Hassett says there is "plenty of room" to cut rates, pledges independence

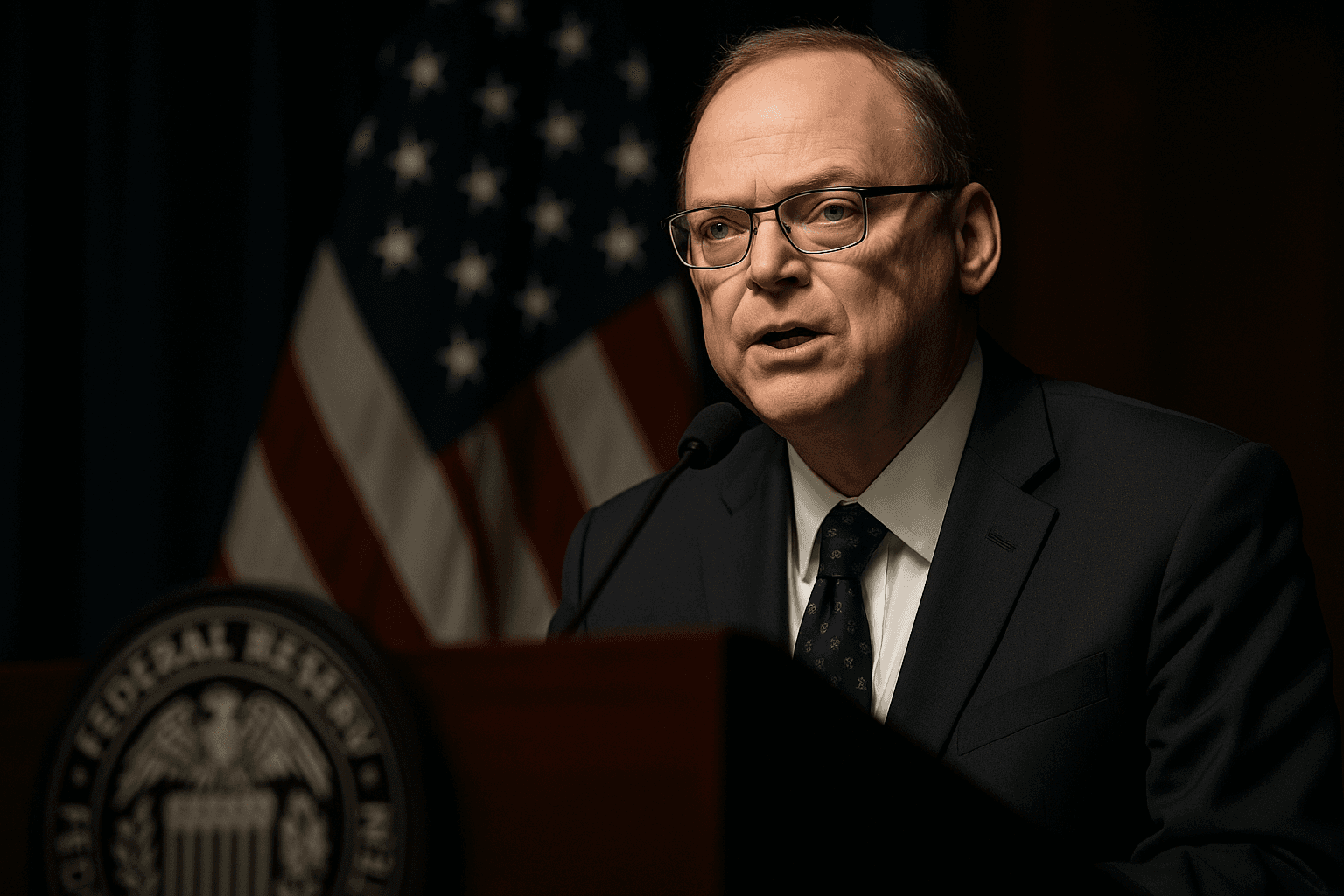

White House economic adviser Kevin Hassett told the Wall Street Journal CEO Council that there is "plenty of room" to cut interest rates further and stressed he would not bow to political pressure if confirmed as Federal Reserve chair. His comments sharpen the political focus on monetary policy as markets and foreign central banks watch for signals ahead of a scheduled Fed meeting.

Kevin Hassett, a senior White House economic adviser and reported front runner for the Federal Reserve chairmanship, told the Wall Street Journal CEO Council on December 9 that there was "plenty of room" to lower interest rates, while insisting he would make decisions based on economic data rather than political direction. The remarks, published by Reuters on the same day, come at a delicate moment for U.S. monetary policy as the central bank prepares for an upcoming meeting and as global markets weigh the possibility of quicker easing.

Hassett sought to balance a clear alignment with the Trump administration's preference for faster rate cuts with an explicit vow of institutional autonomy. He argued that advances in artificial intelligence have boosted productivity enough to temper inflationary pressure, and he pointed to signs of a weakening labor market as additional justification for potential easing. At the same time he emphasized that any policy shift would be guided by incoming data rather than by political timetable.

The appearance underscored how monetary policy has become a central battleground in domestic politics, with implications far beyond U.S. borders. A Federal Reserve willing to cut rates sooner would likely push down global borrowing costs, alter capital flows and pressure other central banks to re evaluate their own policy settings. For emerging markets with large dollar denominated debts, an easier U.S. stance could be a relief for balance sheets, yet it could also complicate inflation management and exchange rate stability.

Hassett framed his argument in a language attuned to both markets and the policy community, invoking productivity gains from AI as a structural force that can change the inflation outlook. That line of reasoning connects a high tech domestic debate to international economic dynamics, from trade competitiveness to job dislocation in economies less able to absorb automation. Global central bankers and finance ministers will watch closely to see whether data driven prudence yields a gradual path to easing or a more abrupt move favored by political allies in Washington.

Legal and institutional questions are also front and center. The Fed's long cherished independence has been tested by political pressure in recent years, and any nominee will face scrutiny in the Senate confirmation process. Hassett's pledge of independence, while intended to reassure markets and lawmakers, will likely be weighed against his prior role advising an administration that has publicly advocated for quicker rate relief.

With the Fed meeting imminent and economic indicators arriving at a rapid pace, Hassett's comments have intensified debate over timing and scale of possible rate cuts. The choices made in Washington will not only determine the trajectory of U.S. inflation and employment, they will ripple through global financial markets, shaping capital flows, exchange rates and policy responses in economies from Tokyo to Nairobi.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip