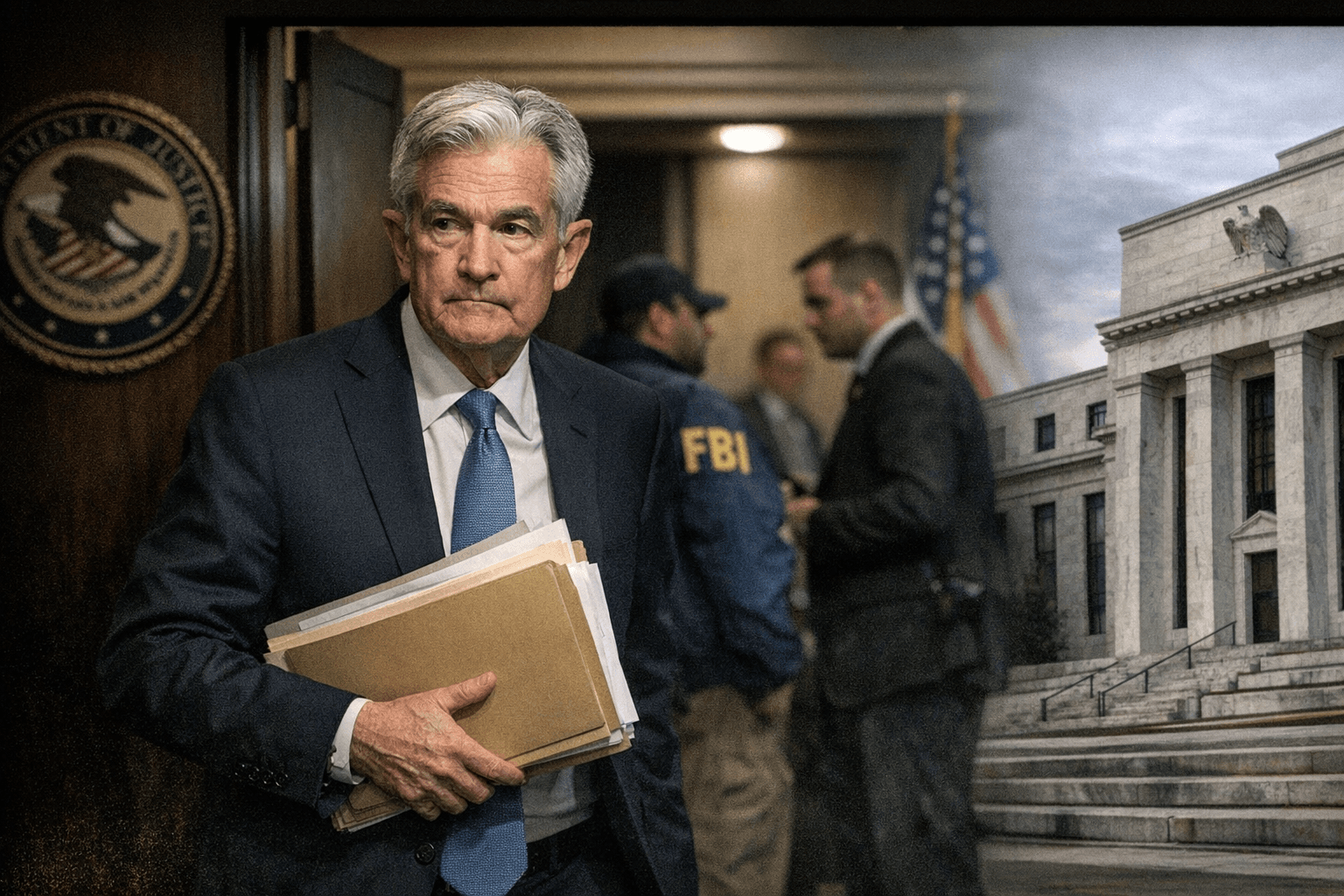

Justice Department subpoenas Federal Reserve, Powell calls indictment pretext

Powell says DOJ subpoenas and threatened indictment are a political pretext to pressure the Fed. Markets and lawmakers reacted sharply.

The Department of Justice served the Federal Reserve with grand‑jury subpoenas on Friday, and prosecutors have threatened a possible criminal indictment tied to Chair Jerome Powell’s June testimony, Powell disclosed Sunday evening. He characterized the investigation and the threat of charges as a “pretext” aimed at pressuring the central bank and said the move raises fundamental questions about the Fed’s ability to set policy independently.

Powell said the subpoenas were delivered to the Fed and announced the development in a written and video statement. He tied the inquiry to testimony he gave about a multi‑year renovation of Federal Reserve office buildings that has been publicly discussed as roughly a $2.5 billion project, but said any effort to link the subpoenas solely to those disclosures was misleading. The Justice Department has not publicly set out the specific statutes or formal charges that might underlie the threatened indictment.

Framing the episode in explicitly political terms, Powell warned that the risk of criminal charges is “a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the president.” He added that the action “should be seen in the broader context of the administration’s threats and ongoing pressure” for different Fed policy outcomes. Powell emphasized his respect for legal norms, saying, “No one — certainly not the chair of the Federal Reserve — is above the law,” and pledged to continue his work “with integrity and a commitment to serving the American people.” He said the episode raises the broader question “about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions — or whether instead monetary policy will be directed by political pressure or intimidation.”

Markets moved quickly on the disclosure. S&P 500 futures fell as much as 0.7%, the dollar weakened, and gold rose to record or extended gains, underscoring investor concern about political interference in monetary policy and the prospect of heightened uncertainty for rate decisions. Analysts said even the appearance of legal pressure on the Fed could alter market expectations for the timing and scale of future rate cuts and complicate the central bank’s communication strategy.

Lawmakers responded with bipartisan alarm over the institutional implications. Republican Senator Thom Tillis said the threatened indictment calls the Department of Justice’s “independence and credibility” into question and announced he would oppose any prospective Fed nominees until the matter is clarified. Senate Majority Leader Chuck Schumer described the moves as “bullying” of the Fed. President Donald Trump, in an interview, said he did not have knowledge of the Justice Department’s investigation.

The episode represents an unprecedented escalation in a long‑running dispute between the Fed and the administration over interest‑rate policy. Powell has overseen policy through four administrations and reiterated his commitment to the Fed’s dual mandate of price stability and maximum employment. The next steps are legal and procedural: how federal prosecutors will use the grand‑jury process, whether subpoenas yield an indictment, and how the dispute will affect the Fed’s capacity to make decisions based on economic data rather than political pressure. Until those outcomes are known, markets and policymakers will be watching whether institutional norms that have underpinned U.S. monetary policy are resilient in the face of intensified political conflict.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip