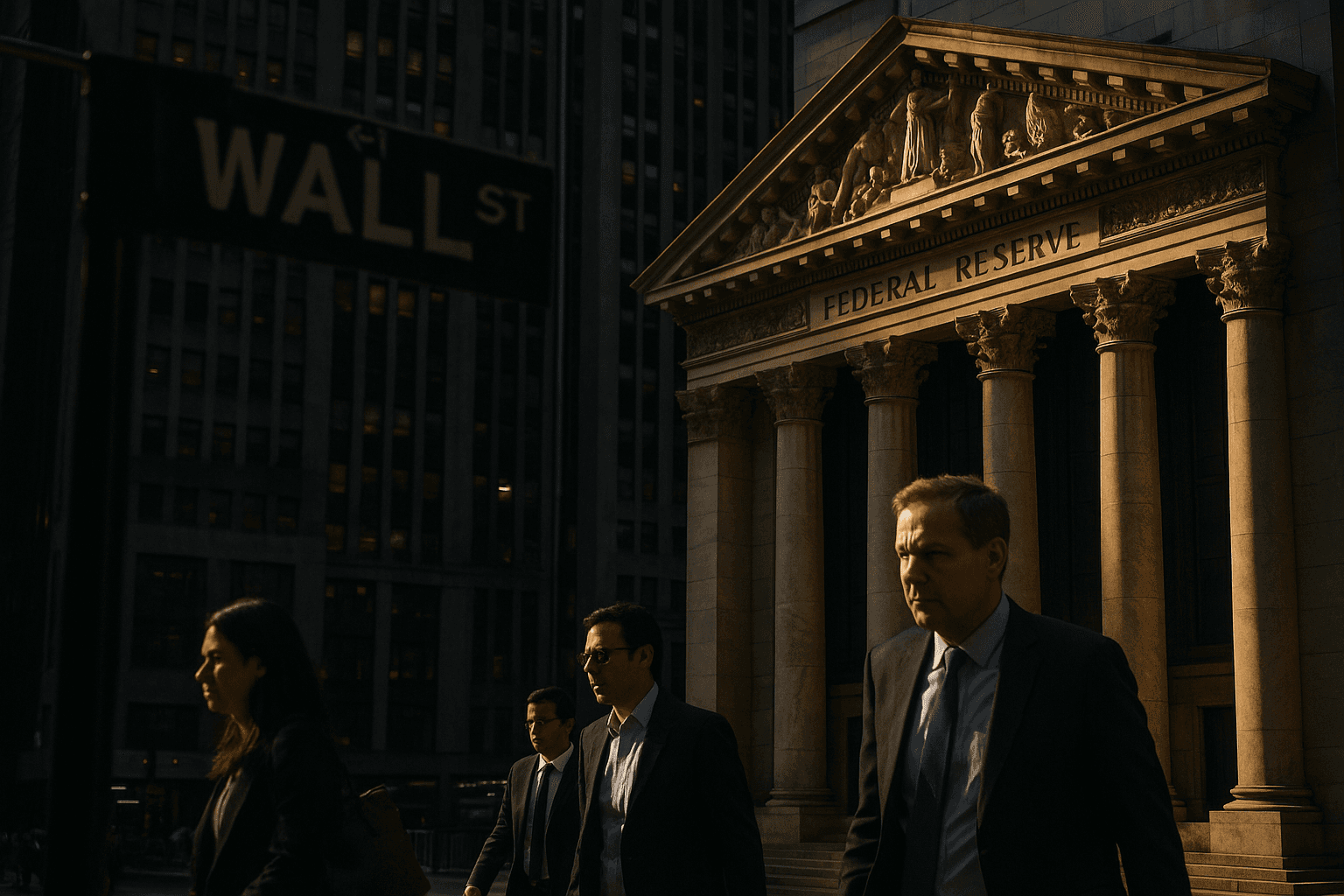

Major Wall Street Banks Now Expect Fed To Cut Rates in December

Morgan Stanley joined J.P. Morgan and Bank of America on Dec. 5 in reversing earlier forecasts and now expects a 25 basis point cut at the Federal Reserve meeting on Dec. 9 and 10, deepening market conviction that policymakers will ease. The shift followed softer US economic data and dovish Fed commentary, leaving traders via the CME FedWatch tool pricing a high probability of a cut and raising questions about potential dissents among FOMC members and short term market volatility.

On Dec. 5 Morgan Stanley revised its forecast and said it now expects the Federal Reserve to cut its policy rate by 25 basis points at the Dec. 9 and 10 meeting, joining similar moves by J.P. Morgan and Bank of America. Reuters reported the changes as softer US data and dovish signals from several Fed officials reshaped economist projections and trader positioning ahead of the policy decision.

The reversal by major brokerages tightened consensus that the Fed will pivot toward easing this month. Market pricing via the CME FedWatch tool showed traders assigning a high probability to a cut, reflecting a rapid reassessment of the Fed timeline after recent data failed to show sustained upside inflation pressures. At the same time analysts continue to expect dissents among FOMC members, leaving room for a split signal when the committee issues its policy statement and any accompanying projections.

The immediate market implications are straightforward. Anticipation of a 25 basis point reduction typically supports risk assets and weighs on short term interest rates, with Treasury yields sensitive to shifts in expected policy. Equities tend to respond positively to easier monetary policy if the move is read as supportive of growth, while the dollar often weakens when rate differentials narrow. Those dynamics can drive volatility around both the announcement and the subsequent press communications, especially if the statement or projections show a wider range of views among policymakers.

For fixed income markets the prospect of an imminent cut compresses short end yields and can flatten parts of the yield curve if longer dated rates do not move as much. That would affect borrowing costs for corporations and households and could alter the pricing of interest rate sensitive sectors. Currency markets and emerging market assets are likely to be sensitive to any perceived softening of US policy, with capital flows responding to changes in carry and risk appetite.

Policy implications extend beyond the immediate market response. A December cut, if delivered, would mark an inflection point in the Fed policy cycle from aggressive tightening and steadiness toward easing. The Fed remains data dependent, and officials signalled in recent commentary that incoming inflation and labor market indicators would dictate timing. Analysts caution that dissents could complicate forward guidance and that an isolated cut does not guarantee a sustained easing path if inflation shows renewed resilience.

Long term, the episode underscores how quickly markets can reprioritize Fed expectations in response to economic surprises and central bank tone. The convergence of softer data and dovish commentary has pushed major financial firms to revise their forecasts, but uncertainty about the committee consensus means investors must prepare for renewed volatility when the Fed publishes its statement, projections and minutes later this month.