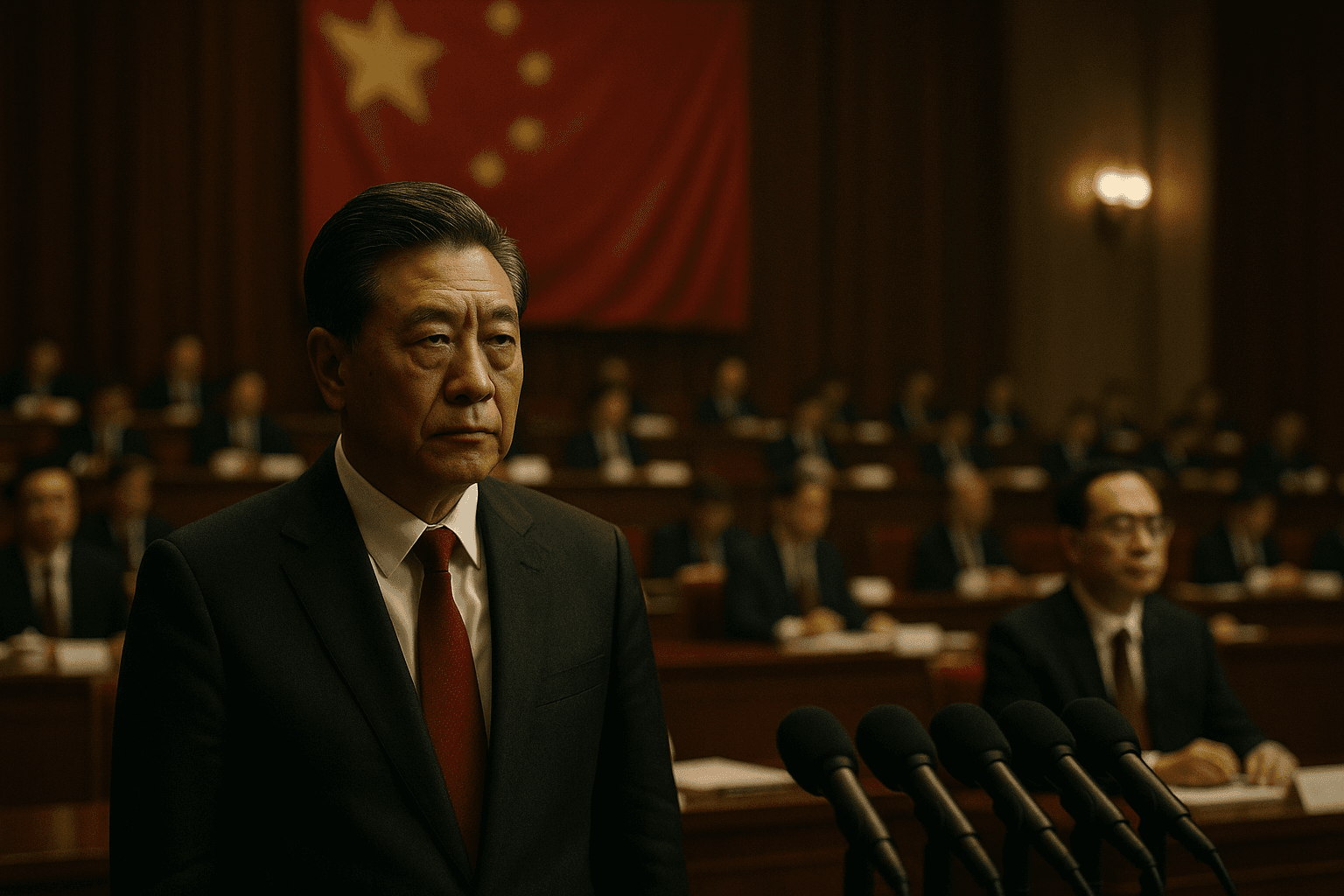

China’s Politburo vows steady fiscal and monetary support into 2026

China’s Politburo on December 8 pledges to maintain supportive fiscal and monetary stances to bolster domestic demand as authorities seek to stabilize growth and employment going into 2026. The move aims to navigate external headwinds including tariffs and a softer global cycle, but leaves investors and firms uncertain about the timing and scale of concrete measures.

China’s top leadership is signaling continuity rather than crisis style stimulus as the Politburo pledges to keep fiscal and monetary policy supportive into 2026. The commitment, issued on December 8, emphasizes stabilizing growth, sustaining employment and using targeted tools to spur consumption and investment while explicitly seeking to manage financial risks and avoid broad based stimulus that could inflate asset prices.

The statement comes as Beijing confronts an uneven recovery in domestic demand and a more challenging external environment. Authorities framed the approach as precision policy making, promising measures tailored to hard pressed sectors and vulnerable households rather than economy wide credit splashes. That triangulation reflects a longer term objective to maintain Beijing’s mandates for social stability and high quality growth, while containing leverage and speculative pressures in property and financial markets.

Analysts see multiple motivations. First, targeted support can buttress consumer spending and business investment without reintroducing the large scale fiscal deficits and monetary loosening that helped power the post pandemic rebound. Second, the posture is defensive against external headwinds cited by the Politburo including tariffs and a weaker global cyclical backdrop which have constrained export momentum. Third, it is an attempt to reassure global investors that Beijing will act to sustain growth while keeping a close watch on financial vulnerabilities.

The practical policy levers likely to be emphasized include expanded issuance of local government special bonds for productive investment, tax relief or vouchers aimed at stimulating household consumption, and selective credit support for smaller firms and green or high tech projects. On the monetary side, the central bank can continue to provide liquidity targeted at bank lending to small and medium sized enterprises, and to mortgage markets where necessary to limit sharp property sector distress. Officials also signaled a willingness to use macro prudential tools to rein in speculative flows and contain leverage.

Market implications are mixed. The Politburo rhetoric is likely to calm some investor fears about a hard landing and reduce tail risk premia for Chinese assets. At the same time the lack of detail on size and timing means equity and credit markets may remain sensitive to incoming data on retail sales, industrial output and employment. For multinational firms and exporters, the pledge offers modest reassurance that domestic demand will be supported, but tariffs and sluggish external demand remain constraints on export growth.

Looking further ahead, Beijing’s strategy underscores a shift toward managing slower, higher quality growth in a complex global environment. China still accounts for roughly 18 percent of global GDP and its policy mix has outsize implications for commodity markets, regional trade partners and global financial conditions. The Politburo’s promise of targeted support rather than broad stimulus signals a balancing act that aims to sustain the economic recovery while reducing the risk of recurring boom and bust cycles. For firms and investors the key questions remain scale, specificity and execution, all of which will determine whether the pledge translates into durable demand and a smoother path into 2026.