Race to Build Fuel Pipeline, West Coast Faces Looming Supply Gap

Energy companies and infrastructure developers are racing to propose a major fuel pipeline to the U.S. West Coast as analysts forecast a potential shortfall of roughly 280,000 barrels per day after two California refineries plan to close. The outcome could reshape fuel supply chains, influence regional prices for gasoline and diesel, and trigger a high stakes policy fight over costs, permitting and energy security.

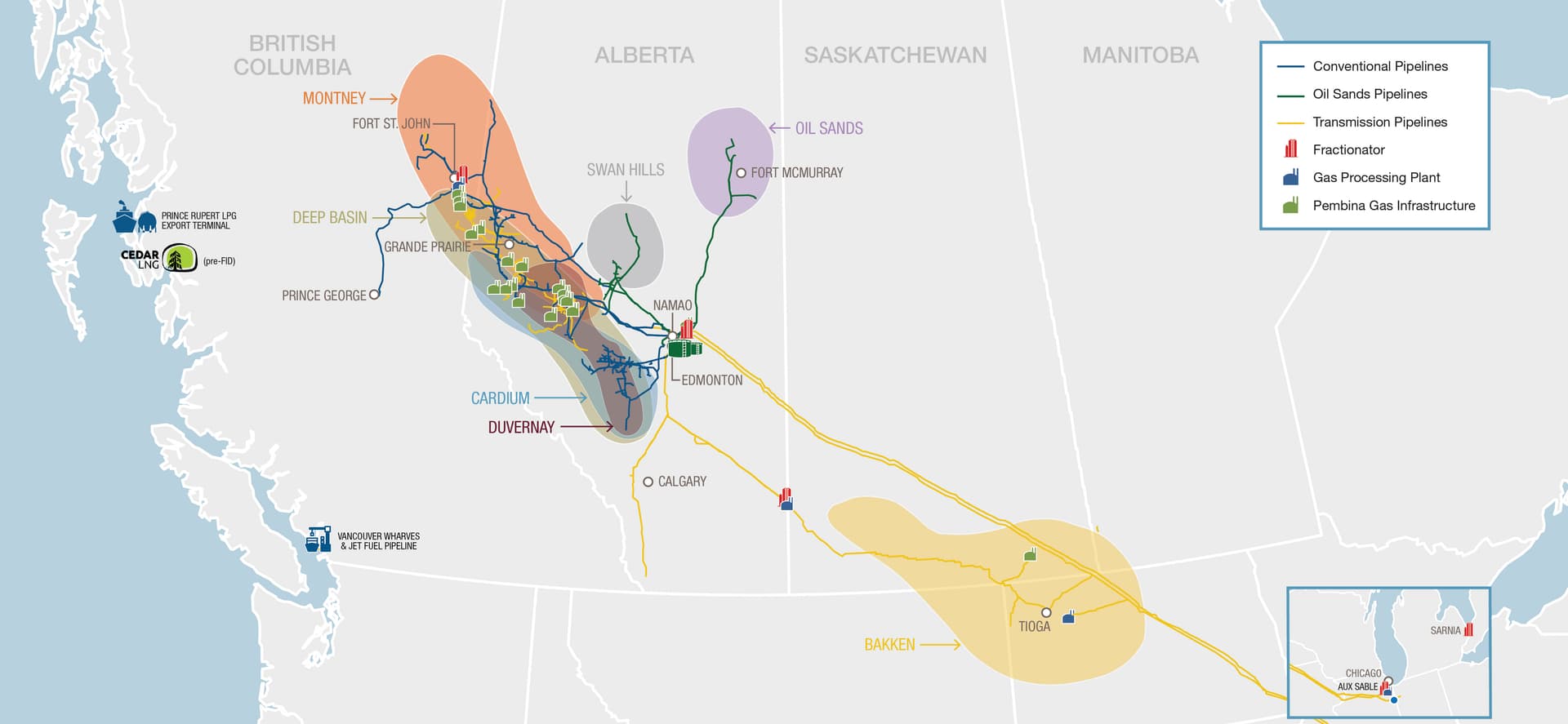

As of November 19, 2025 energy companies and pipeline developers are intensifying efforts to design and advance a major fuel pipeline to the U.S. West Coast, driven by projections that the planned closure of two California refineries could create a shortfall near 280,000 barrels per day. The proposals aim to link Gulf Coast and Midcontinent refining capacity with West Coast distribution hubs, addressing a market long isolated from the continental pipeline network and heavily reliant on coastal tanker shipments.

Proponents argue a new pipeline would reduce price volatility and supply risk for consumers in California and the Pacific Northwest by creating a predictable, high volume route for gasoline and diesel. In markets where supply disruptions have historically triggered large local price spikes, developers say pipeline connectivity could smooth wholesale price spreads between regions and lower the marginal cost of securing replacement barrels. For wholesalers and retailers, a more integrated continental grid would also change hedging strategies and inventory economics.

Opponents counter that the projects face steep financial and regulatory barriers. Construction costs for long distance refined product pipelines are high and the routes would face complex environmental permitting at multiple levels of government. Local and state regulators in California have tightened scrutiny of fossil fuel infrastructure in recent years which will complicate approvals. Opponents also note the time required to plan, permit and construct such projects means they may not address near term shortages and could lock in large capital expenditure amid accelerating energy transition trends.

Market participants are weighing alternatives while proposals advance. Short term responses could include increased tanker imports, expanded rail and truck movements, and higher terminal storage capacity on the West Coast. Each option carries its own cost structure and capacity limits and is likely to maintain higher consumer prices relative to an integrated pipeline scenario. In the longer term the economics of demand may shift as vehicle electrification, efficiency improvements and changing refinery economics alter baseline fuel needs.

The policy calculus is complicated. Federal and state agencies must balance energy security concerns against environmental and community impacts, and finance markets will assess the commercial viability of large projects in an era of uncertain demand trajectories. Investors will scrutinize permitting timelines and regulatory risk while insurers consider exposure to long term carbon transition.

The intensifying competition to design a pipeline underscores a broader realignment in U.S. fuel infrastructure. Refining consolidation and plant closures are reducing local resilience in some coastal markets, prompting debates over whether to rebuild supply through new long distance transport capacity or rely on adaptive logistics and demand management. The path chosen will shape fuel costs, regional trade flows and policy priorities for years to come.