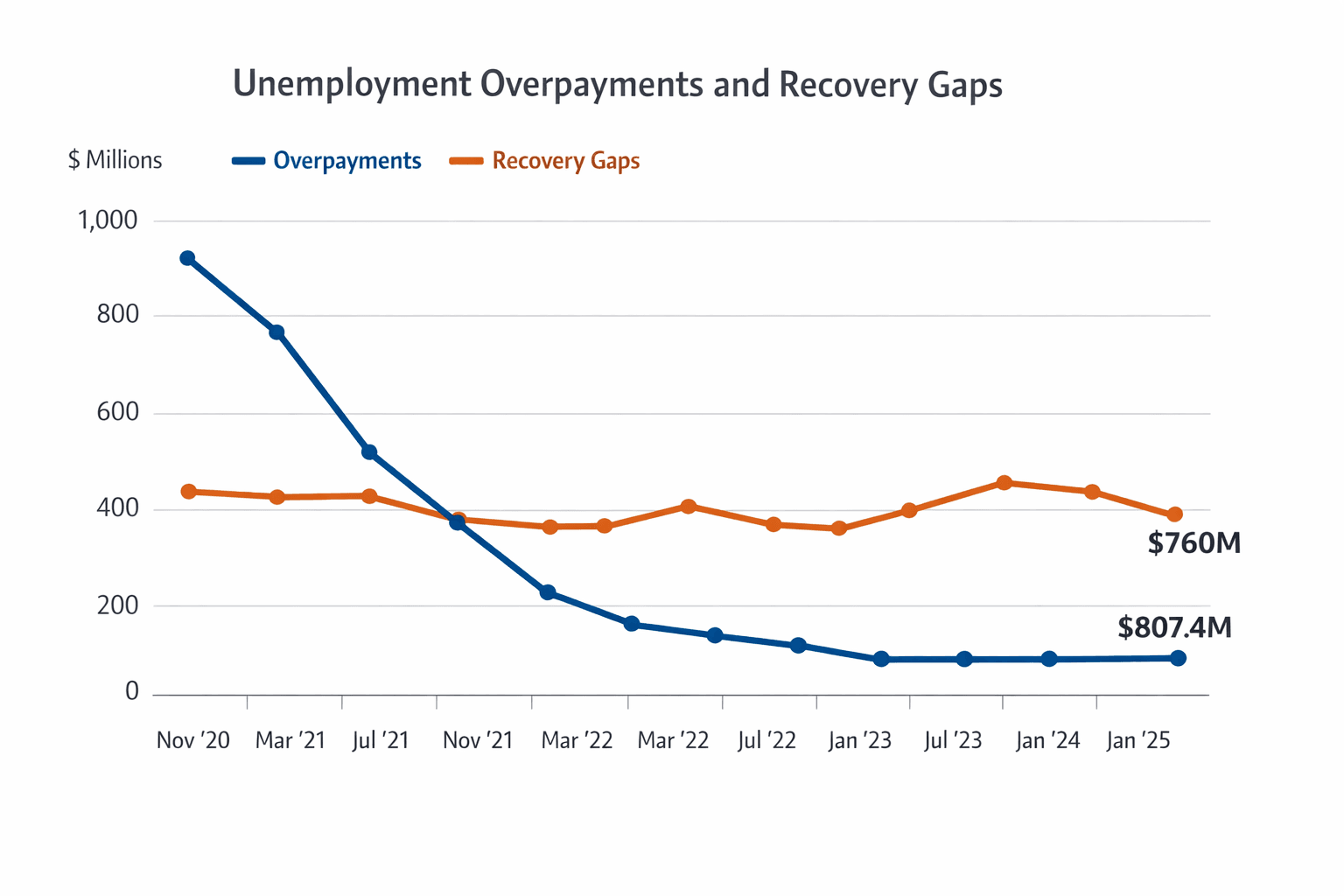

Maryland audit finds $807.4 million in unemployment overpayments, recovery gaps

A state audit found $807.4 million in pandemic-era unemployment overpayments and missed chances to recover $760 million; Baltimoreans may see notices and state budgets could shift.

A Maryland Office of Legislative Audits review released Jan. 10 found the state overpaid $807.4 million in unemployment benefits during the pandemic period under review and missed opportunities to recover roughly $760 million because recovery actions were not timely. The auditors identified process and oversight failures and placed significant blame on earlier administrations, while noting the state has begun remedial steps.

The bulk of the overpayments occurred between Nov. 16, 2020, and Jan. 15, 2025, a stretch when federal pandemic funds were plentiful. Auditors say that plentiful federal funding, combined with weak controls and delayed follow-up, limited the state's ability to detect errors and to act promptly to recoup improper payments. The report frames the problem as both an operational breakdown and a fiscal exposure as Maryland prepares budgets for coming years.

For Baltimore residents, the immediate effects will be practical and personal. Individuals who received unemployment during the period could receive notices seeking repayment or offering repayment plans. Employers and payroll professionals may see renewed scrutiny as the state tightens eligibility verification and benefit-integrity checks. Local workforce programs and benefits navigators that help jobseekers could also face new reporting requirements and administrative burdens as state agencies change procedures.

At the city level, the audit has budgetary implications. A large unrecovered liability makes state fiscal planning less predictable and could influence allocations to cities for social services, workforce development, and public health programs. Baltimore officials who rely on state funding for homelessness prevention, job training, and similar services may face pressure to adjust priorities if the state reallocates resources to address recovery efforts and strengthen integrity systems.

The audit also raises legal and ethical questions for claimants who now face potential collection notices years after benefits were received. Repayment notices can complicate household budgets and affect credit, particularly for residents already struggling with housing and employment instability. Community organizations and legal clinics that assist low-income Baltimoreans should prepare for increased demand for counseling on appeals and hardship waivers.

The state has started remedial actions, including process reviews and efforts to improve recovery timeliness. Baltimoreans should monitor mail and official Maryland Department of Labor portals for notices, preserve documentation about past claims, and act promptly on any communications. Community groups and neighborhood leaders can help by sharing clear information and directing neighbors to free legal and benefits counseling.

Our two cents? If you received unemployment in 2020–2025, check your records and your Maryland Labor account now, and reach out for help if a repayment notice arrives. Staying ahead of paperwork will make a painful process easier to manage.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip