Volkswagen Commits €160 Billion Through 2030, Recasts Investment Focus

Volkswagen Group said it will invest about €160 billion through 2030, a modest trim from earlier multi year plans, as pressure from tariffs and cutthroat competition in China and the United States forces a strategic recalibration. The shift toward Germany and Europe, with emphasis on products, technology and infrastructure, signals how the global auto transition is colliding with geopolitical and market realities.

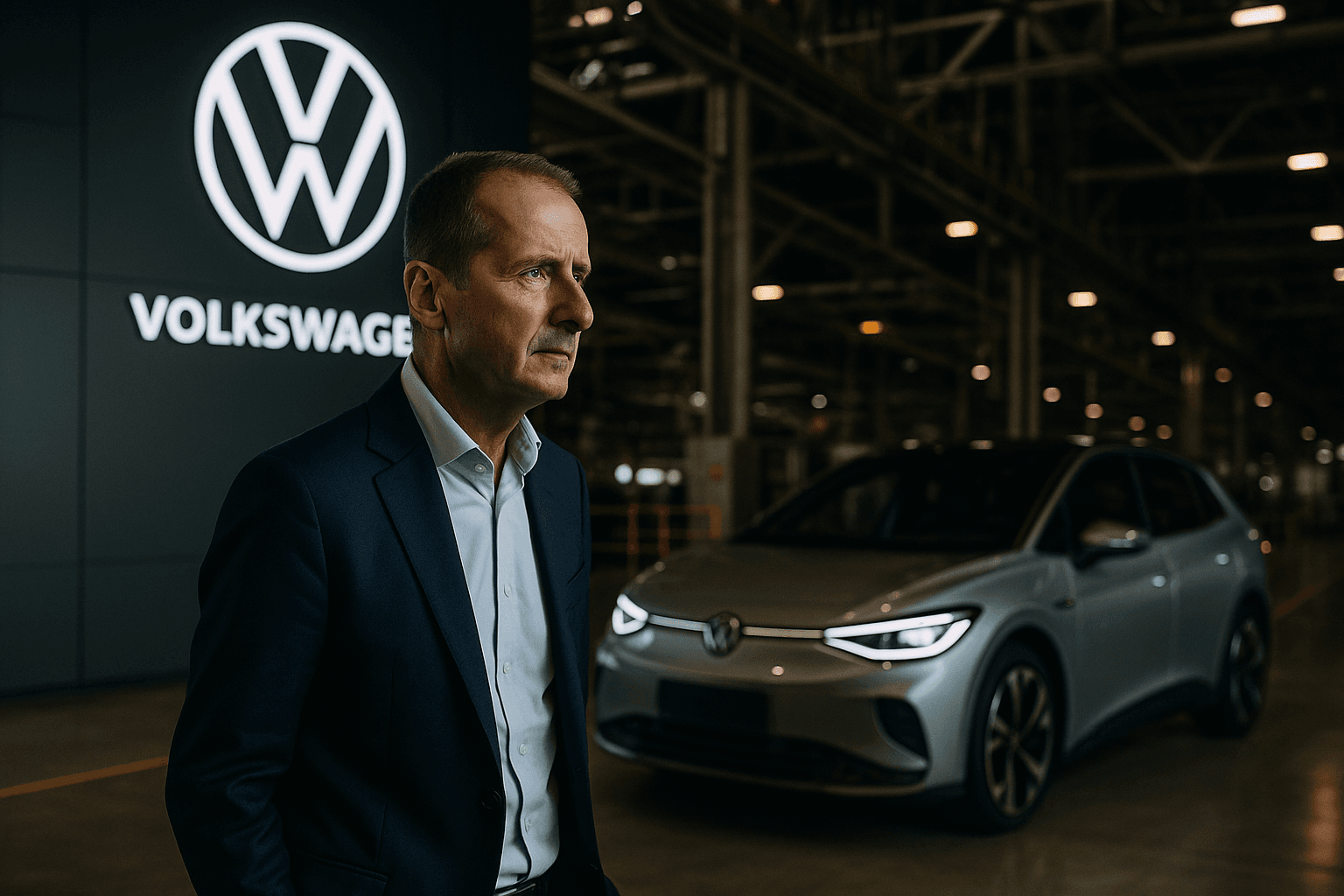

Volkswagen Group announced on December 6, 2025 that it will invest roughly €160 billion through 2030, equivalent to about $186 billion, marking a slight reduction from prior multi year investment commitments. Chief executive Oliver Blume told the German press the move reflects mounting headwinds in Volkswagen’s two largest markets, China and the United States, where tariffs and intensifying competition have squeezed margins and complicated long range planning.

The updated plan shifts capital allocation toward Germany and the rest of Europe, prioritizing product development, technology and infrastructure. Executives framed the reorientation as a defensive and pragmatic response to an uncertain external environment, while maintaining investment in the auto industry’s long term transformation toward electrification, software defined vehicles and charging networks.

Market implications for Volkswagen are immediate and multifaceted. Investors will watch closely for signs that the lower headline investment number translates into tighter capital discipline or deferred projects that could affect future revenue growth. For suppliers and regional economies in Germany and Europe the increased focus may mean sustained demand for components and engineering talent, but it also raises questions about interoperability with factories abroad and the resilience of global supply chains.

The firm flagged profit pressures at some of its marquee brands, notably Porsche, where management said discussions about cost savings are ongoing. The reference to Porsche underscores how premium marques are not immune to margin compression amid higher development costs for electric models and a more competitive luxury market. Separately, Volkswagen said the prospect of building an Audi plant in the United States would depend on potential government support, underscoring the growing role of industrial policy in automakers’ siting decisions.

Volkswagen’s announcement reflects broader trends in the auto industry. Capital intensity for electric vehicles and associated infrastructure remains high, forcing companies to prioritize investments that produce the clearest returns and to rely increasingly on public subsidies when they are available. At the same time, trade frictions and a more contested global market are encouraging some firms to localize production and concentrate investment where political and regulatory frameworks are more predictable.

Policy makers will also take note. A U.S. plant contingent on government backing highlights the leverage that subsidy programs and tariff regimes provide in shaping investment flows. In Europe, the commitment to invest heavily at home may be welcomed by governments seeking industrial resilience, while also prompting scrutiny of incentives, skills shortages and grid capacity needed to support faster electrification.

Volkswagen’s €160 billion plan is both a confirmation of the enormous capital demands of the auto transition and a recognition that strategy must adapt to a bolder geopolitical era. How the company balances near term profitability with long term technological leadership will determine whether the recalibrated plan secures its position in a rapidly evolving global market.