State finance officials warn SEC change could weaken shareholder oversight

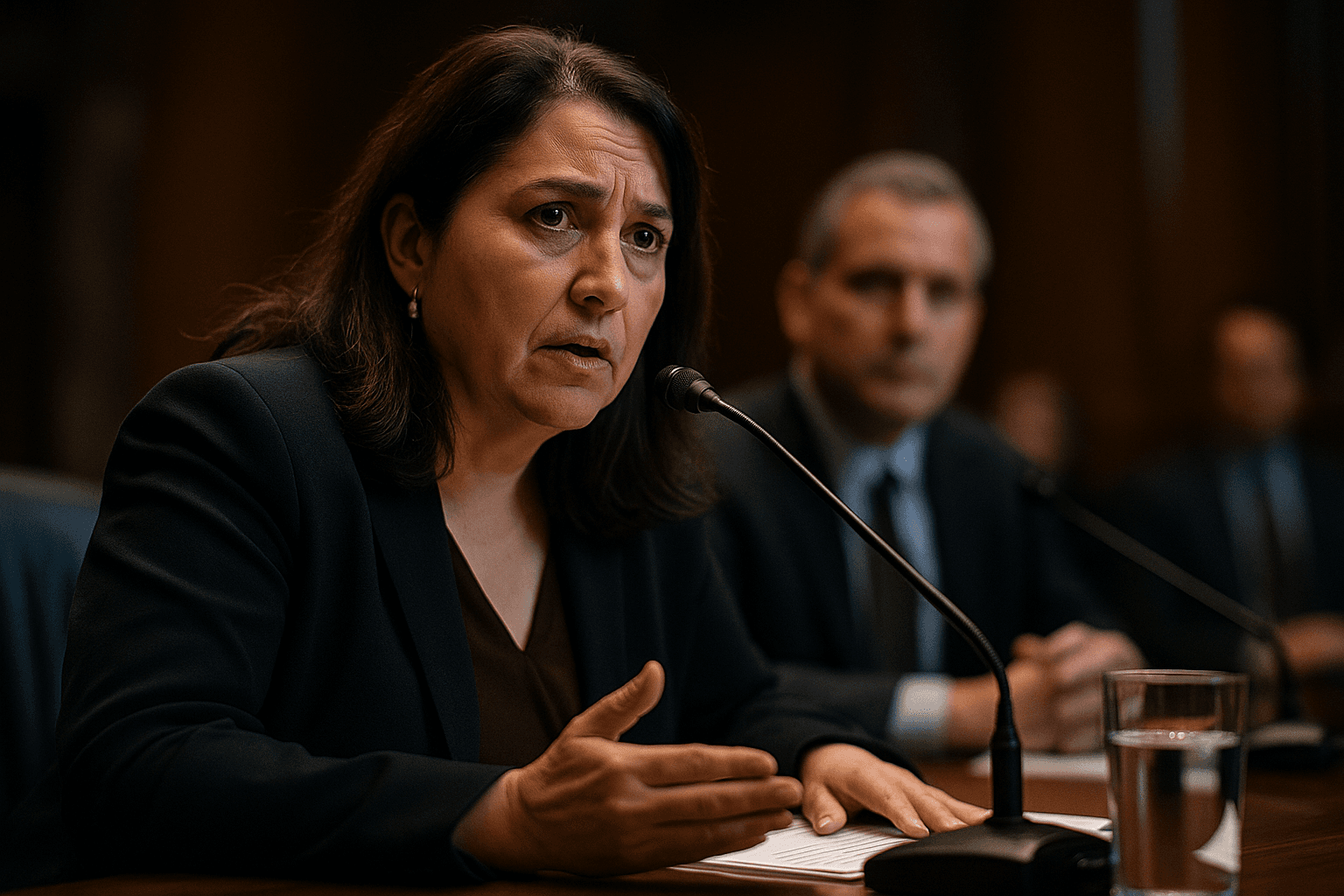

New Mexico Treasurer Laura Montoya joined 16 other state finance officials on December 7, 2025 in urging the Securities and Exchange Commission to reverse a recent policy shift that allows companies to exclude shareholder proposals if viewed as improper under state law. The coalition warned the change reduces corporate accountability, threatens investor protections and could carry consequences for public pensions and municipal stakeholders in Los Alamos County.

New Mexico Treasurer Laura Montoya on December 7, 2025 signed a letter with 16 other state treasurers and finance officials addressing Securities and Exchange Commission Chair Paul S. Atkins. The coalition challenged an SEC position that grants companies greater latitude to exclude shareholder proposals based on untested interpretations of state law during the current proxy season, Oct. 1, 2025 to Sept. 30, 2026.

Signatories argued that the shift moves decision making away from standardized federal guidance and toward uncertain state law readings, a change they say raises reputational risk and undermines corporate accountability. “Our concerns are grounded not in ideological preference but in fiduciary duty,” the letter stated, and added that “These changes would suppress shareholder governance, diminish corporate transparency and accountability, and create risks to profitability and reputation for companies further undermining the confidence that has attracted global investors to American firms and markets.”

The letter also criticized public comments by Chair Atkins that suggested the SEC would be inclined to accept company requests to ignore shareholder proposals, describing those remarks as conveying “high confidence” in such outcomes. The coalition warned that sidelining federal review will likely push investors toward more disruptive tactics. “Sidelining the rule … increases the likelihood that investors will escalate their concerns through more disruptive and adversarial channels,” the letter said, while adding that “Rather than alleviating pressure on corporate boards, these changes risk fueling board level instability and reputational risk if companies appear to block investor voice.”

An SEC spokesperson defended the decision as an administrative choice made “after thoroughly considering the staff’s role in the shareholder proposal process, staff resources, and timing issues,” and added that “this decision will allow staff to focus on time sensitive transactional matters including capital formation and investor protection.” The signatories counter that the Commission’s repeated policy changes without formal rulemakings or public comment run counter to its investor protection mandate. “The Securities and Exchange Commission is tasked with investor protection as a core tenet of its three part mandate. Under your tenure, the Commission has repeatedly made significant policy changes affecting shareholders’ rights to engage with the companies they own, without undertaking formal rulemakings or soliciting public comment. We are deeply concerned by this trend.”

For Los Alamos County residents, the dispute matters because shareholder proposals and proxy voting are primary mechanisms by which public pension funds, municipal investors and other institutional holders press companies on governance, environmental and financial risks. Changes that constrain those channels could alter how trustees engage with portfolio companies and increase the likelihood of escalatory tactics that affect corporate boards and investment returns. County trustees and voters will face decisions about how to monitor pension exposures, evaluate proxy voting practices and maintain oversight of public assets in a shifting regulatory environment that affects accountability across markets.