Retired firefighter appeals as insurer denies life‑prolonging cancer therapy

A retired San Francisco firefighter and supporters urged city officials after Blue Shield denied coverage for treatment his UCSF doctors say could slow stage 4 lung cancer progression. The case raises equity and oversight questions for the city employee health plan.

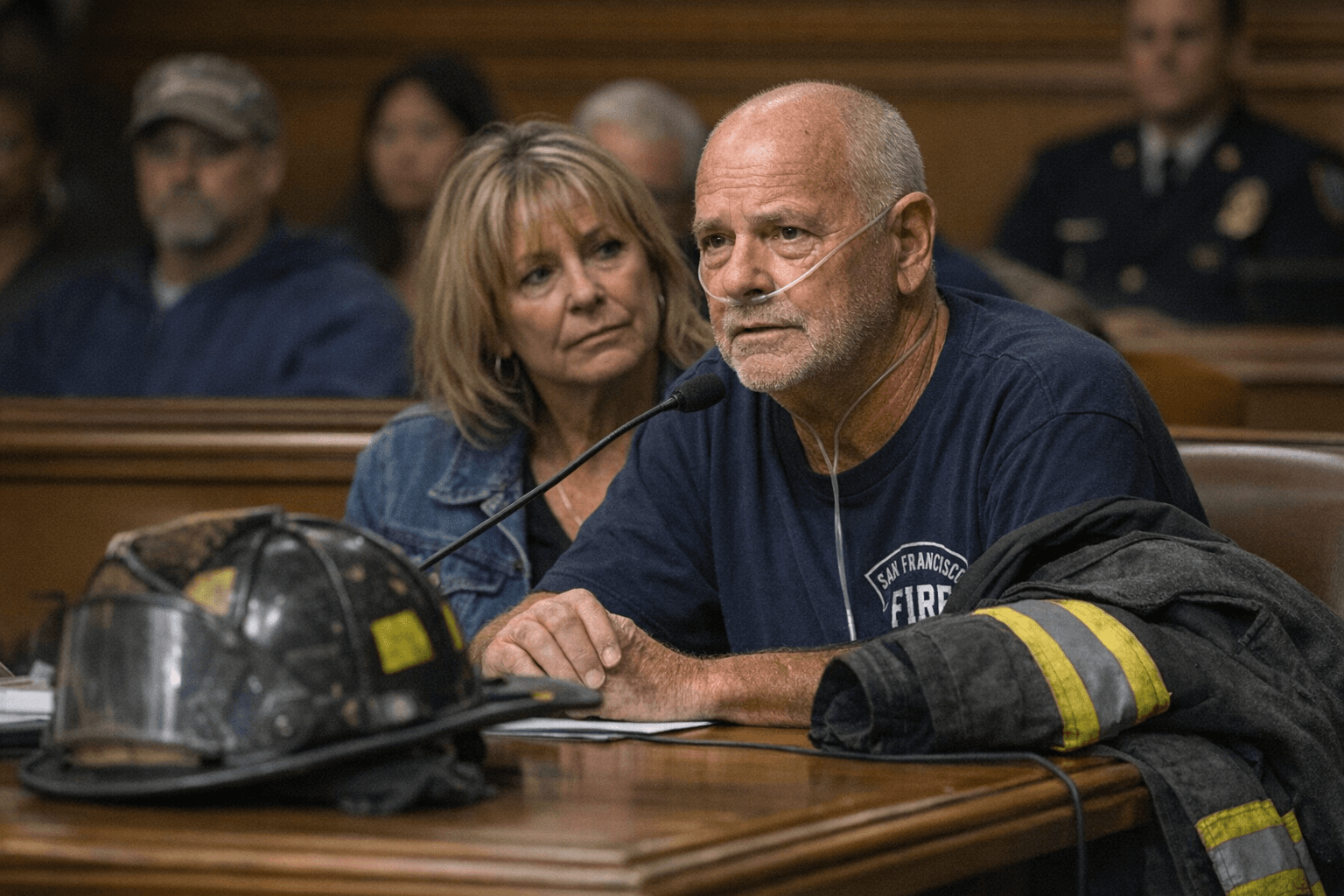

Retired San Francisco firefighter Ken Jones and his family stood before the city Health Service Board on Jan. 9, 2026, asking officials to intervene after Blue Shield denied coverage for a chemotherapy-immunotherapy regimen that UCSF oncologists said could slow progression of his stage 4 lung cancer. The family described the denial as life-threatening and said the out-of-pocket cost for the course of care would be roughly $50,000.

Jones was joined at the hearing by former fire chiefs and fellow first responders who framed the dispute as more than an individual claim. They urged city leaders to scrutinize how the plan administered by Blue Shield evaluates claims for complex, high-cost cancer treatments for retirees and active city employees. Local elected officials and former department leaders called for review of the contract and insurer practices for the city employee health plan.

The Health Service Board has investigatory levers but cannot force an insurer to reverse a claims decision. Board members can probe plan administration and apply political pressure on plan managers and vendors, a procedural limit that left supporters focused on public pressure and fundraising to cover immediate costs. The family said fundraising and other outreach were underway to meet the roughly $50,000 gap.

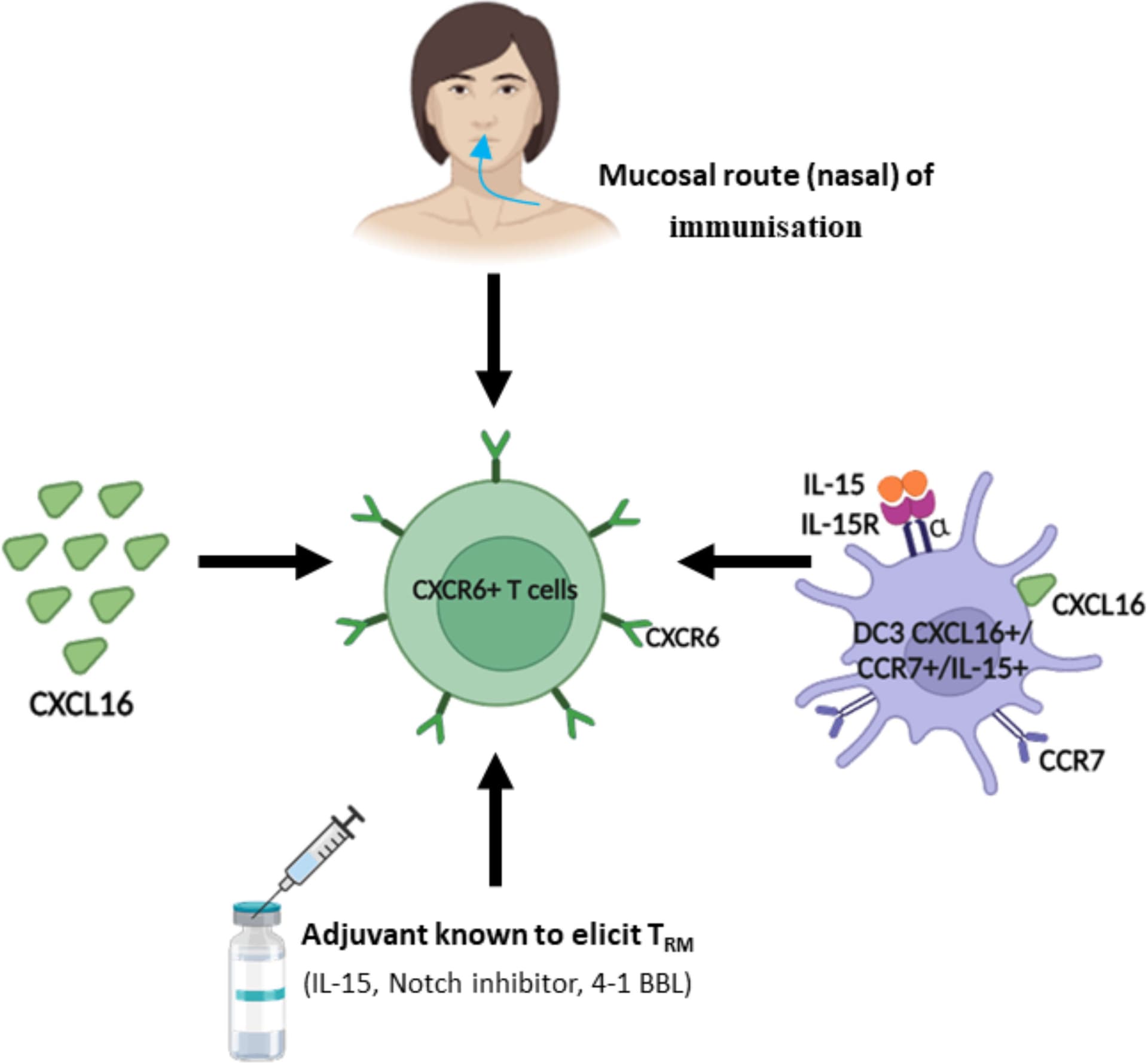

This dispute highlights broader public health and equity issues in San Francisco. First responders face elevated occupational risks for certain cancers tied to repeated smoke and toxin exposure; when retired workers encounter coverage denials for cutting-edge or combination therapies, the result can be catastrophic financial strain and interrupted care. Denials for treatments recommended by treating oncologists raise questions about clinical decision rules used by plan administrators, transparency in appeals processes, and whether contract oversight adequately protects vulnerable retirees on fixed incomes.

For city workers and retirees, the case underscores the practical limits of employer-sponsored coverage. When high-cost therapies are involved, claim denials can translate into immediate treatment delays. That outcome has downstream public health implications: later-stage patients who go without recommended systemic therapy can require more intensive emergency care and place additional strain on hospital and community resources in neighborhoods across the city.

Our two cents? If you or a loved one rely on San Francisco’s city plan, check plan directories, confirm whether specialty cancer drugs and combination regimens are covered, and speak with your HR office or benefits administrator early when complex care is proposed. For the community, the Jones case is a reminder to press for contract transparency and stronger oversight so that life-saving treatment decisions are made on clinical grounds, not cost alone.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip