Strategy, the Bitcoin Treasury Firm, Keeps Nasdaq 100 Place

Strategy retained its spot in the Nasdaq 100 after the index provider completed its annual reshuffle, a decision that preserves the company’s visibility in major passive funds and ETFs. The outcome matters because Strategy’s large bitcoin holdings and high share price sensitivity to crypto markets raise questions about index classification and potential future reweighting.

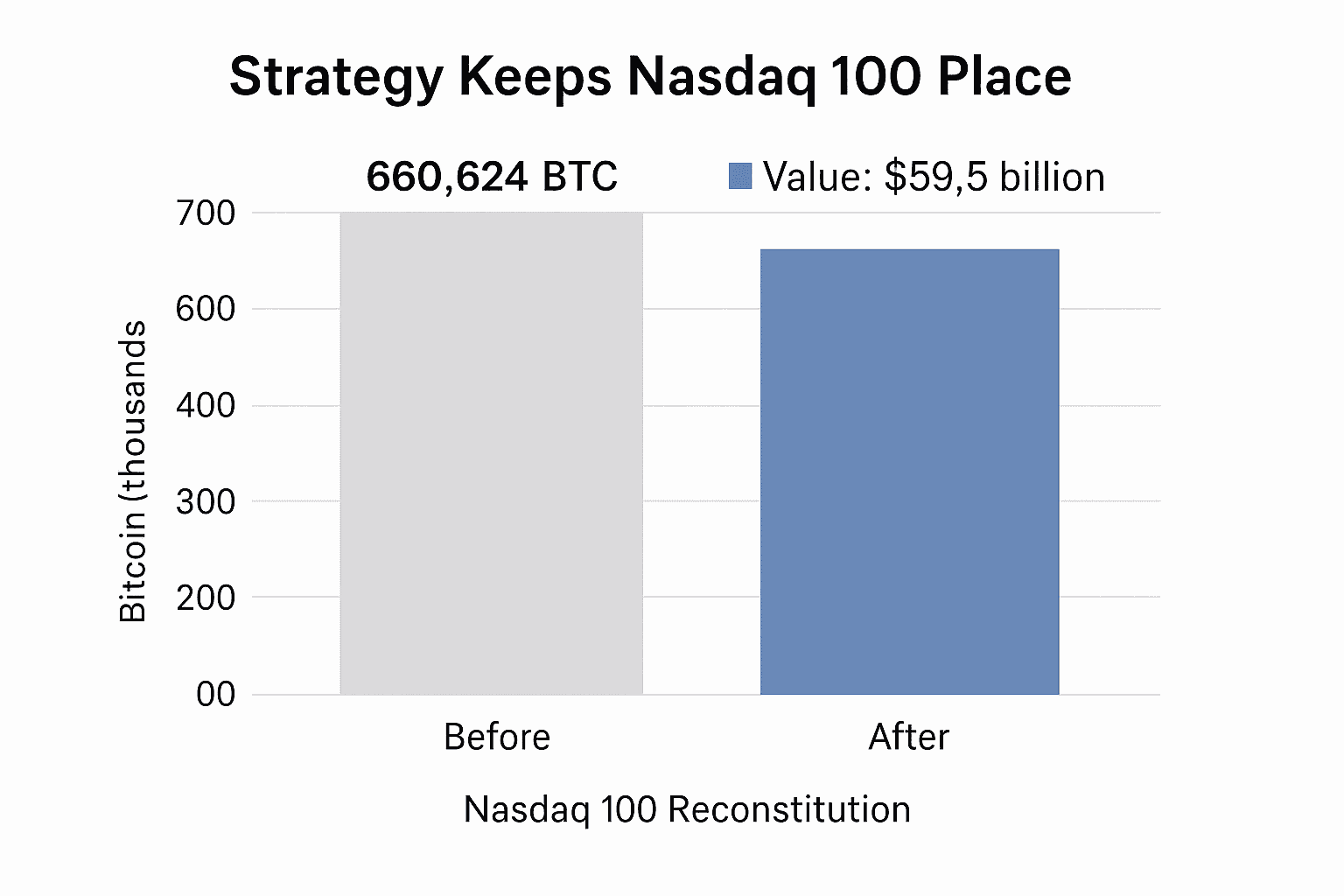

Strategy, the company once known as MicroStrategy, will remain a constituent of the Nasdaq 100 after the index’s annual reconstitution was announced in mid December. Nasdaq disclosed its reshuffle between December 12 and December 13 and said the changes will take effect on December 22, with six firms removed and three added. Strategy, which joined the Nasdaq 100 in December 2024, survived the review and will continue to be represented in the benchmark when the new lineup becomes effective.

The company has shifted over the past five years from business intelligence software to operating as a bitcoin treasury vehicle. Public filings and reporting list Strategy as the largest corporate holder of bitcoin, with 660,624 BTC on its balance sheet. At current market prices that stake was valued at roughly $59.5 billion at the time of reporting. Investors use Strategy stock, ticker MSTR, as a way to gain exposure to bitcoin without holding the token directly, a dynamic that links the company’s equity performance closely to bitcoin price swings.

That linkage has become a focal point for analysts and index providers. Strategy shares were down more than 40 percent year to date, and some market observers expressed concern that the company may be overleveraged. Reports note that Strategy has issued debt to acquire additional coins, exposing shareholders to the combined risks of leverage and cryptocurrency volatility. Those factors feed debate over whether a company whose principal activity is accumulating digital assets should be classified and included alongside traditional non financial technology companies.

MSCI, a major index provider, has publicly flagged the matter and is considering whether to exclude companies whose primary business is acquiring bitcoin or other cryptocurrencies from some benchmarks. Media coverage has said an MSCI ruling could come in January. Nasdaq itself had not indicated it was reviewing Strategy’s eligibility ahead of this year’s reshuffle, leaving open the possibility that other index managers could take different approaches.

The immediate market impact of Strategy’s retention is pragmatic. Passive funds and exchange traded funds that track the Nasdaq 100 will continue holding MSTR, avoiding forced trades that would have followed a removal. But the episode sharpens longer term questions about index construction and market exposure. If more corporate treasuries follow Strategy’s model, benchmarks designed to reflect large non financial issuers will face rising concentration risk tied to a single asset class. That could amplify volatility in major equity benchmarks when bitcoin moves.

For investors and policymakers the case presents a tradeoff. Including Strategy preserves a market reality where big companies adapt their capital strategies to seek returns, but it also tests index rules that aim to separate operating companies from investment vehicles. With roughly one year since Strategy first entered the Nasdaq 100 and with MSCI review imminent, the debate over classification, leverage and index eligibility is likely to continue into the new year. Executive Chairman Michael Saylor remains the most prominent public face of the company’s bitcoin first strategy, and how index providers respond will help determine whether such corporate treasury models become mainstream or are confined to a niche.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip