Eli Lilly to invest more than $6 billion in Alabama API plant

Eli Lilly announced a more than $6 billion investment to build an active pharmaceutical ingredient manufacturing complex in Huntsville, Alabama, a move that reflects growing industry momentum to onshore drug production. The facility will make small molecule and peptide APIs including orforglipron, Lilly’s oral GLP 1 candidate, and is expected to reshape regional labor markets and U.S. pharmaceutical supply chains over the next decade.

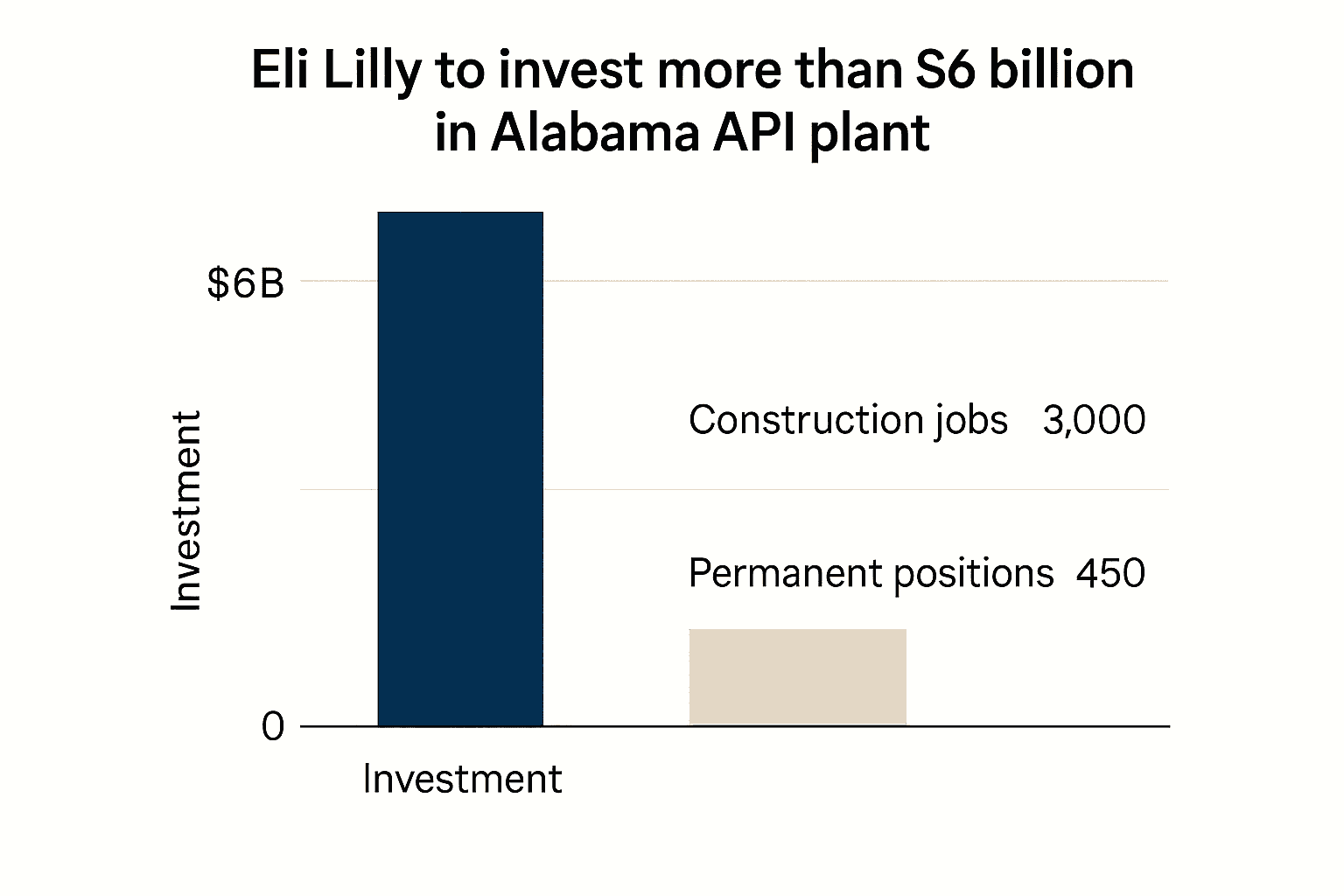

Eli Lilly said on December 9 that it will invest in a large active pharmaceutical ingredient manufacturing facility in Huntsville, Alabama, committing more than $6 billion to a project that the company plans to start building in 2026 and finish in the early 2030s. The plant will produce both small molecule synthetic APIs and peptide APIs, including material for orforglipron, Lilly’s experimental oral GLP 1 candidate, and is part of a broader expansion in which the company intends to develop several large domestic sites.

The company estimates the project will create about 3,000 construction jobs through the multi year build and roughly 450 permanent scientific and operations positions once the facility is operational. That mix of temporary and long term employment underlines the dual economic effect of large pharmaceutical capital projects, providing near term demand for local construction and long term additions to regional high skill employment.

This announcement comes against a backdrop of sustained U.S. policy emphasis on strengthening domestic production of essential medicines and pharmaceutical inputs. Since the pandemic, federal and state officials have repeatedly encouraged onshoring to reduce reliance on foreign suppliers for APIs, which were highlighted as a vulnerability during supply chain disruptions. Industry leaders have cited similar concerns, and Lilly’s move signals a strategic bet that demand for domestic API capacity will remain robust for the coming decades.

From a market perspective, the plant aligns Lilly’s manufacturing footprint with pipeline priorities. Orforglipron is part of the broader wave of GLP 1 based therapies that has reshaped the pharmaceutical landscape, driving higher volumes and intensifying competition for both drug substance and drug product capacity. By investing in peptide API capability alongside small molecule production, Lilly is positioning itself to secure upstream supply for complex molecules that require specialized manufacturing techniques and quality controls.

The scale and timeline of the investment also reflect long lead times inherent in pharmaceutical manufacturing. A build that spans the late 2020s into the early 2030s involves sustained capital deployment and assumes continued market demand. The multi year horizon creates exposure to regulatory and technological risks, including potential shifts in therapeutic trends, policy changes, and evolving manufacturing technologies that could alter cost structures.

For Huntsville and Alabama, the announcement represents a significant economic development. Huntsville’s existing technology and engineering ecosystem, which includes aerospace and defense contractors and research institutions, offers a talent base that can support advanced pharmaceutical operations. Local officials are likely to focus on workforce development to fill specialized roles in chemistry, process engineering, and quality assurance.

Overall, Lilly’s multi billion dollar commitment is emblematic of a broader industrial trend toward vertical integration and regionalized pharmaceutical supply chains. If completed as planned, the Huntsville plant would strengthen domestic API capacity at a time when both policymakers and industry are prioritizing resilience, while also locking in long term strategic advantages for companies that control the upstream inputs to high demand therapies.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip