Southeast Emerges as New Hub for Subsea Fiber and Data

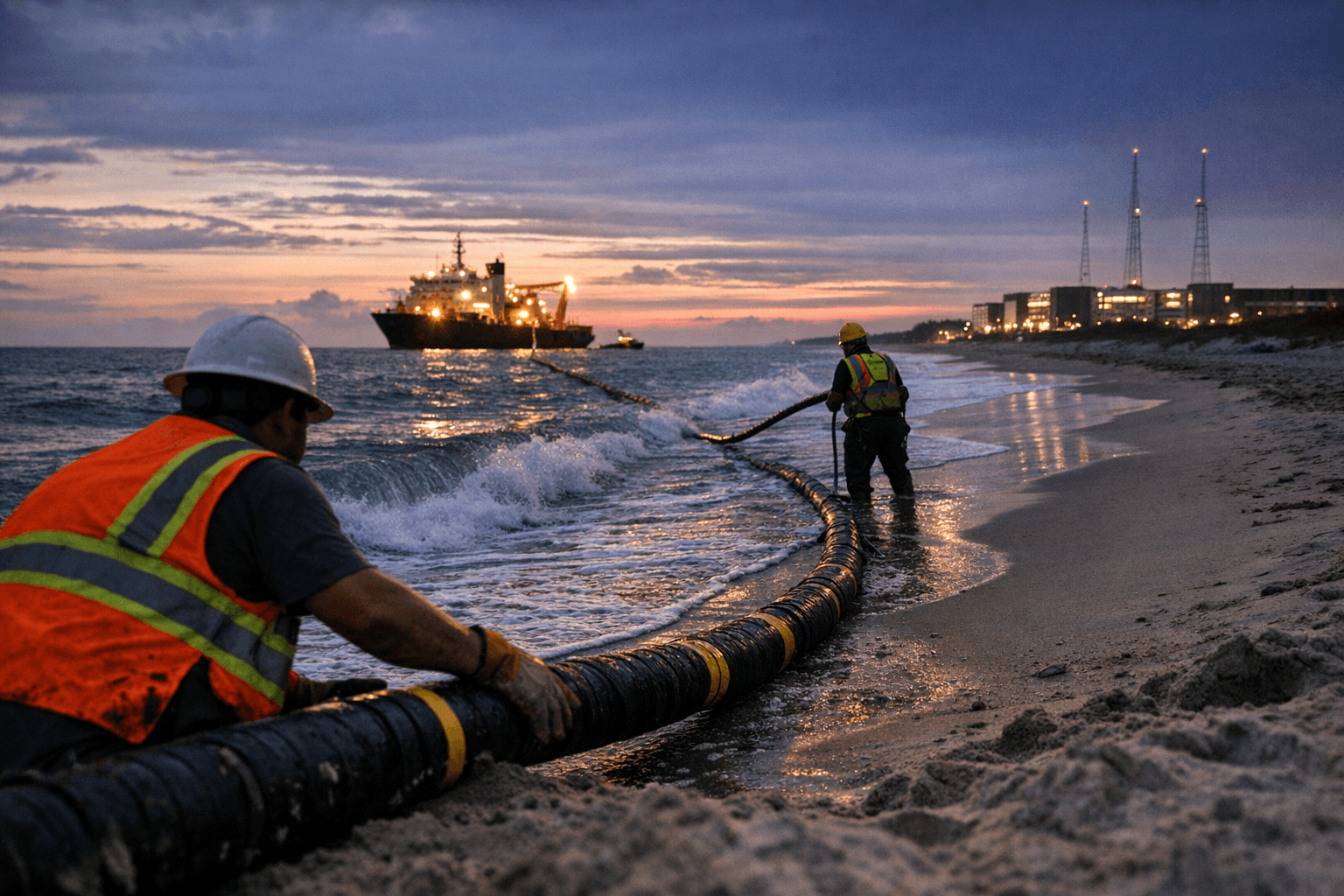

Telecom and cloud companies have begun routing more undersea fiber and related infrastructure to the U.S. Southeast, citing capacity and resilience benefits tied to rising AI and cloud demand. The shift, visible in recent cable landings and expansions in Myrtle Beach and Virginia Beach, could reshape supply chains and economic opportunities for Guilford County and the broader Triad region.

On January 5, 2026, industry activity and infrastructure projects underscored a growing trend: network operators and data-center builders are redirecting undersea cable capacity and landing facilities toward the U.S. Southeast. Notable moves include DC BLOX’s new Myrtle Beach landing station and expansion projects in Virginia Beach, developments that reflect broader efforts to diversify cable landings beyond the traditional Northeast corridor.

The economic logic driving the shift is straightforward. Rising demand for cloud services and AI workloads is increasing transoceanic bandwidth needs, and operators are seeking landing sites that can lower construction complexity, reduce exposure to single-point failures concentrated in the Northeast, and accelerate routes to inland markets. Analysis from TeleGeography has emphasized that diversifying landing locations can lower overall system costs and improve network resilience by avoiding congested corridors and shortening terrestrial backhaul distances.

Policy changes are also nudging the market. New Federal Communications Commission rules intended to tighten control over foreign involvement in subsea cable construction have altered how consortiums plan financing and sourcing, encouraging some operators to favor U.S.-centric routes and partners. At the same time, local permitting regimes, coastal environmental constraints, and shoreline engineering considerations in North Carolina and neighboring states shape where cables can land, making sites in South Carolina and Virginia commercially attractive for companies seeking predictable timelines and regulatory clearance.

For Guilford County and the Triad, the implications are indirect but tangible. Data-center supply chains increasingly require reliable inland fiber routes, power upgrades, and connected campuses for edge computing. Greensboro and nearby communities sit along likely backhaul corridors linking Southeast landing stations to inland hubs, which can mean increased demand for fiber construction, electrical infrastructure upgrades, and logistics services. That in turn can support construction jobs, equipment supply firms, and potential new operations from colocation and interconnection providers seeking proximity to inland network access.

Local officials and economic developers should weigh these trends when planning land use, workforce training, and utility investments. The shift toward Southeast landings does not produce immediate large-scale data-center campuses in the Triad by itself, but it changes the calculus for regional competitiveness: shorter, more resilient routes to landing stations can make Guilford County more attractive to companies that require low-latency connections to transoceanic capacity. As AI and cloud traffic continue to grow, the Triad’s role as a fiber and power crossroads could translate into steady infrastructure investment and modest gains in employment and tax revenue over the coming years.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip