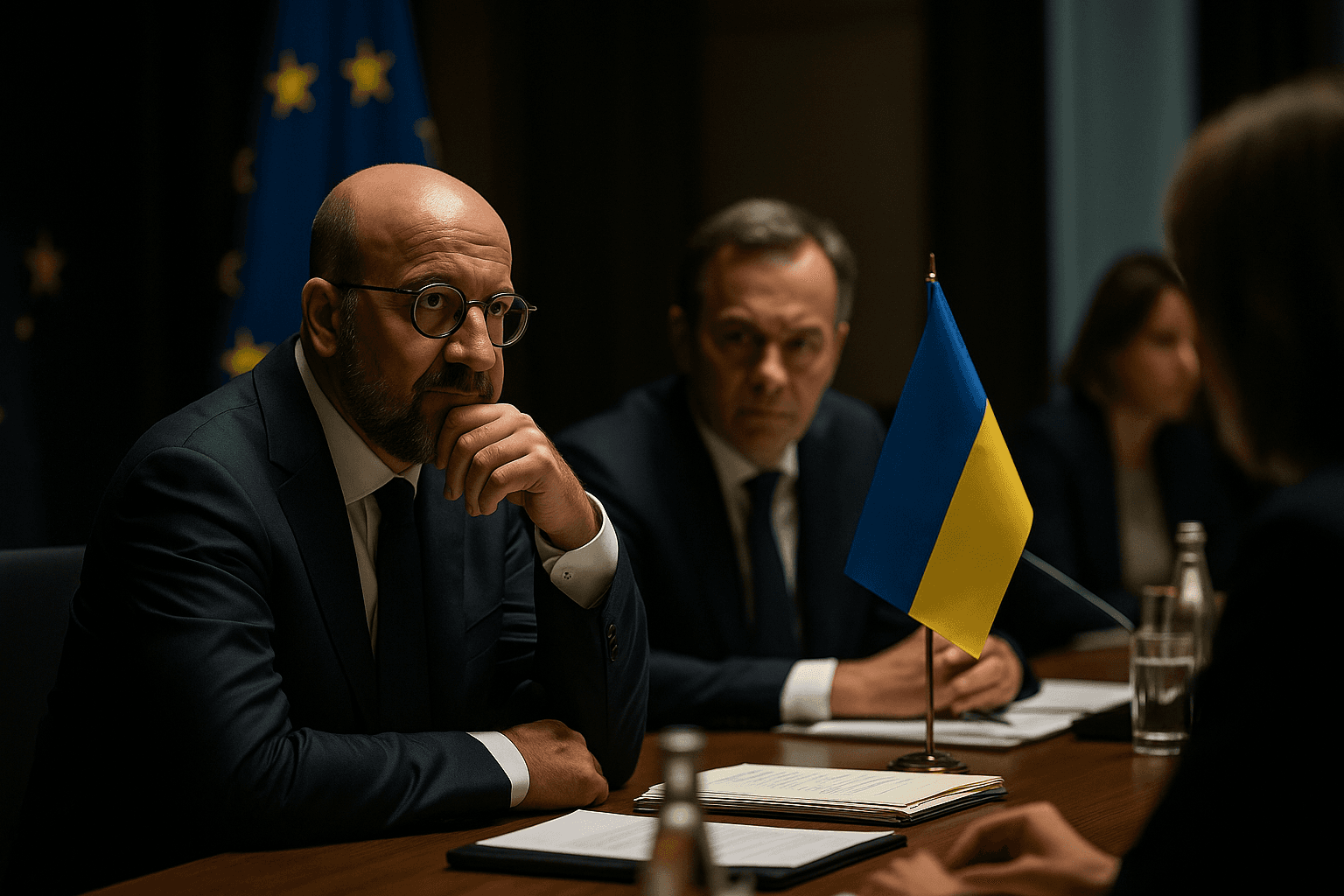

EU leaders press to use frozen Russian assets, back Ukraine loan

European leaders are racing to formalize and extend the immobilisation of roughly €210 billion in frozen Russian sovereign assets and to use their cash value to underwrite a large EU loan to Ukraine. The push, aimed at meeting Kyiv’s immediate financing gap and setting a precedent for reparations, will test legal limits, member state politics and market confidence ahead of a crunch summit.

European capitals are intensifying efforts to convert the cash value of frozen Russian sovereign assets into a financing backstop for Ukraine as leaders seek to agree legal and political terms before a summit next week. The proposal centers on immobilising about €210 billion in assets, roughly €185 billion concentrated at Euroclear with another €25 billion elsewhere, and using that pool as collateral to underwrite a bloc wide loan rather than directly confiscating funds.

The intervention would be built around a European Commission construct that officials see as a reparations linked loan. Politico cited a Commission figure of €165 billion for the package, while the International Monetary Fund’s estimate of Ukraine’s financing needs for the next two years is about €135 billion, a number echoed by multiple outlets. EU officials aim to supply roughly two thirds of Kyiv’s requirements, making the Commission’s loan framework central to Brussels’ strategy for sustaining Ukraine through 2026.

Mechanically the plan would extend or make indefinite the immobilisation of sovereign assets by invoking emergency powers, and require participating member states to provide national guarantees in proportion to their shares. That backstop architecture is intended to let the EU offer a large loan safely without formal confiscation, and it would oblige states to commit billions in contingent liabilities. Germany is reported to be the largest potential guarantor with up to €52 billion, which is roughly a quarter of the possible backstops.

The proposal faces acute legal and political hurdles inside the European Union and beyond. Advancing it will likely require a qualified majority, meeting a threshold of at least 15 member states representing 65 percent of the EU population. Hungary has emerged as a firm opponent, and Belgium’s prime minister has raised concerns that his country could be left with repayment liabilities unless risk sharing is clarified. Supporters in the Baltic states, Finland and Poland, along with several German lawmakers, have urged rapid action, saying the scheme is the most viable option to meet Ukraine’s urgent financing gap.

The plan has also been denounced in Moscow. Al Jazeera reported that the Russian central bank called wider EU plans to use the assets to aid Ukraine "illegal, contrary to international law" and in breach of "the principles of sovereign immunity of assets." Legal challenges are therefore expected and could prolong uncertainty even if political agreement is reached.

Markets and policy makers are watching for immediate consequences. Immobilising large pools of assets at Euroclear would represent an extraordinary assertion of financial statecraft that could prompt litigation, influence sovereign risk premia and complicate relations with non EU investors. Longer term the initiative would signal a shift toward using asset freezes as strategic leverage and could reshape expectations about the sanctity of sovereign assets in crises.

Diplomatically the asset debate is unfolding alongside US efforts to frame a ceasefire and reconstruction package, underscoring that financing, security guarantees and legal arrangements will be negotiated in parallel. EU negotiators are pressing to finalize the legal vehicle within days, with officials aiming to present a completed framework at the summit next week.

Know something we missed? Have a correction or additional information?

Submit a Tip