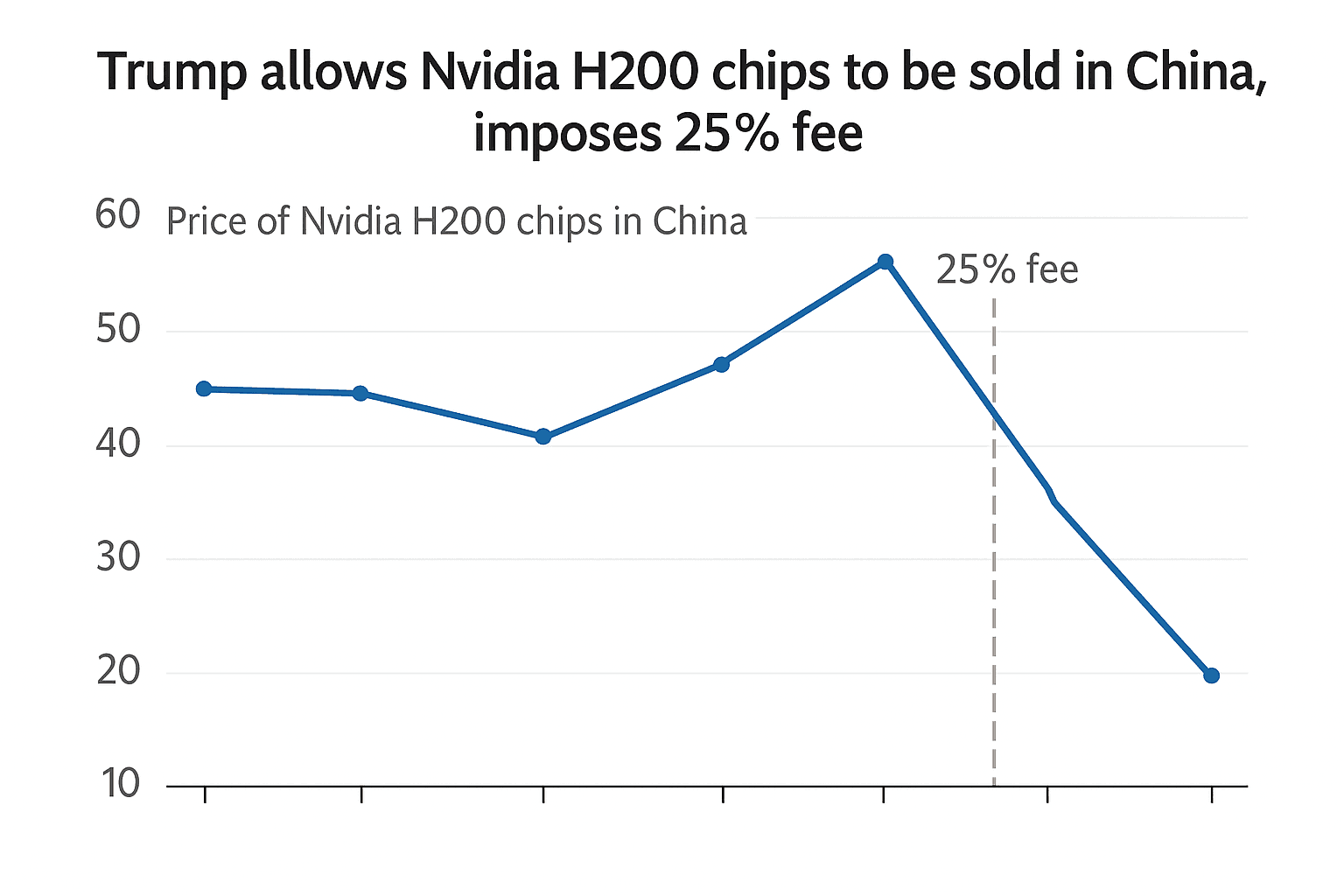

Trump allows Nvidia H200 chips to be sold in China, imposes 25 percent fee

President Donald Trump announced that the United States will permit exports of Nvidia H200 artificial intelligence training chips to approved customers in China, while collecting a 25 percent fee on those sales. The decision signals a policy shift intended to protect national security while preserving U.S. commercial interests, and it has provoked immediate criticism and uncertainty about its effects on global technology competition.

The Trump administration on Monday moved to allow exports of Nvidia’s H200 artificial intelligence training chips to approved Chinese customers while imposing a 25 percent fee on such transactions, a policy shift from earlier U.S. restrictions on advanced AI semiconductors. The administration framed the decision as a calibrated approach to safeguard national security while sustaining the competitiveness of U.S. semiconductor firms, but the announcement quickly drew sharp criticism and raised questions about enforcement and geopolitical consequences.

The Commerce Department is finalizing implementation details for the program and officials indicated the same framework could be extended to other major chipmakers including AMD and Intel. Under the plan, exports would only proceed after U.S. licensing and fees. The administration presented the fee as a way to capture economic value and to fund oversight, though the specifics of licensing criteria and compliance mechanisms remain under development.

Critics on both sides of the political aisle reacted strongly. China hawks and some Democrats warned that easing restrictions could inadvertently assist Beijing’s military modernization and accelerate Chinese efforts to supplant U.S. leadership in advanced chips and AI. Supporters within the tech industry argued that allowing controlled sales preserves American firms’ access to the world’s largest market and prevents competitor nations from filling any void left by U.S. isolation.

Financial markets responded with modest gains for Nvidia and other chipmakers after the announcement, reflecting investor relief that potential market opportunities would not be entirely foreclosed. Analysts cautioned that U.S. approval does not guarantee immediate or sizable sales in China. They pointed to possible regulatory barriers in Beijing, reluctance among Chinese commercial customers to purchase U.S. technology amid geopolitical tensions, and China’s long running push for domestic semiconductor self reliance as factors that could limit uptake in the near term.

Policy experts said the move establishes a precedent for export control that blends economic incentives with national security constraints, a model that could be applied across other strategic technologies. That approach raises implementation challenges, including monitoring end use in a country where dual use civilian and military applications are difficult to disentangle, and policing re exports once advanced chips enter Chinese supply chains.

The decision comes at a pivotal moment in the global AI race, as companies and governments invest heavily in training models that require vast computing power. Nvidia’s H200 chips represent some of the most advanced training hardware available, and access to them could accelerate Chinese AI development in commercial and sensitive domains.

As the Commerce Department finalizes the operational rules, the debate is likely to intensify in Washington and Beijing. Lawmakers will scrutinize the licensing standards and fee structure, while the Chinese government will weigh its response in the context of industrial policy and strategic autonomy. For now, the move underscores the delicate balancing act facing policymakers who must reconcile economic priorities with national security imperatives in a deeply interconnected technology landscape.