Oil plunges as Trump’s Iran remarks trigger rapid geopolitical de‑risking

President Trump's Oval Office comments that killings in Iran "have stopped" prompted traders to unwind war hedges, sending Brent down more than 2 percent and wiping out a recent risk premium.

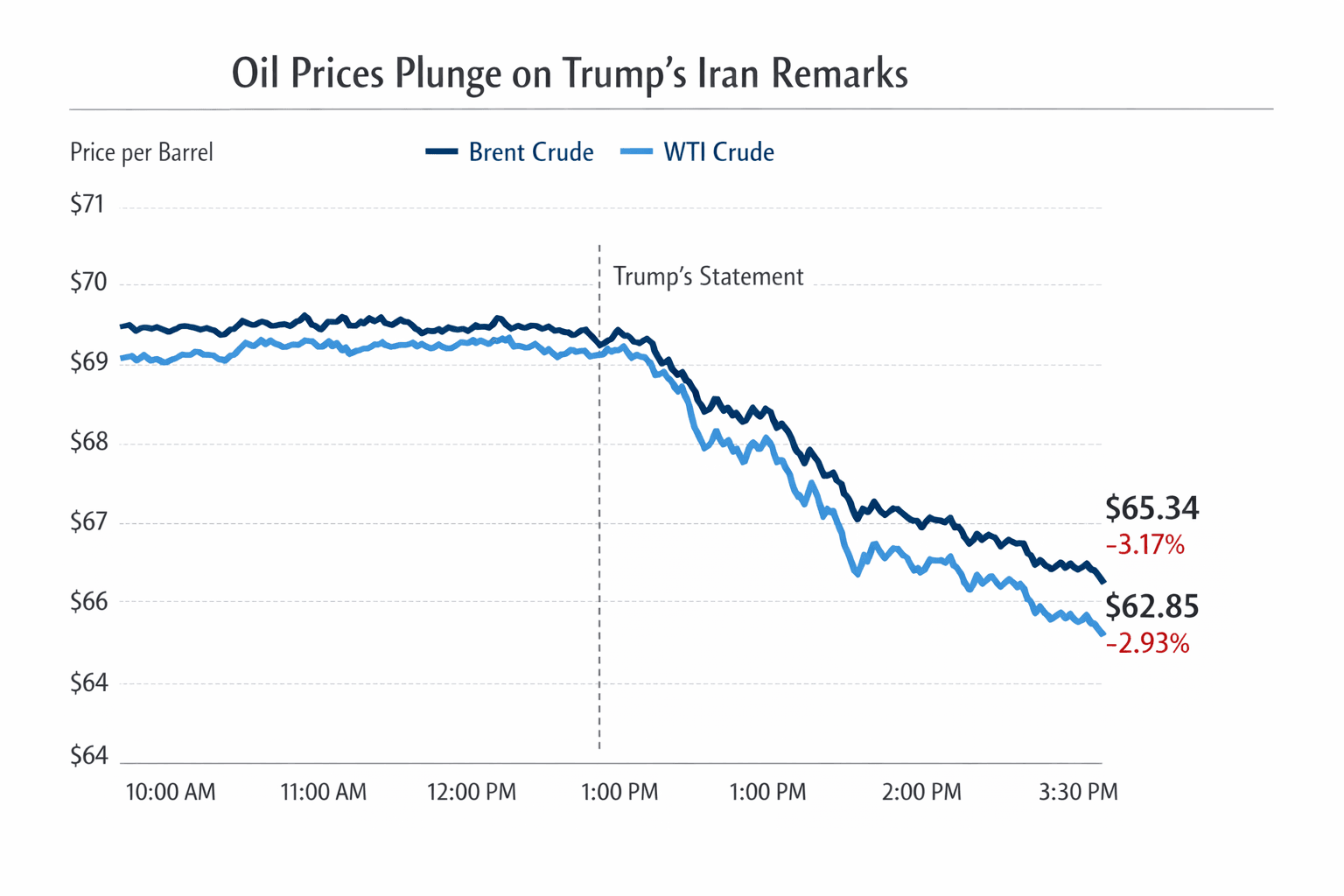

Oil markets swung sharply after President Donald Trump told reporters in the Oval Office that "the killing in Iran ... has stopped, is stopping, and there's no plans for executions," adding that "we have been informed by very important sources on the other side, they've said the killing has stopped, and the executions won't take place." Traders interpreted the comments as a signal that near‑term U.S. military intervention was less likely, and prices quickly re‑priced geopolitical risk.

ICE Futures data showed Brent crude for March loading settling at $66.52 a barrel on Jan. 14, a high not seen in over three months, with an intraday print of $66.31. In New York, February West Texas Intermediate on NYMEX closed at $62.02. Within minutes of the Oval Office remarks, Brent plunged roughly $2 in about six minutes before recovering nearly $1 as participants digested the news. By early Asian trade on Jan. 15, Brent had fallen more than 2 percent to about $64, a decline of roughly $1.67 from the prior close.

The moves underscored how much of the recent rally into the mid‑$60s had been driven by an Iran risk premium. Market participants had grown increasingly concerned that deadly unrest in Iran and heated rhetoric could lead to supply disruption, prompting some U.S. allies to adjust force posture in the region. Jorge Montepeque, managing director at Onyx Capital Group, described the backdrop as "a period of geopolitical instability and potential supply disruption," adding that protests in Iran were seen as potentially leading to regime change and that "the possibility of a U.S. attack is looking high."

Institutional desks and energy funds moved swiftly to unwind those positions. Trading sources said institutional investors and trading desks positioned for de‑escalation rapidly dumped war hedges, and energy options skew - the spread between bullish calls and bearish puts - returned to levels last seen in mid‑2025. That market structure shift helped magnify the initial downside pressure even as part of the move was reversed later in the session.

Analysts and strategists cautioned that the repricing could prove premature. Supply fundamentals remain mixed: OPEC+ discipline has tightened effective spare capacity, Chinese demand trends are pivotal for the second half of the year, and inventories in developed economies have not returned to their pre‑pandemic relationships. Citigroup analysts had flagged that the rally could extend above their $55–$65 per barrel forecast range if geopolitical risk persisted.

Parallel developments in Venezuela added complexity. U.S. actions involving Venezuelan vessels briefly supported U.S. prices earlier in January, but the prospect of meaningful Venezuelan exports returning hinges on political developments in Caracas. Helima Croft of RBC Capital Markets noted that the potential for Venezuela to add volumes "all hinges on whether Venezuela defies the recent history of US‑led regime change efforts," underscoring uncertainty around incremental supply.

For now, markets have removed a meaningful slice of the Iran risk premium after the president's comments, but traders and policymakers remain alert. A reversal in the security situation on the ground, changes in military deployments, or fresh signs of supply tightening from OPEC+ or Venezuela could rapidly reintroduce volatility and push prices back above recent levels.

Know something we missed? Have a correction or additional information?

Submit a Tip