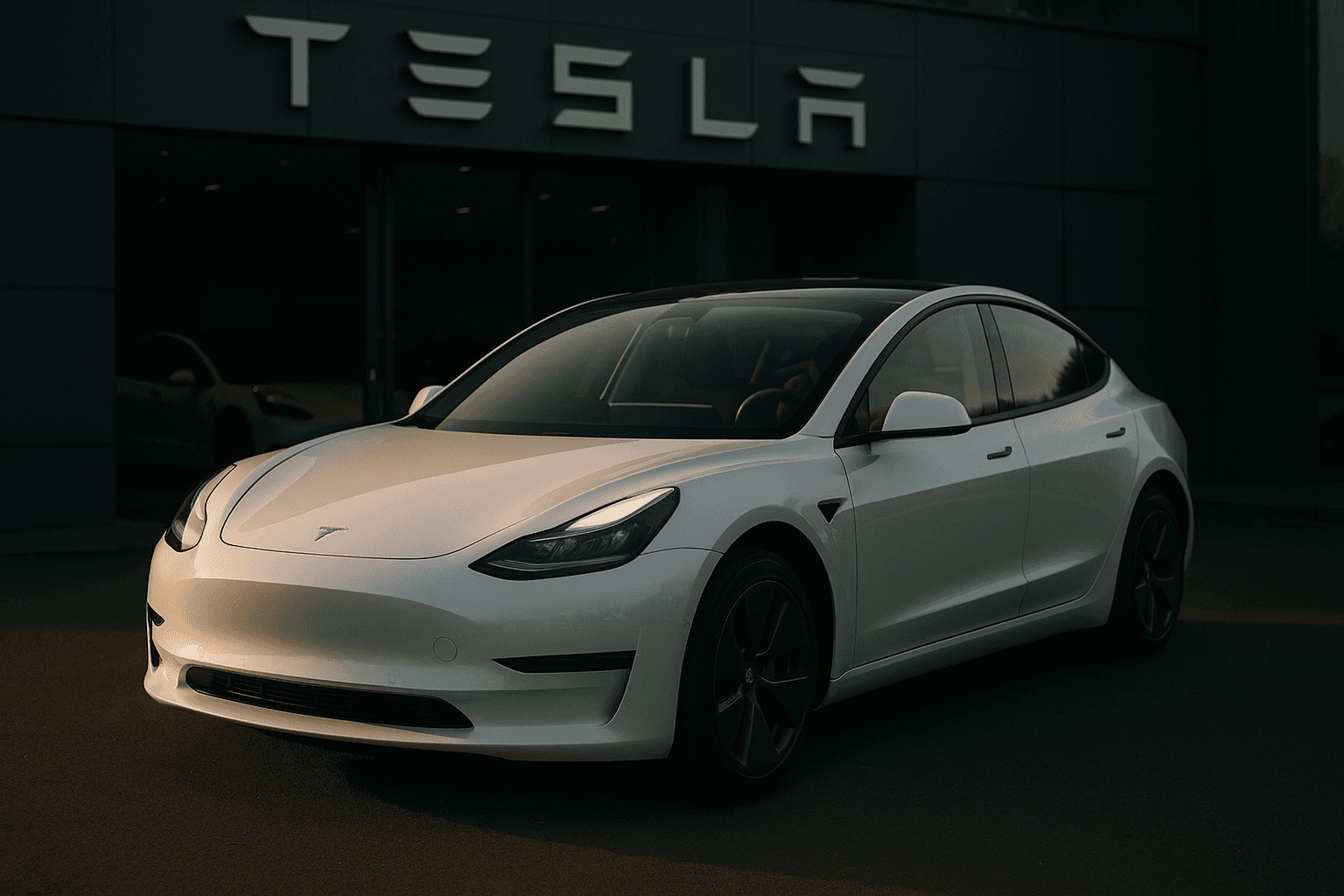

Tesla Cuts Price, Launches Model 3 Standard in Europe

Tesla introduced a lower priced Model 3 Standard to European markets to revive sluggish demand and blunt growing competition from lower priced Chinese and European electric vehicles. The move could shore up near term revenue while complicating margins and intensifying price competition across the continent.

Tesla on December 5 launched a lower priced Model 3 Standard in Europe, following a U.S. debut two months earlier, a strategic effort to arrest slowing demand and defend market share against aggressively priced rivals. Reuters reported list prices including €37,970 in Germany and said local pricing was posted for Norway and Sweden, with deliveries expected in the first quarter of 2026. Tesla advertises the Standard variant as retaining an electric range above 300 miles, while trimming some premium features to reach a lower price point.

The timing reflects a tension familiar to mature hardware businesses, where near term sales support must be balanced against longer term investments. Analysts cited by Reuters characterized the European rollout as a near term revenue play, while Tesla continues to pour resources into artificial intelligence and other long term initiatives. The Standard variant is intended to plug a gap emerging in Europe, where competitors from China and established European brands are launching models priced below $30,000, exerting downward pressure on list prices and consumer expectations.

A Model 3 listed at €37,970 sits above the sub $30,000 threshold many rivals are targeting, but the variant narrows the gap to mainstream internal combustion alternatives and lower priced EV entrants. For consumers facing elevated borrowing costs, rising living expenses, and the removal or tapering of some national EV incentives, lower sticker prices can materially affect purchase decisions. For Tesla, increased volume on a simpler spec sheet may offset per unit margin pressure if manufacturing efficiencies and volume leverage hold.

Market implications extend beyond Tesla earnings. A lower price point from the market leader can force competitors to respond, accelerating price competition and potentially compressing margins across the sector. Battery suppliers, semiconductor vendors, and logistics partners may see order patterns shift as automakers chase volume over higher margin premium features. That dynamic risks prompting consolidation among smaller makers unless they can carve out niche value propositions or secure cost advantages.

Policy considerations also matter. European climate and emissions targets continue to favor electrification, but policymakers have limited fiscal room to subsidize purchase incentives at scale. Affordability becomes the lever to increase EV adoption in the absence of generous subsidies. A mainstream Model 3 could therefore support broader emissions goals by converting buyers who are sensitive to upfront cost rather than operating cost.

Over the longer term, Tesla’s strategy points to two parallel tracks. One is price accessibility, where simpler configurations extend reach into price sensitive segments. The other is an aggressive push into AI and software defined features that promise higher margin services and differentiated products. How successfully Tesla manages the trade off between volume driven by lower prices and returns on heavy AI investment will shape profit trajectories and competitive dynamics in Europe through 2026 and beyond.