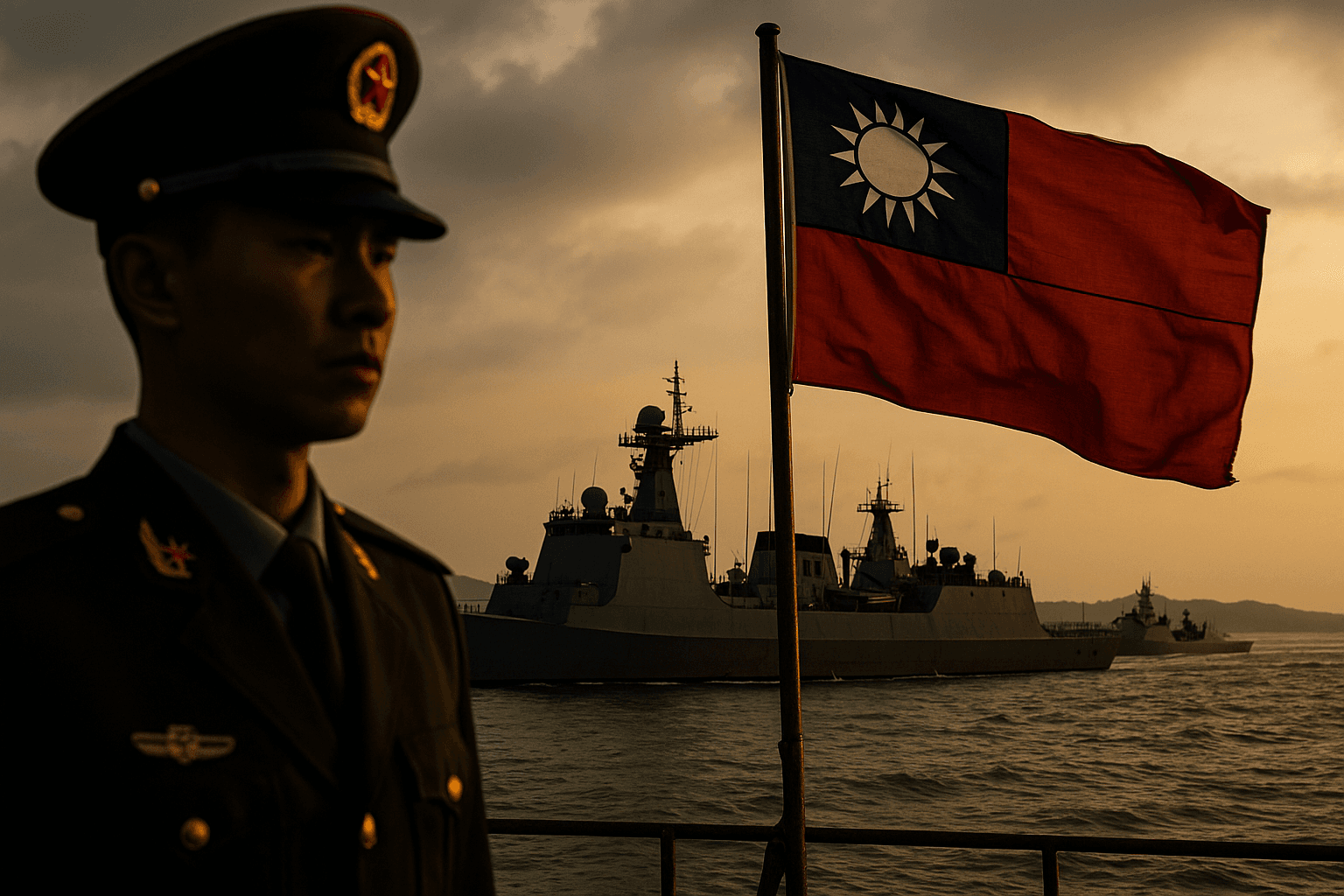

China Vows to Defend Taiwan Sovereignty, Criticizes U.S. Strategy

China responded sharply to the United States’ newly released National Security Strategy, saying it will firmly defend its sovereignty over Taiwan and warning against external interference, language that raises the stakes in an already fraught region. The exchange matters because Taiwan anchors critical global supply chains, particularly advanced semiconductors, and renewed tensions could accelerate economic decoupling and military posturing by both powers.

Beijing issued a stern rebuke to the United States on Monday after Washington published a National Security Strategy that stresses deterrence of conflict with China and calls for a stronger U.S. military posture in the Indo Pacific. A foreign ministry spokesperson said Taiwan remains a core interest and a "red line" and criticized the U.S. document for steps the Chinese government described as provocative and destabilizing for regional peace.

The Chinese statement said Beijing would take measures to safeguard its territorial integrity, including diplomatic and military responses, and urged the United States to refrain from encouraging "Taiwan independence" forces. Taiwan’s government welcomed the U.S. emphasis on regional stability and signaled it would continue strengthening its own defenses, framing its posture as defensive amid an intensifying strategic competition.

Analysts said the exchange highlights how Washington and Beijing are clasped in a cycle of signaling that raises the risk of miscalculation. Military and diplomatic activity in the East and South China Seas has grown more frequent in recent years, and both capitals are increasing investments in capabilities intended to shape the balance of power around Taiwan. The U.S. strategy’s call for a firmer military posture in the Indo Pacific is designed to deter coercion, yet it also risks provoking reciprocal measures from Beijing.

Economic considerations sharpen the geopolitical stakes. Taiwan supplies the vast majority of the world’s most advanced semiconductors, a sector that underpins everything from smartphones to defense systems. Global semiconductor sales exceed half a trillion dollars annually, and disruptions to supply chains centered on Taiwan would have outsized effects on global manufacturing and technology markets. Investors and corporate supply chain managers monitor such political signals because even a brief crisis could prompt factory shutdowns, rerouting of components, and higher costs for chip reliant industries.

The confrontation comes against the backdrop of a broader trend toward strategic decoupling and supply chain reshoring. Since 2020, governments and firms in both China and the United States have pursued policies intended to reduce vulnerabilities, including incentives for semiconductor manufacturing outside Taiwan and tightened export controls on certain technologies. Those policies are expensive and slow to bear fruit, and in the near term they increase the economic cost of sustained geopolitical tension.

For policymakers the immediate question is crisis management. Washington has emphasized deterrence while seeking to reassure allies and avoid unintended escalation. Beijing is balancing domestic political pressures and long standing territorial claims against the economic costs of confrontation with the United States, which together account for roughly 40 percent of global economic output. Diplomats and defense planners will now test whether existing communication channels and confidence building measures are sufficient to prevent a misstep that could trigger a wider conflict.

The exchange on Monday is likely to harden positions on both sides, reinforcing long term patterns of strategic competition that will shape investment, trade policy, and military planning for years to come.