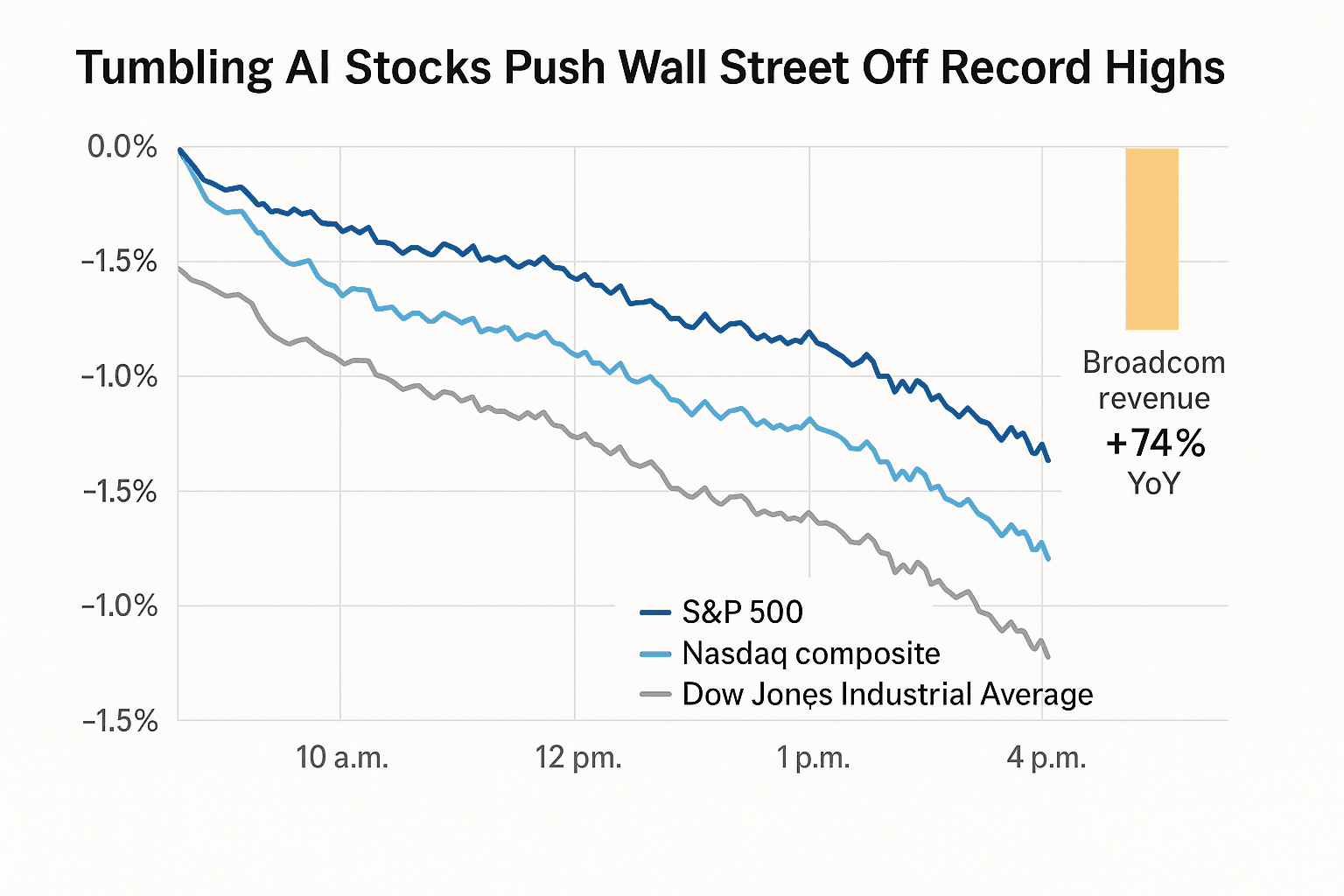

Tumbling AI Stocks Push Wall Street Off Record Highs

A sharp selloff in high profile AI linked technology stocks dragged major U.S. indexes off fresh records on Friday, producing the S&P 500’s worst session in three weeks. The move exposed the narrow nature of the rally and raised questions about whether lofty valuations and company guidance can sustain the market’s momentum.

Major U.S. stock indexes reversed course on Friday as declines in AI linked technology leaders erased recent gains and produced the S&P 500’s weakest trading day in three weeks. The S&P 500 fell about 1.1 percent from its all time high, the Nasdaq composite led losses with a roughly 1.7 percent drop, and the Dow Jones Industrial Average gave back about 245 points, or 0.5 percent, after setting its own record the prior trading day.

The selling centered on a small number of so called superstar tech stocks that have driven this year’s gains. Broadcom was singled out as the principal market drag after the chip maker reported a stronger than expected profit for the latest quarter but provided guidance that left investors uneasy. Broadcom plunged roughly 11.4 percent on the session, even though its results showed a 74 percent increase in AI semiconductor revenue from the comparable period. Analysts described the quarter as solid, yet some traders focused on forward commentary and concerns about “how much profit it can squeeze out of each $1 of revenue.”

Broadcom came into the day having run up about 75.3 percent year to date, a gain several times the S&P 500’s advance for the period, and some market participants said the stock’s run may simply have run out of momentum. Oracle was another notable decliner, plunging nearly 11 percent a day after reporting a bigger quarterly profit than analysts expected.

Newsroom accounts tracked intraday and later figures with slight discrepancies. An Associated Press mid afternoon snapshot at about 1:52 p.m. Eastern showed the S&P down roughly 0.9 percent, the Nasdaq down 1.3 percent, and the Dow down about 147 points or 0.3 percent. Later aggregated reporting converged on the larger full session moves used here.

The episode underscored two interrelated dynamics that have shaped markets in 2025. First, a narrow leadership of a few AI exposed technology firms has lifted major indexes to records, leaving the broad market dependent on a handful of stocks. Second, while investors broadly prefer lower interest rates because they can boost economic activity and raise asset prices, company level profit and guidance details can prompt swift intraday reversals, particularly in high valuation names.

Traders and global observers were watching for spillovers. Images from trading floors and foreign exchange dealing rooms captured attention in New York and abroad, with an Associated Press photo from Seoul showing currency traders watching screens that displayed the Korea Composite Stock Price Index and the dollar won exchange rate as U.S. moves registered globally.

Market strategists said two immediate storylines merit follow up in the coming weeks. One is whether Broadcom’s guidance signals a broader slowing in AI semiconductor margins. The other is whether recent one day reversals mark a regime change away from the narrow AI led leadership that has propelled benchmarks higher. Both questions will influence risk appetite, sector rotation, and how retail and institutional investors allocate capital as 2026 approaches.

Know something we missed? Have a correction or additional information?

Submit a Tip