Pentagon to invest $1 billion in L3Harris rocket motor spin-off

The Pentagon will take a $1 billion convertible stake in L3Harris's missile propulsion unit to shore up munitions production and back a planned 2026 IPO.

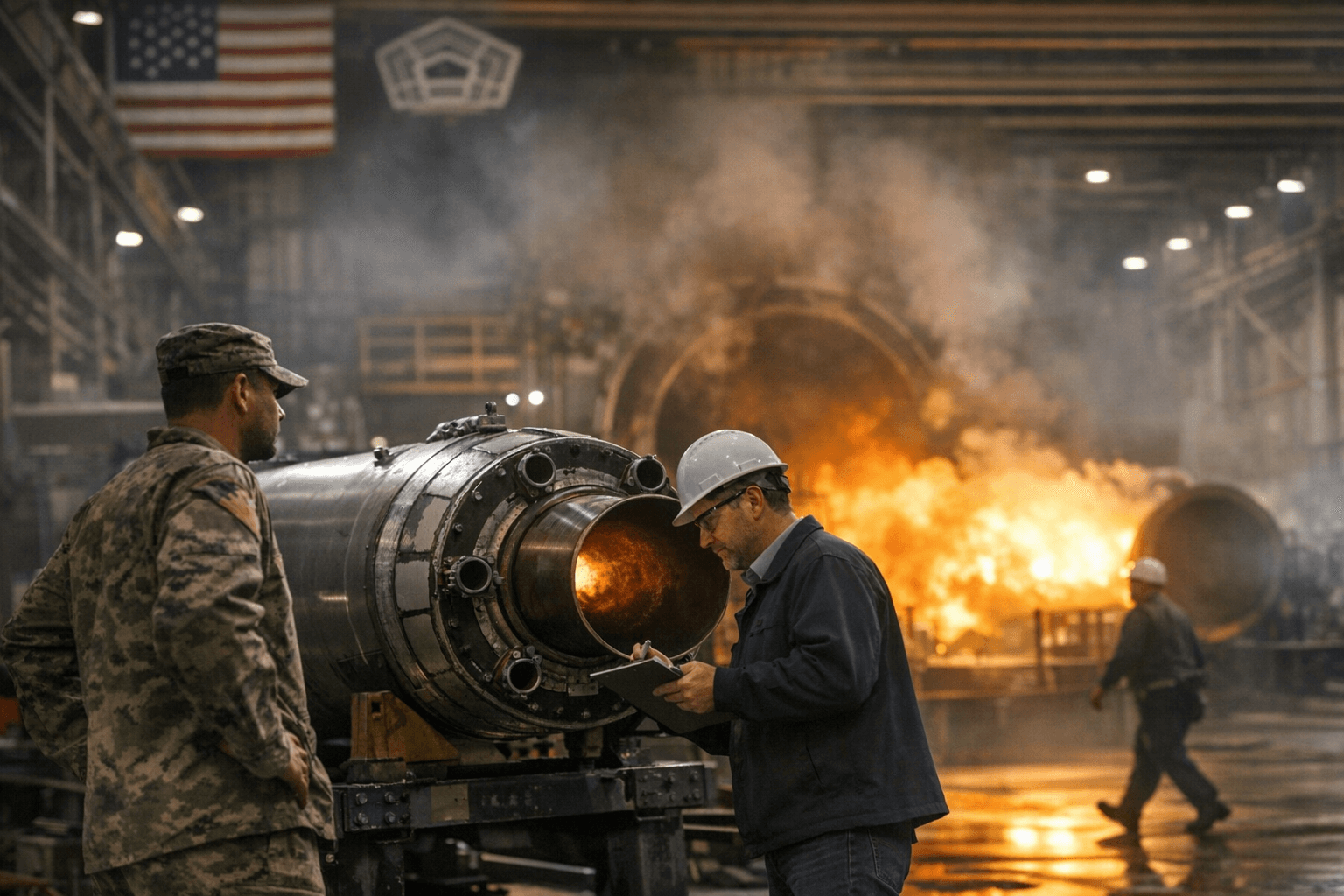

The Pentagon announced a $1 billion convertible-security investment in L3Harris Technologies’ Missile Solutions unit, a move designed to underwrite a planned spin-off and initial public offering of the rocket motor business in the second half of 2026. The department described the financing as the first direct-to-supplier equity-style partnership under its Acquisition Transformation Strategy and Go Direct-to-Supplier initiative.

The investment will take the form of a convertible preferred-type security that will automatically convert into common equity when the carved-out unit completes its IPO. L3Harris will separate missile propulsion into a publicly traded company while retaining majority ownership of the new entity after the spin-off. L3Harris chief executive Christopher Kubasik characterized the investment as "purely an economic investment," saying the Pentagon will not sit on the company's board or manage the business and calling the U.S. government "the ideal strategic partner" to help replenish munitions supply.

Missile Solutions manufactures solid rocket motors used across a range of U.S. and allied systems, with end uses that include Tomahawk cruise missiles, Patriot interceptors and THAAD batteries. The Pentagon framed the equity stake as a way to boost and stabilize domestic production capacity for those components at a moment when U.S. munitions stockpiles are depleted and global demand is rising. Michael Duffey, Under Secretary of Defense for Acquisition and Sustainment, said the move "fundamentally shifts our approach to securing our munitions supply chain" and aims to build a "resilient industrial base" that will allow "the American people to share in its future success." He added the department is not merely "writing a check" but taking an equity position to add capacity.

Market reaction was immediate. Pre-market trading showed L3Harris shares rising as much as 11.4%, and an early-session snapshot recorded an increase of about 2% to $349, reflecting different intraday moments of investor response. Analysts called the structure innovative and potentially shareholder-friendly while emphasizing its strategic intent to accelerate manufacturing. Some observers said the package is likely to address DoD demands for faster munitions production by providing upfront capital for capacity expansion.

The arrangement marks a notable shift in the government's role in the defense industrial base and follows other high-profile public investments in industry, including a roughly 10% federal stake in a major semiconductor firm and targeted investments in critical mineral producers, as well as a recent Pentagon agreement to expand PAC-3 missile production with a major contractor. That broader context underscores a willingness by policymakers to use equity tools alongside traditional contracting to secure supply chains.

The novel direct-to-supplier model also raises governance and procurement questions. Critics warn that a government ownership stake in a supplier that competes for major defense contracts could create perceived conflicts of interest and invite political and regulatory scrutiny. L3Harris retaining majority control will limit the Pentagon's governance role, but oversight of conversion terms, contract awards and board composition after the IPO will be focal points for lawmakers and investors as the deal moves toward completion in 2026.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip