Supreme Court Asked to Clarify ERISA Loss-Causation Burden

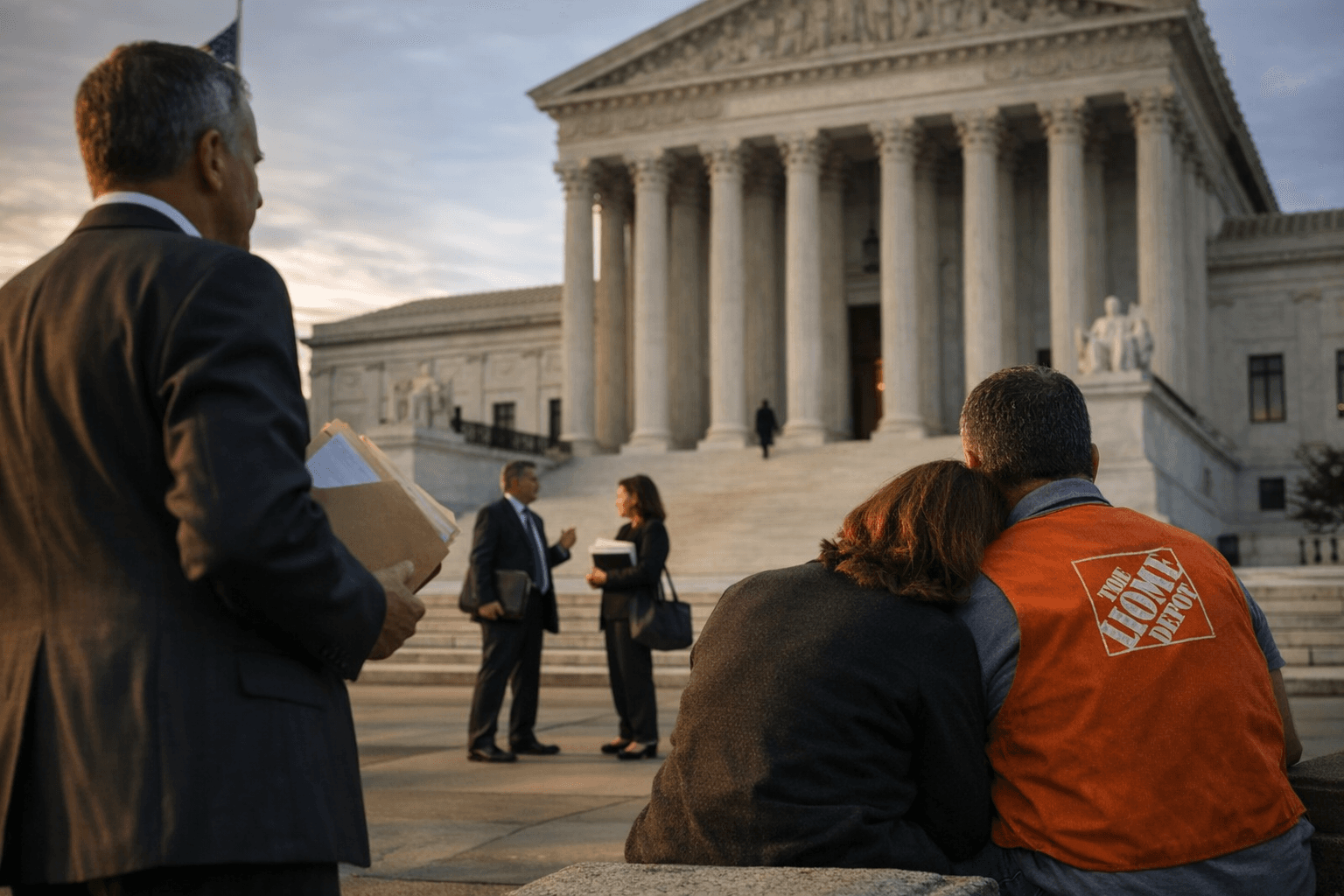

Plaintiffs in Pizarro v. Home Depot asked the U.S. Supreme Court to resolve whether plaintiffs or defendants must prove loss causation in ERISA fiduciary-breach cases involving company 401(k) plans. The U.S. Solicitor General filed views backing plan sponsors and urged the Court to take the case, a development that could reshape the pleading and proof landscape for excessive-fee and mismanagement claims affecting workers' retirement savings.

Plaintiffs in a lawsuit against Home Depot over alleged fiduciary breaches in the company 401(k) plan asked the U.S. Supreme Court to resolve a split among federal appeals courts about who bears the burden of proving loss causation in ERISA fiduciary-breach litigation. The U.S. Solicitor General filed briefed views supporting plan sponsors and fiduciaries and urged the Court to grant review, signaling the issue’s national importance for retirement-plan litigation.

At issue is whether plaintiffs bringing ERISA claims must prove that alleged fiduciary breaches caused losses to the plan, or whether defendants must disprove causation once liability elements are otherwise shown. Courts are divided, and that division affects how easily participants can survive initial pleadings and how defendants allocate litigation resources. If the Supreme Court adopts the position urged by the Solicitor General, plaintiffs could face higher hurdles at the motion-to-dismiss and summary-judgment stages, changing the calculus for both plaintiffs and plan sponsors.

The question matters to millions of workers because it goes to the core of how disputes over plan management and fees are litigated. Many ERISA suits allege excessive fees or imprudent investment lineups; those suits often hinge on whether alleged errors actually caused measurable losses to participants’ accounts. A rule that places a heavier burden on plaintiffs could reduce the number of cases that proceed to discovery or trial, while a rule favoring plaintiffs could make it easier to challenge fiduciary conduct and potentially increase settlements or judgments that affect plan finances and sponsor liability.

Plan sponsors, fiduciaries and their advisers have already been parsing the implications. Practitioner analyses and plan-sponsor summaries have circulated that explain the legal background, the question presented to the Court and practical steps fiduciaries may take now, including tightening documentation of decision-making, reviewing fee benchmarking and reconsidering plan governance practices. For participants and employee advocates, the prospect of a shift in burden affects not only litigation strategy but also incentives for monitoring plan governance and raising concerns internally before disputes escalate.

If the Court grants review, the resulting decision would likely clarify pleading and proof standards nationwide and influence how ERISA suits are filed and defended. Until then, plan fiduciaries and participants should expect heightened attention to documentation, fee disclosure and the alignment of investment choices with fiduciary duties, while litigators on both sides prepare for a potentially significant change in ERISA doctrine.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip