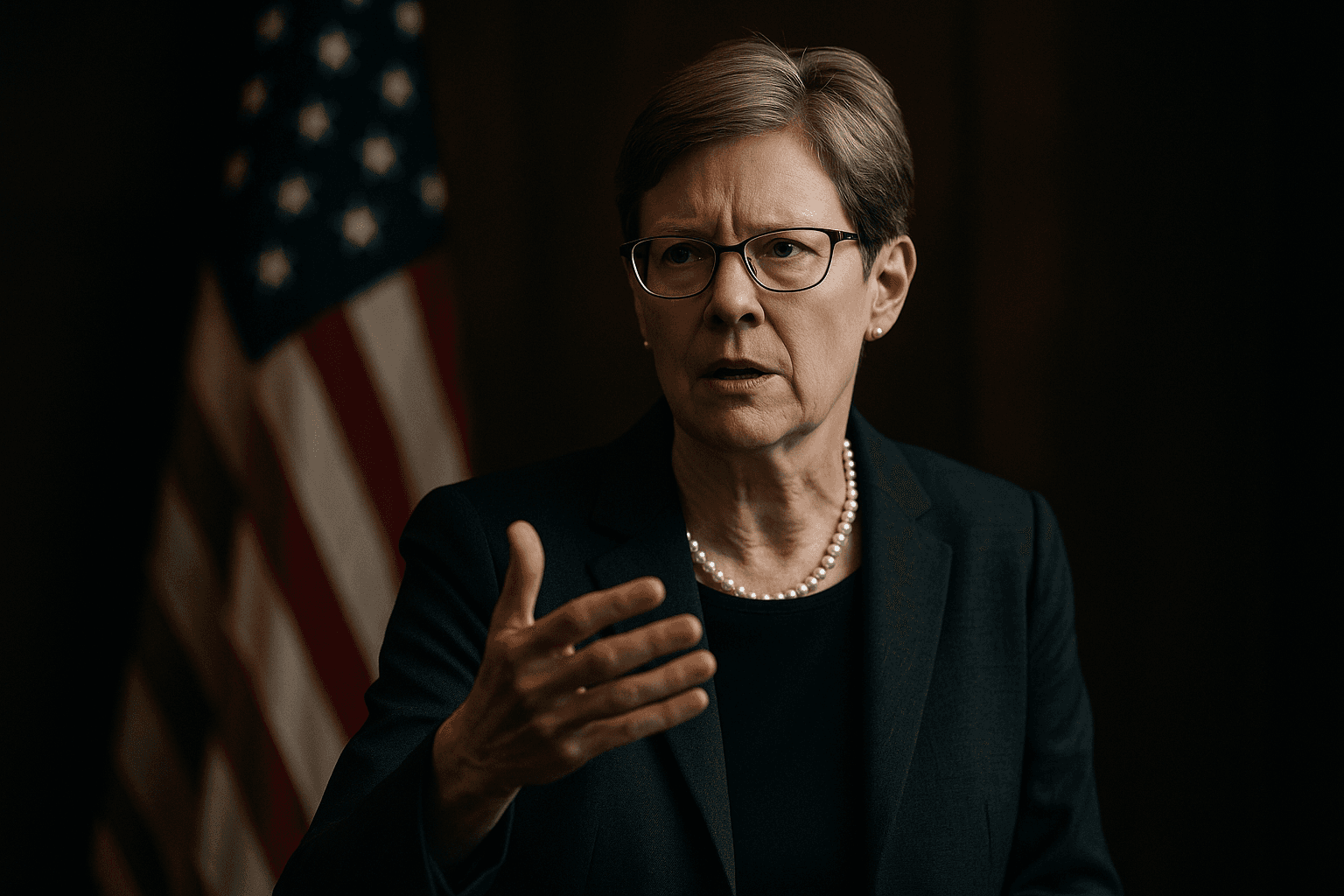

Philadelphia Fed Chief Says Policy Remains Restrictive, Expects Inflation to Cool

Philadelphia Federal Reserve President Anna Paulson told a Wilmington audience that the Fed’s stance, even after recent cuts, is still restrictive and should help bring inflation down, while she voiced greater concern about signs of labor market weakness. Her comments matter because she will join the roster of voting presidents at the January FOMC meeting and could influence whether policymakers pivot further toward easing in 2026.

Anna Paulson, president and CEO of the Federal Reserve Bank of Philadelphia, said on December 12 that the Fed’s current monetary stance remains restrictive and should contribute to easing inflation over the coming year, even as she signaled heightened concern about the labor market. Speaking at an event hosted by the Delaware State Chamber of Commerce in Wilmington, Ms. Paulson described policy as “right around neutral” and added that she “would prefer to be on a slightly more restrictive stance.”

Her comments come after three consecutive Fed rate cuts that have lowered the federal funds target by 75 basis points over recent meetings. Markets that week priced the most recent reduction as a 25 basis point move that set the target range at 3.50 percent to 3.75 percent. Paulson said the easing has removed some insurance against further labor market deterioration, underscoring the balancing act confronting policymakers.

On the tradeoffs facing the Fed, Paulson placed greater weight on downside risks to employment than on upside inflation risks. She said she is “on the margin still more worried about the labor market than inflation,” and added that “on net, I am still a little more concerned about labor market weakness than about upside risks to inflation.” At the same time she acknowledged that inflation remains “too high” and saw a “decent chance that inflation will come down as we go through next year.”

Paulson’s assessment reflects a cautious, data dependent approach as she prepares to take her first turn as a voting member of the Federal Open Market Committee in January under the rotation of regional presidents. She took up leadership of the Philadelphia Fed in July and has delivered a string of economic outlook speeches since taking office, including presentations on October 13 and November 20.

Her framing highlights the internal debate at the Fed after the late 2025 pivot to easing. Some officials argued for holding rates steady, a stance that was reflected in dissent among regional presidents who preferred a more restrictive policy. Kansas City Fed President Jeffrey Schmid warned that inflation remained “too hot,” a view that contrasts with Paulson’s emphasis on guarding against labor market slack. Chicago Fed President Austan Goolsbee has counseled patience, saying policymakers should wait for additional inflation data even as he expected potential cuts next year.

Markets have reacted to the Fed’s three cut moves by reassessing the path of rates in 2026, pricing a range of possible additional easing. Policymakers will face incoming data on wages, job gains, and price measures that will determine whether the Fed stays near current rates, returns to a more restrictive stance, or eases further.

For now Paulson’s message is one of guarded confidence that prevailing policy will help cool inflation, coupled with a modest tilt toward protecting employment. That stance positions her as a pragmatic voice on the committee as it navigates the difficult tradeoff between returning inflation to the two percent target and avoiding unnecessary damage to the labor market.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip