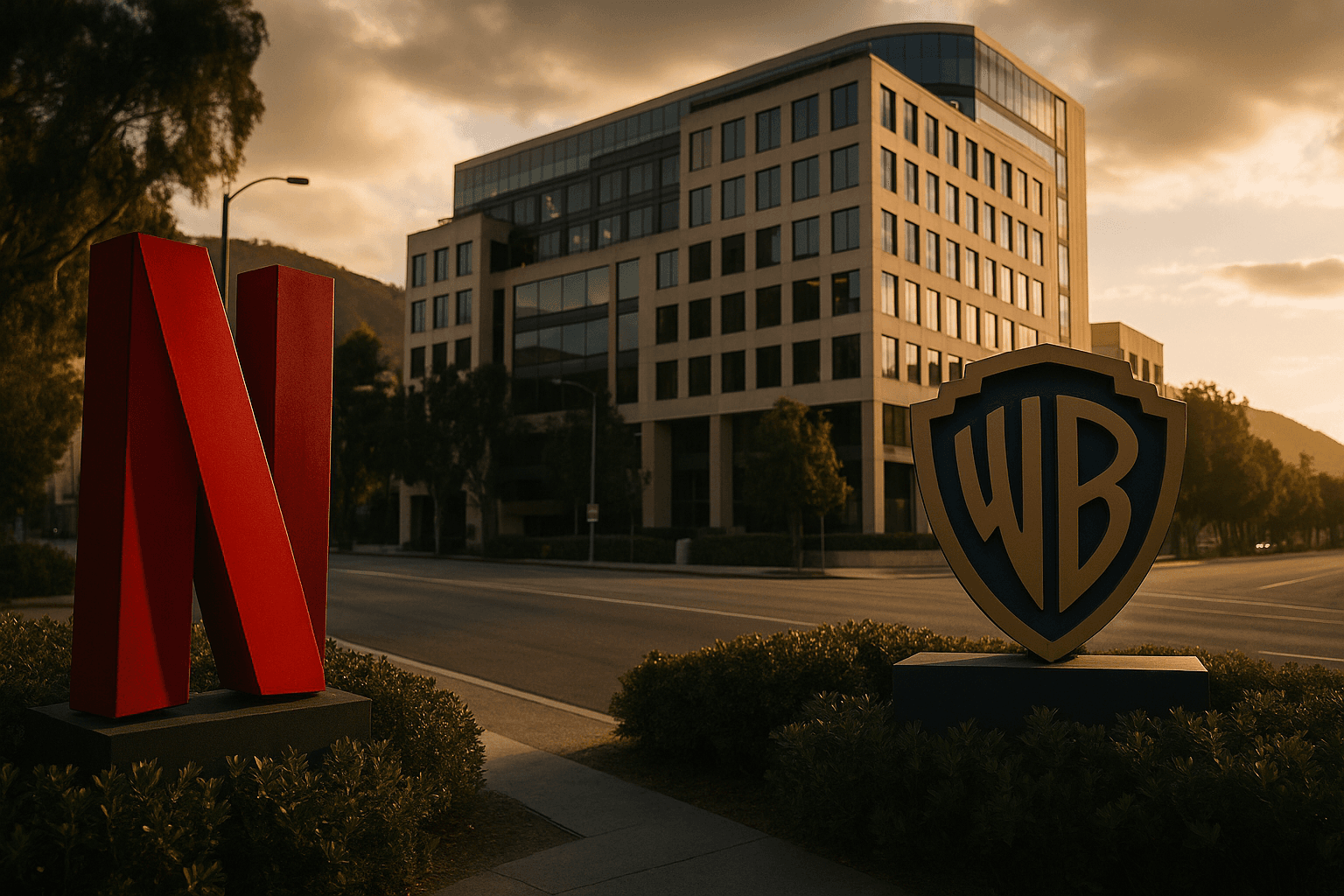

Netflix to Acquire Warner Bros Discovery studios and streaming for $72 Billion

Netflix and Warner Bros. Discovery on December 5, 2025 announced a deal in which Netflix will buy WBD’s television and film studios and its streaming division in a cash and stock transaction valued at roughly $72 billion in equity, about $82.7 billion including debt. The deal reshapes the global media landscape, triggering immediate regulatory scrutiny and raising questions about competition, creators’ bargaining power, and the future of theatrical and streaming distribution.

Netflix and Warner Bros. Discovery said on December 5, 2025 that they have reached a definitive agreement under which Netflix will acquire WBD’s television and film studios and its streaming business in a cash and stock transaction valued at about $72 billion in equity. Including debt the transaction is roughly $82.7 billion. Under the terms disclosed, WBD shareholders will receive $23.25 in cash plus approximately $4.50 of Netflix stock per share, a total of about $27.75 per share.

The purchase follows a multi-bidder process in which Netflix emerged ahead of offers from Paramount Skydance and Comcast. The transaction is conditioned on Warner Bros. Discovery completing a planned spin off of its global networks unit, to be called Discovery Global, which the companies now expect to complete in 2026. The companies say the acquisition will not close until that spin off is completed.

Netflix has provided a $5.8 billion breakup fee to WBD, a provision that would be payable if the deal fails under stipulated circumstances. Netflix also projects annual run rate savings of between $2 billion and $3 billion by the third year after the transaction closes, reflecting anticipated cost synergies and consolidation of content operations.

Industry reaction was immediate and polarized. Executives at rival media companies and antitrust watchdogs warned that the size and scope of the combined business will invite intense scrutiny from regulators in the United States and the European Union. The merged company would consolidate ownership of major franchises and valuable library content including Game of Thrones, the DC universe, and the Harry Potter catalog, amplifying concerns about market concentration in streaming, vertical control over distribution, and leverage in negotiations with theaters, advertisers, and licensors.

Netflix executives framed the deal as a strategic move to secure long term content rights, accelerate growth in interactive and gaming offerings, and expand theatrical release capabilities tied to marquee franchises. Opponents, including lawmakers and industry groups, countered that the transaction risks reduced competition, higher costs for consumers over time, diminished bargaining power for creators and workers, and potential harm to independent cinemas that rely on open access to blockbusters.

Regulatory review is likely to focus on streaming market share, vertical integration between production and distribution, and the effects on content licensing and consumer choice. Remedies could include divestitures or behavioral conditions, though officials have not announced any specific proposals. The required approvals will include shareholder votes and antitrust clearances, and the spin off of Discovery Global adds a corporate governance step that delays finalization until at least 2026.

The deal marks one of the largest consolidation moves in entertainment history and sets the stage for protracted legal and regulatory engagement. As the parties move from announcement to detailed filings and review, stakeholders from unions and creative communities to theater owners and consumer advocates are preparing for a sustained debate over how to balance innovation and scale with competitive safeguards. Reporting for this package draws on company statements and market sources compiled by multiple Reuters reporters.