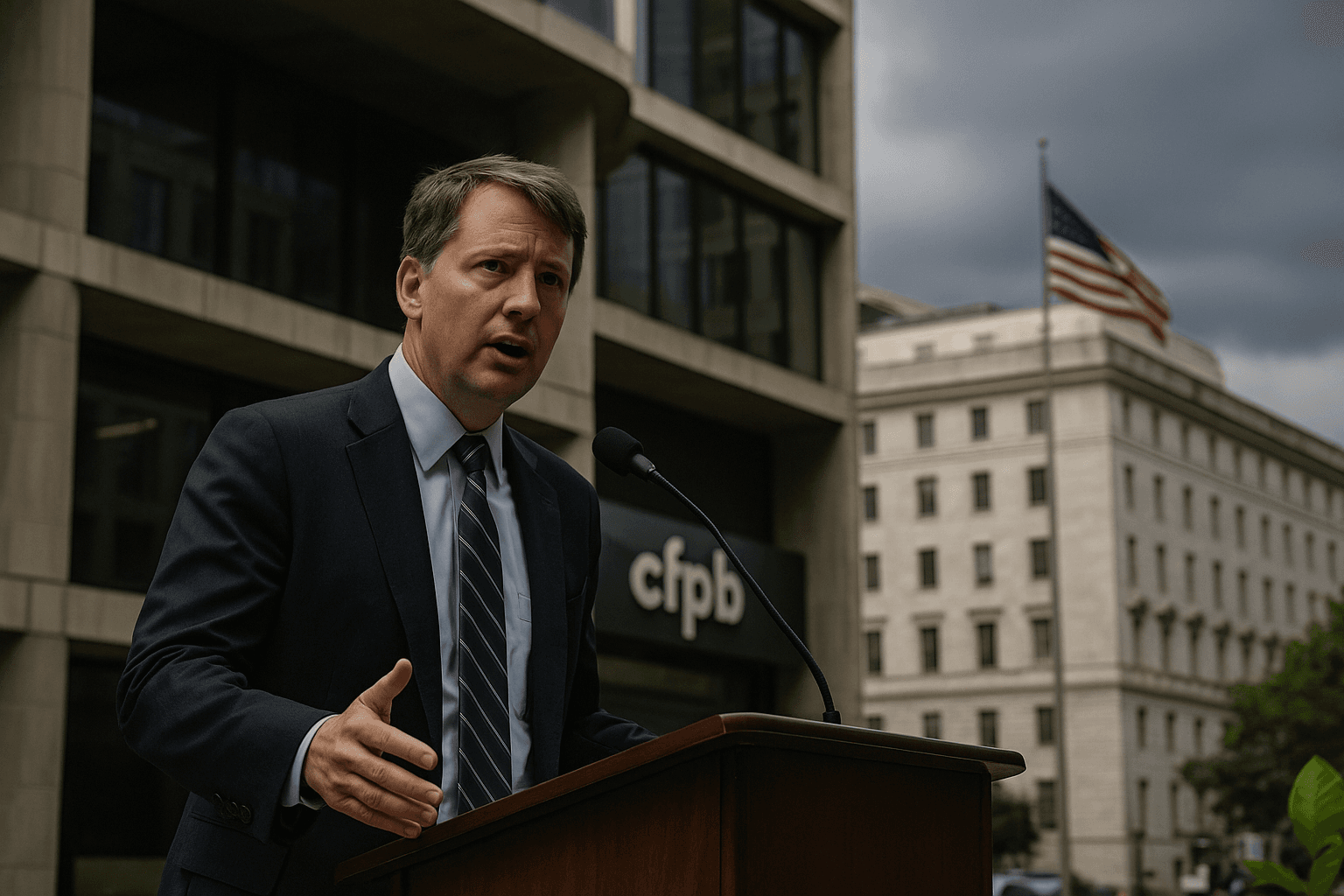

CFPB Issues Interim Rule on Open Banking Amid Funding Shortfall

The Consumer Financial Protection Bureau said it will issue an interim final rule on open banking and consumer data rights after telling a federal court it expects to run out of funds before completing a full rewrite of prior regulations. The decision could produce immediate changes in how banks and fintech companies share consumer financial information, while leaving longer term policy questions to further rulemaking and litigation.

The Consumer Financial Protection Bureau announced on December 9 that it will publish an interim final rule governing open banking and consumer data rights, a move the agency said was necessary because it expects to exhaust available funds before it can complete a comprehensive rulemaking rewrite of Biden era regulations. In filings with a federal court, the bureau said it anticipates funding through December 31, 2025 and plans to use an interim mechanism to push policy forward amid a funding standoff with the White House.

Open banking rules determine how consumers credit card, checking, savings and other financial account information may be shared with banks, fintech firms and third party service providers. The boundaries set by the bureau influence competition, consumer privacy and fintech access to the market. Industry groups have pushed back against elements of the bureau proposal, raising particular concern about proposed bank data access fees that some firms say would raise costs and limit competition. The proposal has also faced legal challenges that put the timing and scope of any final regulation in doubt.

By choosing an interim final rule the CFPB is asserting a tool that allows immediate implementation while preserving the ability to refine or replace the regulation through subsequent notice and comment or additional agency action. That procedural choice is likely to accelerate operational and compliance consequences for banks and technology firms, potentially requiring changes to data sharing protocols, consumer consent frameworks and fee structures on short notice. It also increases the likelihood of expedited court challenges testing both the bureau s authority and the validity of the interim measure.

The timing underscores a broader institutional conflict over governance and resources. The bureau s statement to the court framed the move as a pragmatic response to an impending funding gap that could otherwise halt agency rulemaking. The White House and other executive branch actors have been engaged in a dispute over the bureau s budgetary trajectory, a conflict that in this instance has pushed the agency to adopt an interim path rather than wait for a completed rulemaking cycle.

For consumers the immediate effects will be mixed. Depending on the final text of the interim rule and how courts respond, some consumers may see expanded access to financial management services and more standardized data portability protections. Others could face new limits on privacy or experience reduced choice if fees or compliance burdens prompt banks or fintech firms to withdraw services. For fintech companies the interim rule may determine whether they gain or lose access to key account level data that underpins budgeting apps, lending algorithms and payment services.

The next phase will unfold in several venues simultaneously. The CFPB will publish the interim final rule and accept further comment while litigation over the underlying Biden era regulations continues. Congressional oversight and potential legislative responses are also likely, as lawmakers assess whether statutory changes are needed to settle disputes over consumer data rights and the bureau s authority. Stakeholders from industry, consumer advocacy groups and state regulators are poised to press competing claims, ensuring that the legal and policy debates over open banking will persist beyond the bureau s immediate intervention.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip