U.S. blockade and seizures set to choke Venezuela-to-China oil flows

A U.S. maritime blockade, tanker seizures and legal pressure are constraining shipments from Venezuela to China, sending arrivals set to decline from February. The disruption risks cutting production and tightening heavy crude supplies.

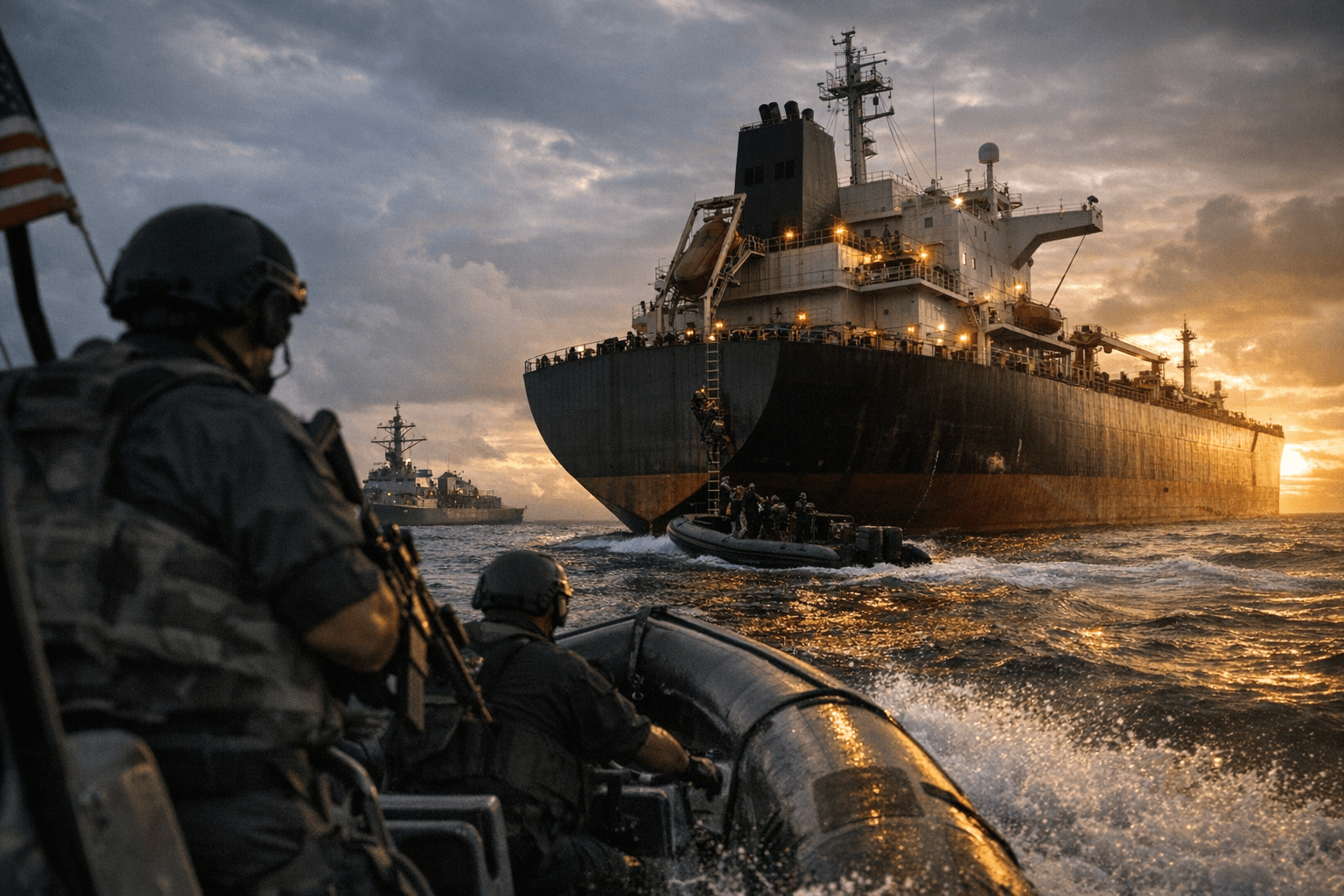

A U.S.-led maritime blockade, a string of tanker seizures and intensified legal pressure have curtailed shipments of Venezuelan crude and fuel oil bound for China, and traders and vessel trackers expect Chinese arrivals to slump beginning in February. Only a handful of tankers have moved eastward since mid-December as owners and operators reassess the risk of interception or legal entanglement.

Since Washington announced the blockade on Dec. 20, 2025, enforcement has stepped up, culminating in a Jan. 3 raid that prompted roughly a dozen loaded tankers to sail away with their Automatic Identification System transponders switched off. Most returned to Venezuelan waters after Caracas’ interim government negotiated a 50 million-barrel oil supply agreement with Washington, but at least five Venezuela-linked vessels have been seized under the U.S. campaign. The Panama-flagged tanker Centuries was among those seized; U.S. Coast Guard forces intercepted the vessel with a U.S. military helicopter observed overhead, and Beijing publicly condemned the interception.

Ship movements show the effect. Only three shipments have successfully passed the blockade since mid-December, while data firms estimate as much as 43 million barrels of Venezuelan crude are currently in transit toward Asia. A small number of tankers that switched off transponders after the raid have continued on course and are expected to arrive in China around late February, but traders say the steady eastward flow that prevailed through 2025 is breaking down.

The disruption is already forcing operational responses inside Venezuela. State oil company PDVSA has reported that China accounted for roughly 75 percent of its oil exports in 2025, and company operations are suffering as onshore storage fills. PDVSA is shutting wells in the Orinoco Belt and plans to cut output by at least 25 percent — a reduction of about 500,000 barrels per day — according to company actions and supplier accounts. U.S. oil major Chevron, operating under a special U.S. license, has continued limited exports.

Shipping patterns have shifted as vessel owners seek to avoid seizure risk. Operators are turning ships away, returning after loading, or sailing with transponders off. Venezuelan authorities have deployed navy vessels and gunboats to escort commercial cargoes inside territorial waters, but escorts appear limited beyond those boundaries. Analysts note that boarding and seizing flagged vessels on the high seas typically requires flag-state authorization and may invoke legal mechanisms such as Salas-Becker, creating a complex web of maritime law and bilateral diplomacy.

Markets are watching for how lost Venezuelan flows will be absorbed. A sustained removal of roughly 500,000 b/d of production would be meaningful for markets already sensitive to disruptions in heavy crude and fuel oil supplies. Refiners that processed Venezuelan grades may scramble for alternatives, potentially widening variety spreads and rerouting trade flows. The near-term price response will hinge on how quickly other suppliers can boost shipments and whether the volumes now in transit — along with the estimated 43 million barrels headed to Asia — arrive before enforcement tightens further.

Geopolitically, tightening enforcement has raised the risk of escalation with China. Beijing has protested seizures, and Caracas has denounced U.S. moves as unlawful; President Nicolás Maduro called the U.S. actions "utterly irrational." Unless legal and diplomatic obstacles are resolved, traders and vessel trackers expect a sharp slowdown in Venezuela-to-China arrivals from February onward, with consequences for production in Venezuela and for heavy crude availability in Asian refineries.

Know something we missed? Have a correction or additional information?

Submit a Tip