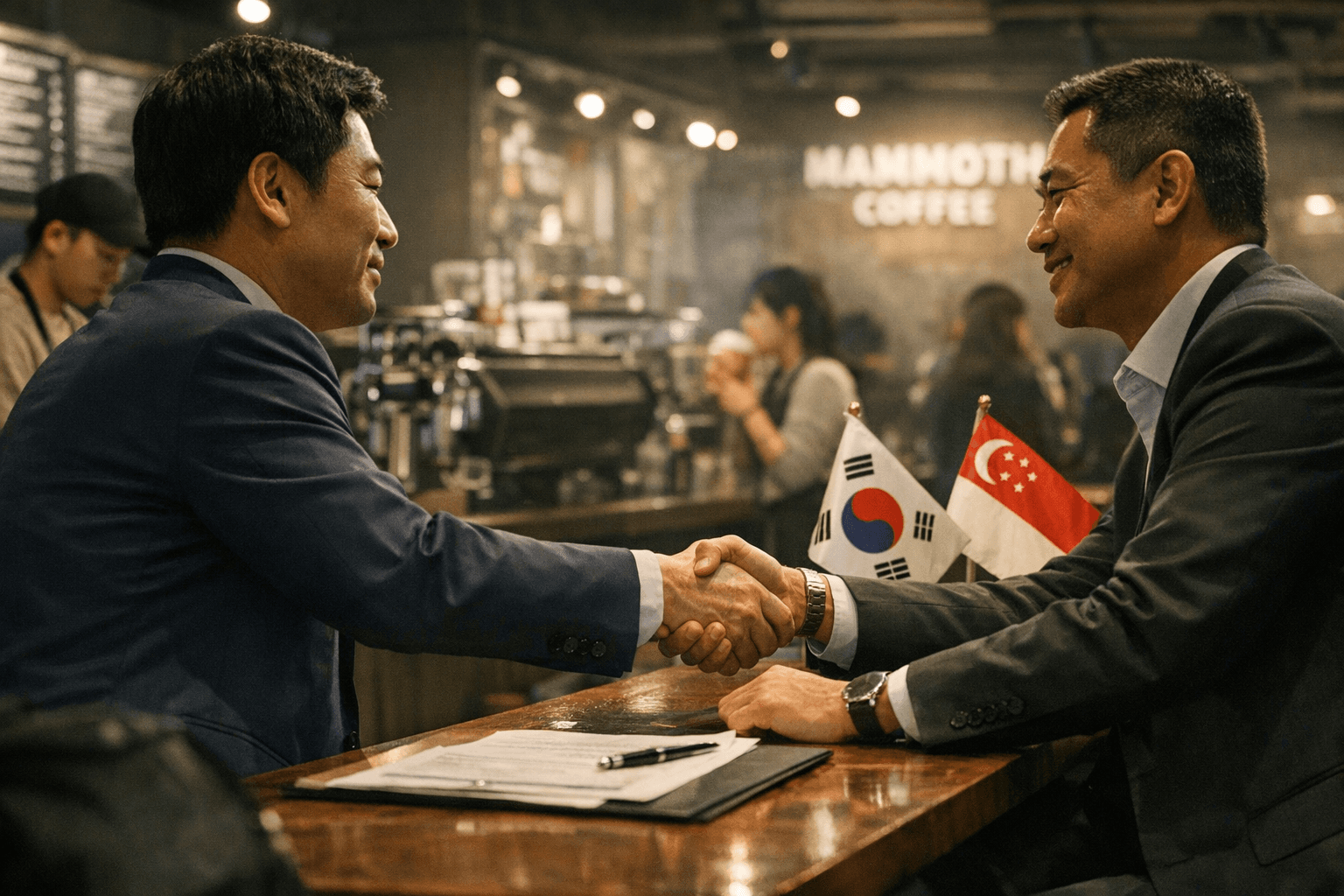

Mammoth Coffee Sells Majority Stake to Singapore Private Equity

Seoul-based Mammoth Coffee has sold a majority stake to a Singapore-based private equity firm on January 8, 2026, a move that positions the chain for faster expansion in South Korea and at least one other major East Asian market. The deal signals continuing consolidation and private equity interest in the region's branded coffee sector, with practical implications for customers, franchisees, employees, and suppliers.

Mammoth Coffee, a Seoul-based chain known for competing in South Korea's affordable-coffee segment, has sold a majority stake to a Singapore-based private equity firm. The transaction, announced January 8, 2026, immediately shifts Mammoth from a locally focused challenger toward a growth-driven platform backed by outside investment.

Under the new ownership, Mammoth is set to accelerate outlet growth across South Korea and pursue expansion into at least one other major East Asian market. That strategy aims to capture market share in a crowded, price-sensitive sector where rapid rollout and brand reach are key competitive levers. The backing from private equity typically brings capital for openings, streamlined operations, and the resources to scale a loyalty or digital ordering program more quickly.

For customers, the immediate effect will likely be more locations and greater consistency across stores. Expect faster openings in urban neighborhoods and suburban shopping areas where affordable coffee formats perform well. Promotions, standardized menus, and coordinated loyalty offers often follow this sort of investment, which can mean better deals for regular buyers and a more recognizable brand experience for occasional visitors.

Franchisees and prospective partners should monitor company communications for franchise expansion windows, training programs, and operational support updates. Existing franchisees often see both opportunities and pressures with PE-led growth: access to shared supply chains and marketing resources may improve, while expectations for uniform execution and performance metrics can increase.

Employees may find growing opportunities as the chain opens new outlets, but should also prepare for tighter operational standards and possible changes in management practices as the private equity owner seeks scale and margin improvement. Suppliers and service providers should anticipate larger, consolidated procurement processes and the possibility of renegotiated contracts as Mammoth centralizes purchasing to support rapid roll-out.

The deal reflects a broader regional trend of consolidation and investor interest in branded coffee chains. Watch for forthcoming announcements from Mammoth on specific expansion markets, outlet targets, and any changes to franchising or employment policies. For now, the sale marks a clear step toward national consolidation and faster regional growth under private equity ownership.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip