Duke Energy Florida ends storm surcharge a month early

Duke Energy Florida will remove its storm cost recovery charge in February, cutting customer bills as the utility says it recovered storm costs ahead of schedule.

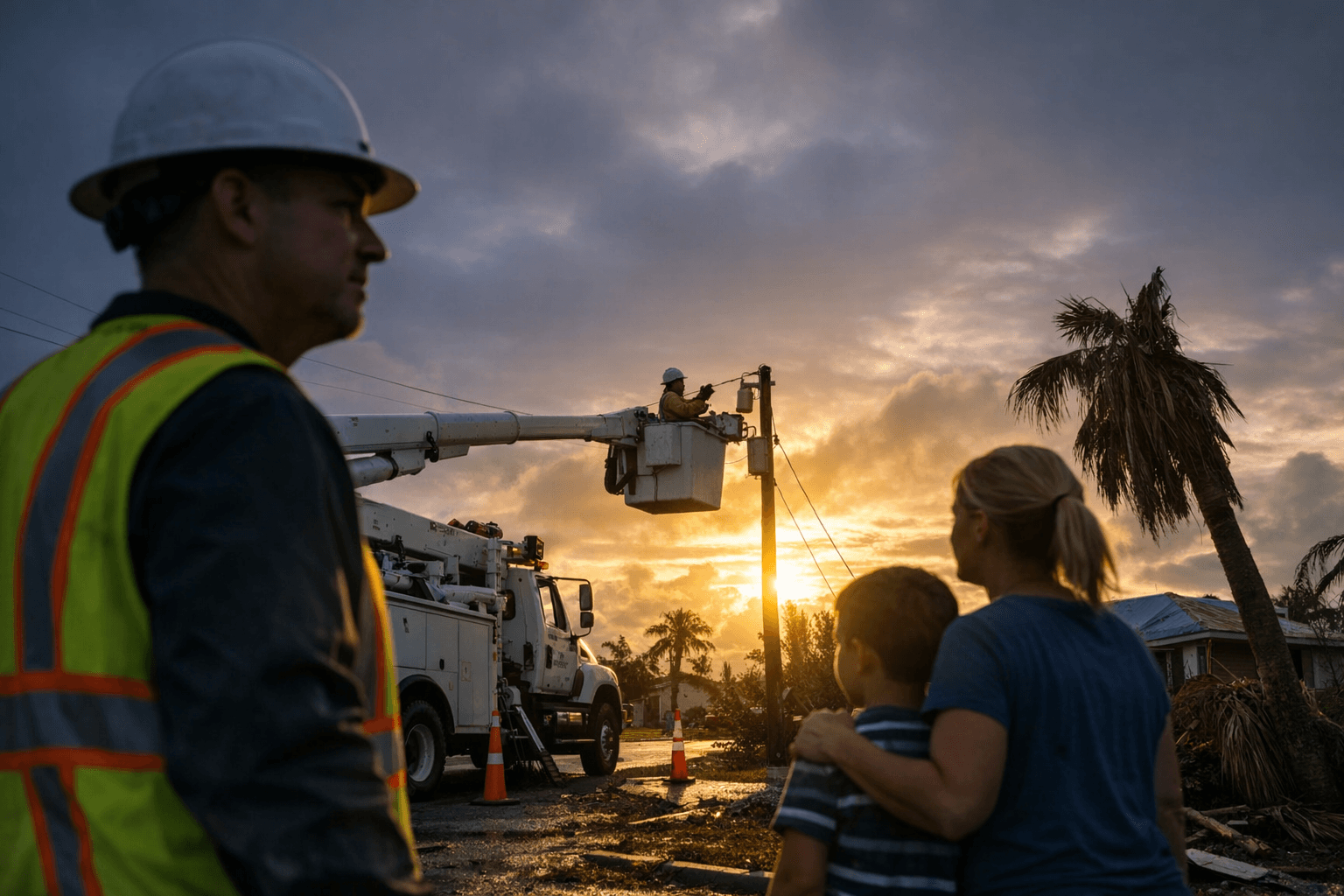

Duke Energy Florida announced on Jan. 14 that it will remove the storm cost recovery charge from customer bills beginning in February 2026, a month earlier than previously scheduled, after recovering the full amount attributable to three storms. The company said roughly $1.1 billion in storm response costs tied to hurricanes Debby, Helene and Milton had been collected ahead of plan, enabling the immediate end of the temporary surcharge.

The change translates into measurable bill relief for consumers. Residential customers will see an approximately $33 reduction per 1,000 kilowatt-hours of use in February compared with January, with an additional roughly $11 reduction per 1,000 kWh applying in March. That yields about a $44 total reduction per 1,000 kWh versus January levels. Commercial and industrial customers are expected to see monthly bills fall roughly 9.6 percent to 15.8 percent compared with January, with the exact decrease varying by usage profile and other rate components.

Duke Energy Florida also highlighted other customer savings the company said it is passing through. Those included $340 million in fuel-cost savings from gas-plant improvements, $750 million in savings from three new solar sites, and $65 million in Inflation Reduction Act tax credits credited to customers. Together with the removal of the storm surcharge, the measures reflect an immediate shift in the utility’s near-term cost structure as presented by the company.

The unit operates about 12,300 megawatts of generation capacity and supplies electricity to roughly 2 million customers across a service area of about 13,000 square miles. Those scale metrics mean the timing of regulatory surcharges and pass-through savings can have meaningful aggregate effects on household and business energy expenses across Florida. The broader Duke Energy Corporation serves more than 8 million electricity customers across multiple states, making such operating decisions noteworthy for investors and policy makers.

Ending the surcharge early carries both consumer and utility sector implications. For ratepayers, the announced cuts provide immediate relief on electricity bills during a winter heating season that can stress household budgets. For the utility, accelerated recovery suggests that the amortization of storm costs—often tracked in regulatory accounts and addressed through temporary surcharges—completed faster than expected, altering short-term cash flow patterns tied to recovery mechanisms.

Policy and long-term trends are also in focus. The company’s cited fuel and solar savings, plus IRA tax-credit pass-throughs, underscore how evolving generation mixes and federal incentives can lower marginal costs for utilities and customers alike. At the same time, repeated storm-related costs remain an ongoing governance challenge as utilities balance infrastructure resilience investments with ratepayer protections and regulatory oversight. Regulators will likely monitor whether accelerated recoveries become more common as utilities deploy more renewables and as extreme-weather risk changes the frequency and scale of storm response costs.

By moving the removal to February, Duke Energy Florida delivered a concrete near-term reduction in bills tied to a specific $1.1 billion cost recovery, while illustrating broader shifts in utility cost drivers that could shape rate discussions and investment priorities in the years ahead.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip