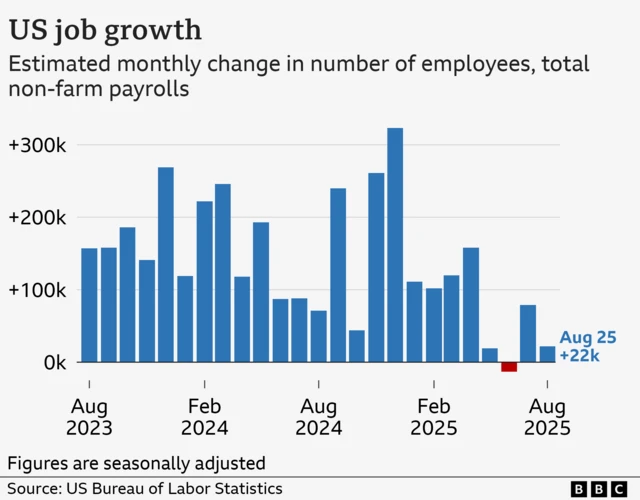

U.S. Job Growth Slows Sharply as Unemployment Ticks Down to 4.4 Percent

U.S. payrolls increased by 50,000 in December 2025, well below economists' forecasts, while the unemployment rate edged down to 4.4 percent, producing mixed signals for markets and policymakers. The weak monthly gains cap a year of historically slow hiring, complicating Fed decisions on interest rates and the outlook for 2026.

Nonfarm payroll employment rose by 50,000 in December 2025, the U.S. Bureau of Labor Statistics reported Jan. 9, while the unemployment rate slipped to 4.4 percent from a revised 4.5 percent in November. The headline gain came in below most forecasts and capped a year that saw average monthly payroll increases of roughly 49,000, a sharp deceleration from 2024’s 168,000 monthly average.

Economists had expected a larger payoff for the month. The Dow Jones median estimate was 73,000, and the consensus cited by several forecasting services clustered near 55,000. The December outcome and downward revisions to prior months reduced the overall momentum in recent data: November’s increase was revised down by 8,000 to +56,000, and October was revised down by 68,000 to -173,000, leaving October and November combined 76,000 lower than earlier shown.

Sector patterns were uneven. Leisure and hospitality drove the December gains, with food services and drinking places adding 27,000 jobs, bringing that industry to an average of about 12,000 hires per month in 2025, roughly in line with 2024’s pace. Health care and social assistance also contributed to payroll growth, while retail trade lost jobs in the month. Wage growth remained modest: average hourly earnings for private nonfarm payroll employees rose $0.12, or 0.3 percent, to $37.02 in December, a 12-month increase of 3.8 percent. Average hourly earnings for private-sector production and nonsupervisory employees were $31.76, up $0.03 for the month.

Statistical uncertainty tempers interpretation of the headline. The BLS notes a 90-percent confidence interval for the monthly change on the order of plus or minus 136,000, implying that a reported increase of 50,000 is statistically consistent with a range from roughly -86,000 to +186,000. That sampling variability means a single monthly print of this size cannot be read as definitive evidence of accelerating or decelerating employment.

Markets reacted to the mixed data. Futures pricing on the probability of a near-term Federal Reserve rate cut declined after the release, with the CME FedWatch tool showing the chance of a January cut falling to roughly 5 percent from much higher odds earlier in the session. The small payroll gain paired with a lower unemployment rate left traders uncertain about the timing of policy easing.

Market strategists and economists framed the report as ambivalent for policy. Art Hogan, chief market strategist at B. Riley Wealth, called the report "a mixed bag" but said "there is more good news than bad." Jennifer Timmerman, senior investment strategy analyst at Wells Fargo Investment Institute, said the 50,000 increase was "close enough to consensus to satisfy markets." Several labor economists characterized 2025 as a notably weak year for hiring. Heather Long, chief economist at Navy Federal Credit Union, wrote that 2025 was "the worst year outside of a recession since 2003," labeling it a "hiring recession" and a "jobless boom." Bill Adams, chief economist at Comerica Bank, summarized the data as "so-so," capping "a disappointing year for the US job market."

For policymakers, the combination of tepid job creation, still-positive wage inflation, and noisy monthly sampling argues for caution. The Fed faces a disconnect: labor markets no longer look overheated on job growth, but wage gains have not fallen far enough to clear the path for immediate easing. How that calculus evolves will shape the pace of rate cuts in 2026.

Know something we missed? Have a correction or additional information?

Submit a Tip