Ceratizit USA LLC agreed to pay $54.4 million to resolve different False Claims Act allegations. Its inclusion in the same announcement highlights DOJ’s broader civil enforcement agenda across industries.

15. Documentation and reporting next steps

Journalists and policy analysts can consult the DOJ Office of Public Affairs release (Jan. 14, 2026) and the Northern District of California dockets listed above for primary documents. Follow‑on reporting should examine how compliance programs change, whether internal reporting cultures improve, and how regulators will monitor coding practices across Medicare Advantage plans to protect beneficiaries and taxpayers.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip