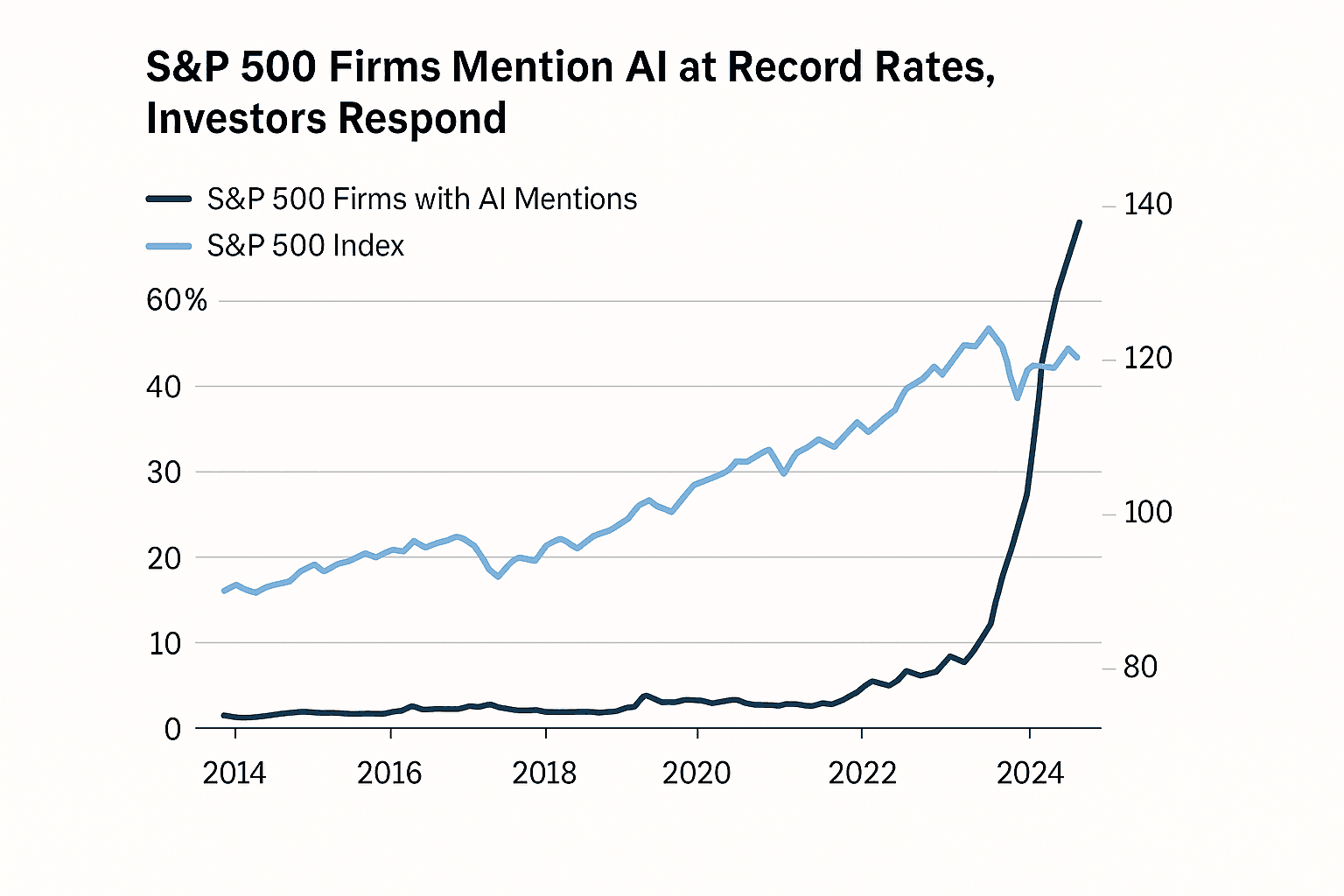

S&P 500 Firms Mention AI at Record Rates, Investors Respond

Mentions of AI on earnings calls surged to a decade high as 306 S&P 500 companies referenced the term between September 15 and December 4, 2025, according to FactSet data cited by Reuters. Analysts say investors have rewarded firms that promise AI driven growth or cost savings, but they warn that turning talk into durable revenue will determine long term returns.

Corporate executives invoked artificial intelligence more often on quarterly earnings calls than at any point in the last ten years, reflecting a broad industry push to position AI at the center of growth strategies. FactSet data cited by Reuters on December 5 showed that 306 S&P 500 companies referenced AI on calls held between September 15 and December 4, 2025, a spike that analysts and market participants said has translated into tangible investor enthusiasm.

The uptick in AI mentions coincided with measurable market reactions. Analysts tracking the calls found that companies discussing AI tended to experience stronger short term stock performance as investors bid up shares on promises of enhanced revenue streams, efficiency gains, or faster product development. Market observers attributed that response to a combination of eager capital seeking exposure to a transformative technology and corporate narratives that emphasize concrete pathways to monetization.

Industry executives have pointed to enterprise adoption of generative AI tools as a principal driver of the conversation. Large firms across sectors are experimenting with AI driven customer service, automated content creation, and decision support systems, while software makers and chip suppliers report increased demand for models and hardware. That demand has in turn stimulated cloud infrastructure spending as companies deploy larger models and require more compute capacity. Analysts said the dynamic has fostered tighter coordination between software, chip and cloud vendors, creating a multi layered supply chain that amplifies the reach and visibility of AI initiatives.

Despite the enthusiasm, some market watchers urged caution. While references to AI in earnings calls helped lift short term valuations, analysts emphasized that the real test will be productization and meaningful monetization. Translating pilot projects and internal tooling into scalable, revenue producing offerings is difficult, they said, and companies that rely on broad promises without clear metrics risk disappointing investors when quarterly results fail to match expectations.

The surge in AI discussion also highlights broader economic and societal questions. As firms pursue cost savings and new revenue from automated systems, workforce impacts and ethical concerns will take on greater prominence. Regulators, customers and employees will increasingly demand transparency about how models are trained, the data that underpins them and the safeguards in place to prevent bias or misuse. Investors weighing AI narratives must therefore balance the excitement of rapid adoption with scrutiny of operational readiness and governance.

Earnings calls have become a staging ground where technology narratives meet market discipline. For now, corporate talk about AI is buying goodwill from investors, but sustaining those gains will require demonstrable products, repeatable revenue models and robust oversight. The next several quarters will reveal whether the current barrage of AI references reflects durable transformation, or an elevated moment that outpaced companies ability to deliver on the promises.