La Paz County to Auction Tax Deeded Properties in January

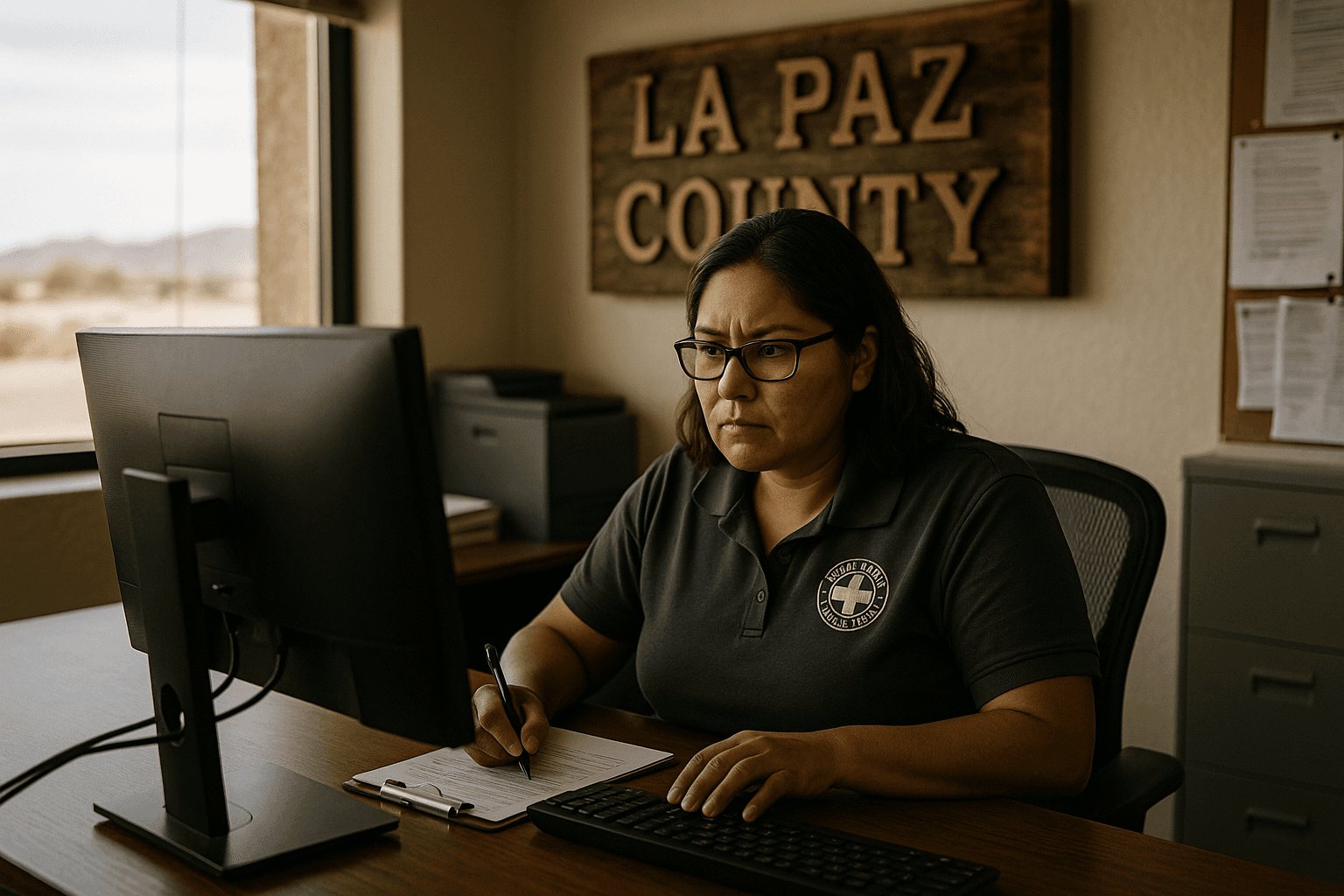

La Paz County announced a tax deed sale of properties held by the state to be conducted January 13, 2026, drawing attention from homeowners and investors alike. Residents with delinquent tax parcels must act by January 6 to submit written bids or risk losing property, while the sale raises questions about local property markets and county revenue practices.

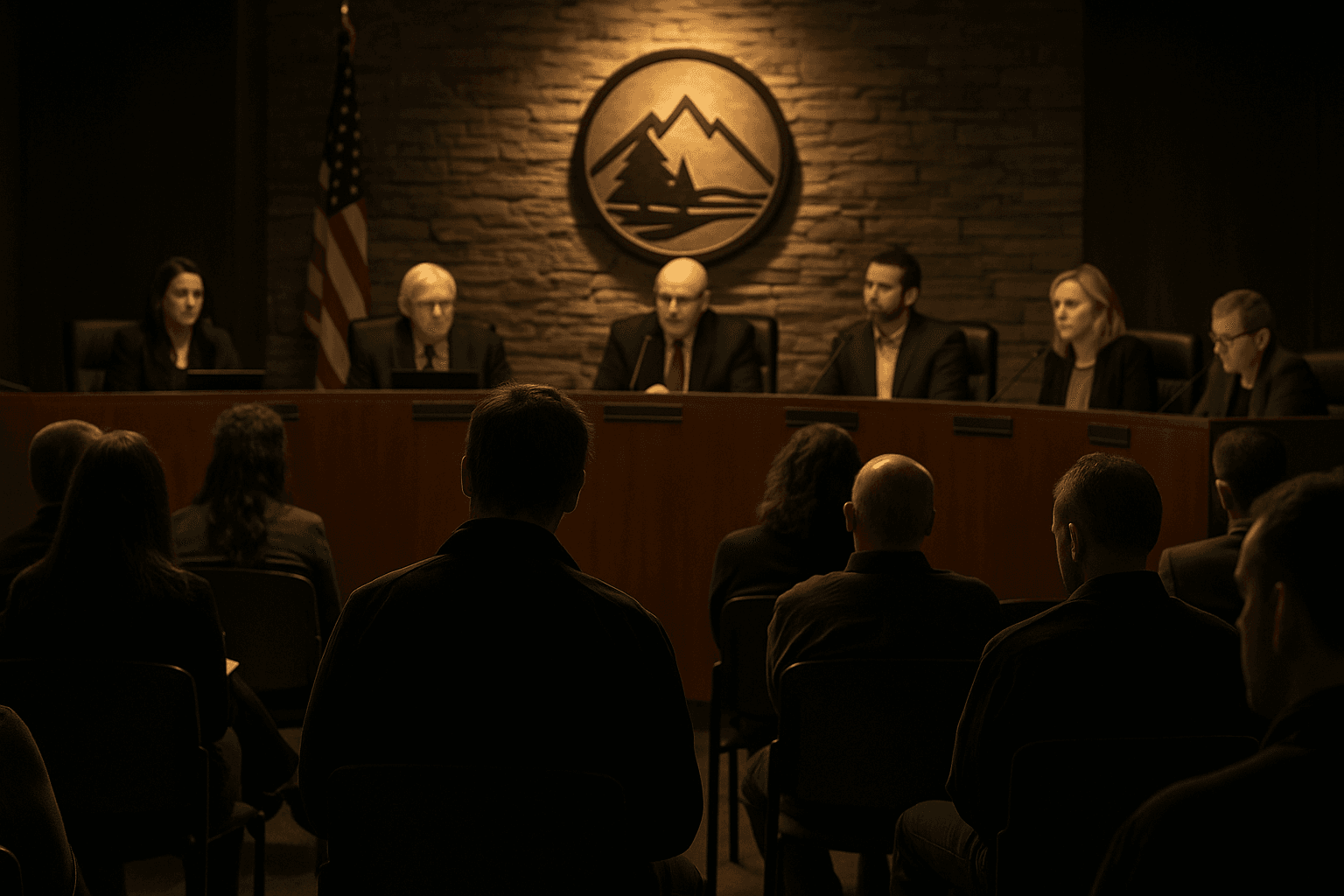

La Paz County will offer real estate held by the state by tax deed for sale to the highest bidder for cash at a Board of Supervisors meeting on Tuesday, January 13, 2026 at 9:00 a.m. The auction is being conducted under A.R.S. Sections 42 18301, 18302 and 18303 and will take place in the Board of Supervisors meeting room at 1108 Joshua Avenue, Parker, Arizona. Written bids will be accepted until 5:00 p.m. on Tuesday, January 6, 2026.

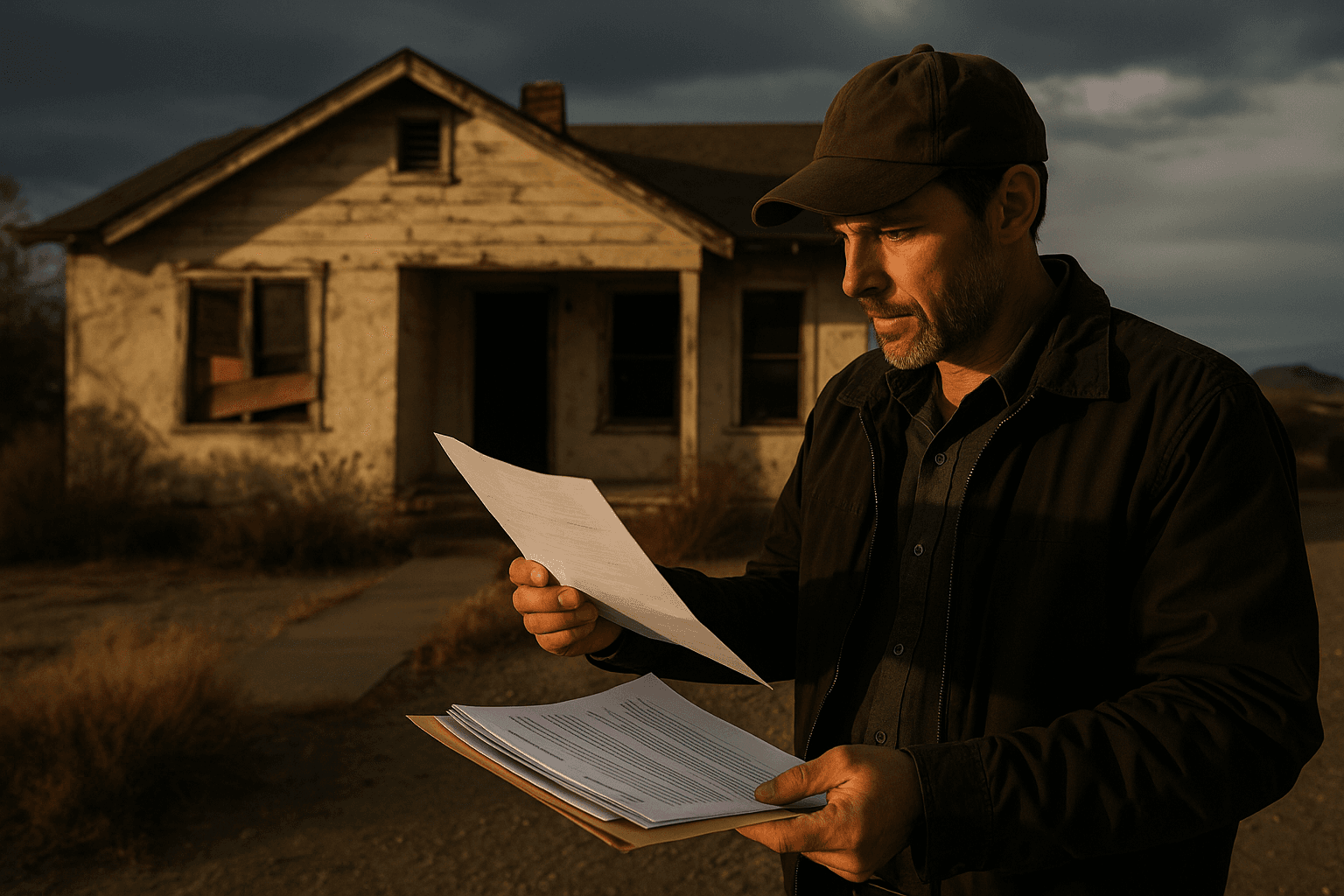

Bidders must submit written bids on the county bid form and post a one hundred dollar bond by cash or cashier check with those bids. The bond will be refunded if no purchase is made or may be applied to a purchase price. The sale itself will accept only cashier checks or cash at the time of sale and a separate thirty dollar recording fee per parcel will be charged. The county notes the sale is without warranty and advises bidders to consult a title company or attorney to obtain clear title.

A list of parcels scheduled for auction is posted on the county website at www.lapaz.gov and the Board of Supervisors office can provide a copy of the auction list and procedures. For assistance residents may call the Board of Supervisors office at (928) 669-6115 or return bid forms to the Board Office at 1108 Joshua Avenue, Parker Arizona.

Sample parcels included in the notice illustrate the range of properties and tax amounts at stake. Examples include Castle Lakes Unit 1 lots with tax costs under one thousand dollars, metes and bounds property with an amount above eight thousand dollars, and Bouse Townsite lots with tax costs exceeding ten thousand dollars. Property owners in areas such as Castle Lakes, Caballo Farms and Bouse should review the listings carefully.

The sale has direct implications for property owners facing tax delinquency and for the local housing market. For residents this is an immediate civic action item, with a firm bid deadline and procedural requirements. For county governance the auction represents a mechanism to clear tax liens and recoup unpaid taxes, while also raising policy questions about notice effectiveness, protections for vulnerable homeowners and the role of public sales in shaping local land use and ownership patterns. Residents seeking clarity or who believe they may be affected should contact the Board of Supervisors office promptly and consider legal or title counsel.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip