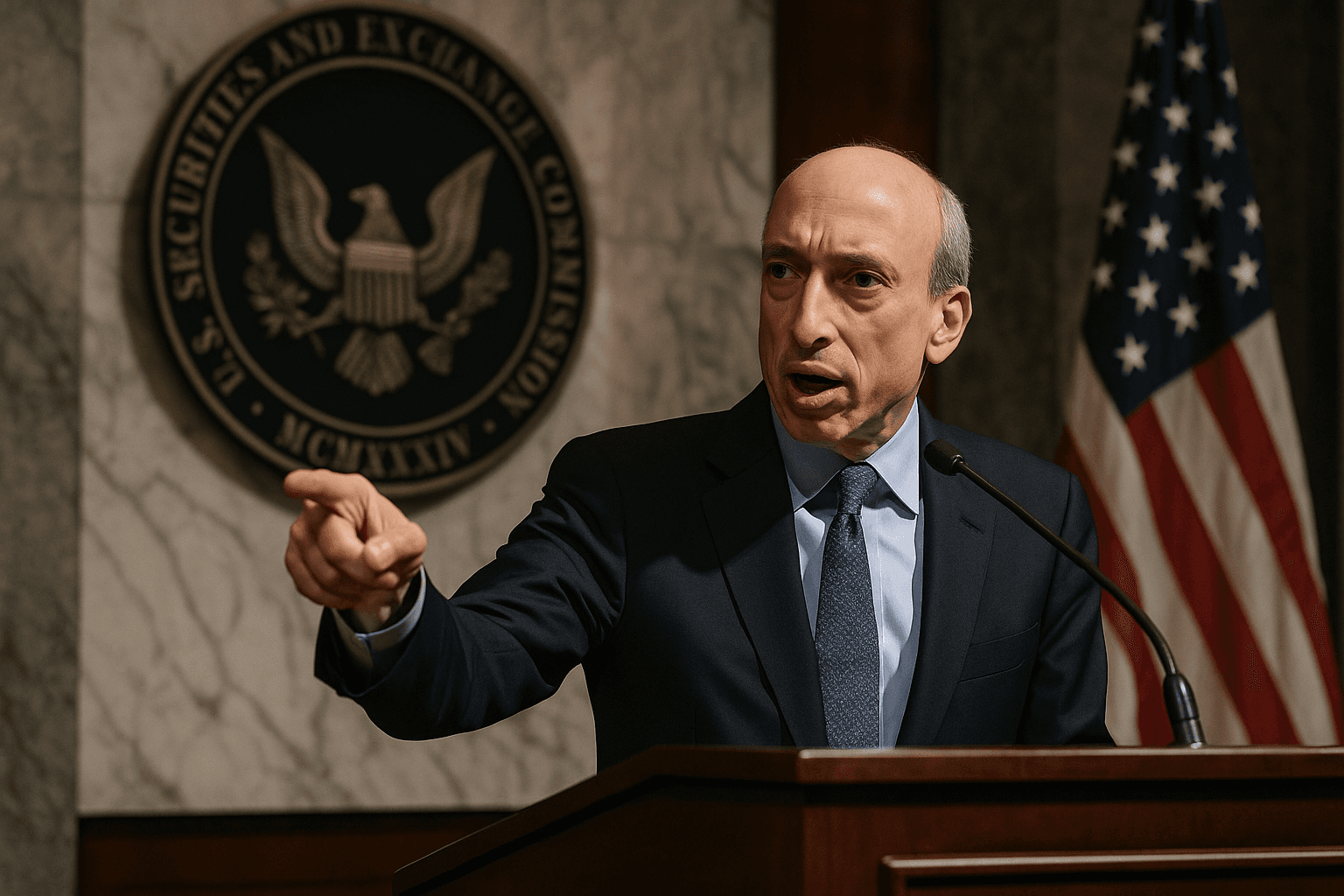

SEC Chair Urges Overhaul of Executive Pay Disclosure Rules

SEC Chair Paul Atkins told an audience at the New York Stock Exchange that the agency should rewrite executive compensation disclosure requirements and ease regulatory burdens on smaller public companies, arguing that current rules impede capital formation. The proposal signals a wider deregulatory agenda that could reshape investor reporting, corporate governance, and the agency's approach to crypto oversight.

Paul Atkins, chair of the Securities and Exchange Commission, said on December 2 at the New York Stock Exchange that the agency must overhaul longstanding disclosure requirements that govern how companies report executive compensation. In remarks that previewed a deregulatory agenda, Atkins argued the disclosure regime has been "hijacked to require information unmoored from materiality" and called for a "re-set" of disclosure requirements so that reporting better aligns with what is financially material to investors.

Atkins framed the effort as a response to regulatory costs that disproportionately affect smaller public companies. He warned that outdated thresholds force relatively small public firms to meet the same disclosure obligations as much larger competitors, a dynamic the chair said raises the cost and complexity of capital raising for smaller issuers. That concern has particular resonance given the long term decline in the number of publicly listed U.S. companies, which has left a market structure dominated by a smaller cohort of large cap firms.

The proposal touches on high profile elements of executive pay disclosure that have been added or strengthened over the past decade. Rules enacted in the wake of the 2008 financial crisis and the Dodd Frank Act introduced expanded executive compensation transparency, including requirements such as the CEO pay ratio, proxy voting disclosures and say on pay procedures. Atkins did not lay out a specific timetable or text for new rules, but his emphasis on materiality would shift the SEC away from uniform templates toward a more judgment driven standard that could reduce the volume of routine, highly detailed filings.

Market and governance implications are significant. Reduced compliance burdens could lower fixed costs for smaller issuers and potentially make IPOs and other listings more attractive. At the same time, investor groups and institutional shareholders warn that removing standardized disclosures can make cross firm comparisons harder and raise information asymmetries between large institutional investors and ordinary shareholders. The trade off between cost savings and transparency will be central to the debate.

Atkins also linked the disclosure overhaul to a broader regulatory reorientation that embraces cryptocurrencies and seeks to move enforcement and oversight emphasis away from routine reporting minutiae toward material disclosures. That represents a change from periods when the SEC pursued extensive enforcement actions against crypto firms and token offerings, and it will likely stir debate in Congress and among commissioners over the agency's priorities.

Any shift will require formal rulemaking and at least a majority vote at the five member commission, followed by public comment. The likely lobbying battle will pit smaller issuers and parts of the business community that favor lower compliance costs against investor advocates and proxy advisory firms that say consistent reporting is essential to accountability. The outcome will help determine whether the SEC moves toward a lighter touch that prioritizes materiality and capital formation, or preserves the standardized disclosures that have guided investor analysis for decades.