China posts record near $1.2 trillion trade surplus as exports hold firm

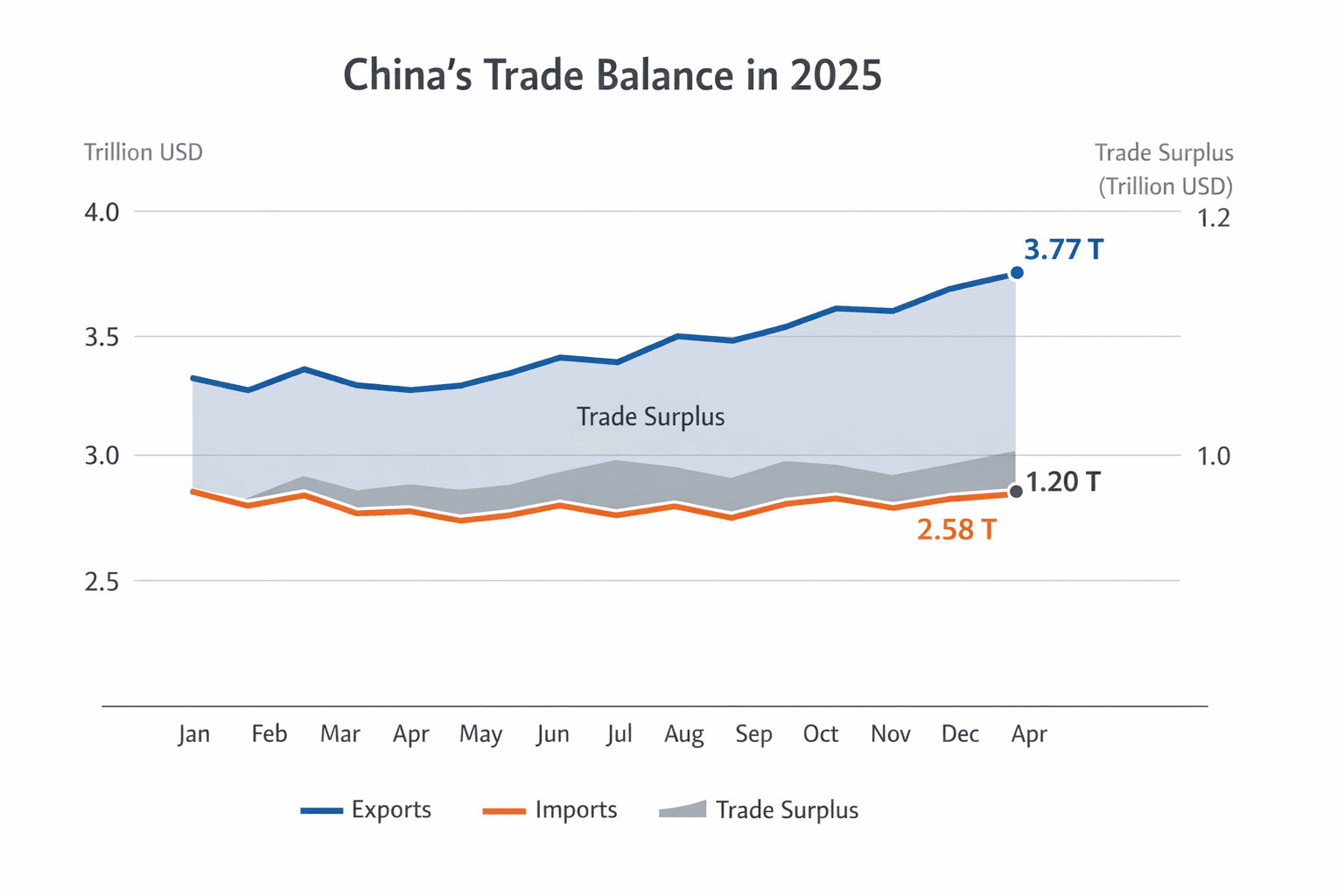

Customs data show a record 2025 trade surplus of about $1.19 trillion, highlighting export strength amid U.S. tariffs and shifting global demand.

Customs data released Jan. 14, 2026, show China recorded a record full-year trade surplus of roughly $1.19–$1.20 trillion in 2025, driven by resilient exports and only modest growth in imports. Merchandise exports rose in the mid single digits for the year, with the Associated Press’s aggregate figures putting exports at about $3.77 trillion and imports at roughly $2.58 trillion, arithmetic that aligns with the nearly $1.2 trillion surplus.

December provided a strong finish. Exports rose 6.6 percent year on year in dollar terms, accelerating from November’s 5.9 percent gain and beating economists’ expectations. Imports also rebounded, rising 5.7 percent in December after a 1.9 percent increase in November. The monthly momentum helped lift the annual totals and capped a year in which external demand supplied a rare bright spot for China’s slowing economy.

Analysts and officials point to shifting trade patterns as a key reason for export resilience. Chinese producers redirected shipments to markets outside the United States, notably South America, Southeast Asia, Africa and Europe, offsetting sharp declines in U.S.-bound exports following a tougher U.S. trade stance. Firms also appear to have accelerated sales of higher-value goods and components, supported by rising overseas factory construction and Chinese investment abroad that has increased demand for Chinese machinery and parts.

Eric Zhu of Bloomberg Economics said China's export engine "continued to support the economy" in late 2025, pointing to the role of exports in filling the gap left by weak domestic demand. BNP Paribas chief China economist Jacqueline Rong said exports will continue to "act as a big growth driver in 2026." Natixis senior economist Gary Ng projects about 3 percent export growth next year and expects the trade surplus to remain above $1 trillion, a view echoed by Barclays economists including Ying Zhang.

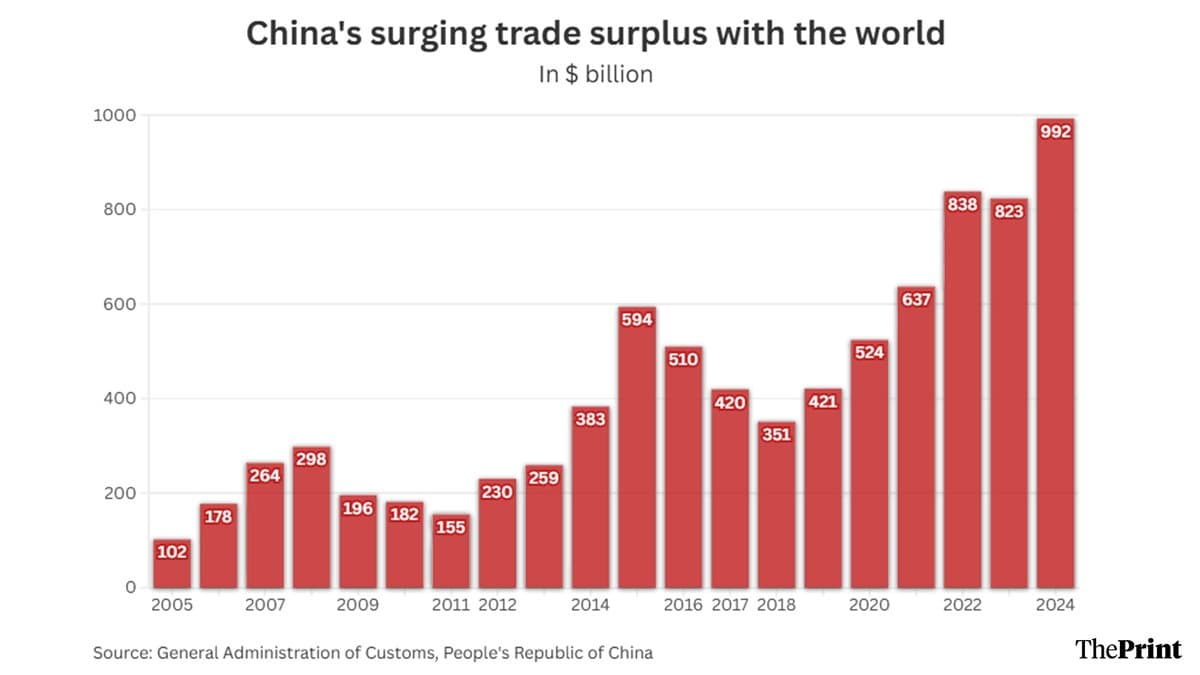

The surge in net exports—up from a $992 billion surplus in 2024—presents both opportunity and challenge for policymakers. Large net exports have buoyed output and employment in manufacturing but have also intensified calls at home and abroad for a more balanced growth model. Beijing has signaled a pivot toward greater import expansion to address that imbalance. Premier Li Qiang urged measures to "proactively expand imports and promote the balanced development of imports and exports," framing rebalancing as a policy priority.

Practical steps have already been taken: Beijing has moved to reduce trade frictions with partners, including ending certain export tax rebate practices in the solar sector that had raised concerns in trading partners. Those measures aim to dampen political friction while preserving export competitiveness.

Market implications are broad. A sustained surplus at this scale can put pressure on global trade balances and complicate geopolitics, while supporting the yuan and domestic manufacturing earnings. For China, the immediate task will be converting export-driven gains into more stable domestic demand and investment, a goal made harder by a slowing property sector and tepid household consumption.

With economists forecasting continued, if slower, export growth in 2026, the near-term outlook is for the surplus to remain large. That will keep rebalancing efforts and international trade tensions high on Beijing’s economic agenda.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip