Russian Oil Export Revenues Fall to Lowest Since 2022 Invasion

Russia's receipts from crude and refined fuel exports plunged to $10.97 billion in November, the lowest level recorded since its February 2022 invasion of Ukraine, the International Energy Agency said. The decline reflects falling export volumes, weaker Urals prices, increased Ukrainian strikes on energy infrastructure, and tighter Western sanctions that together raise risks for global supply and Moscow's fiscal position.

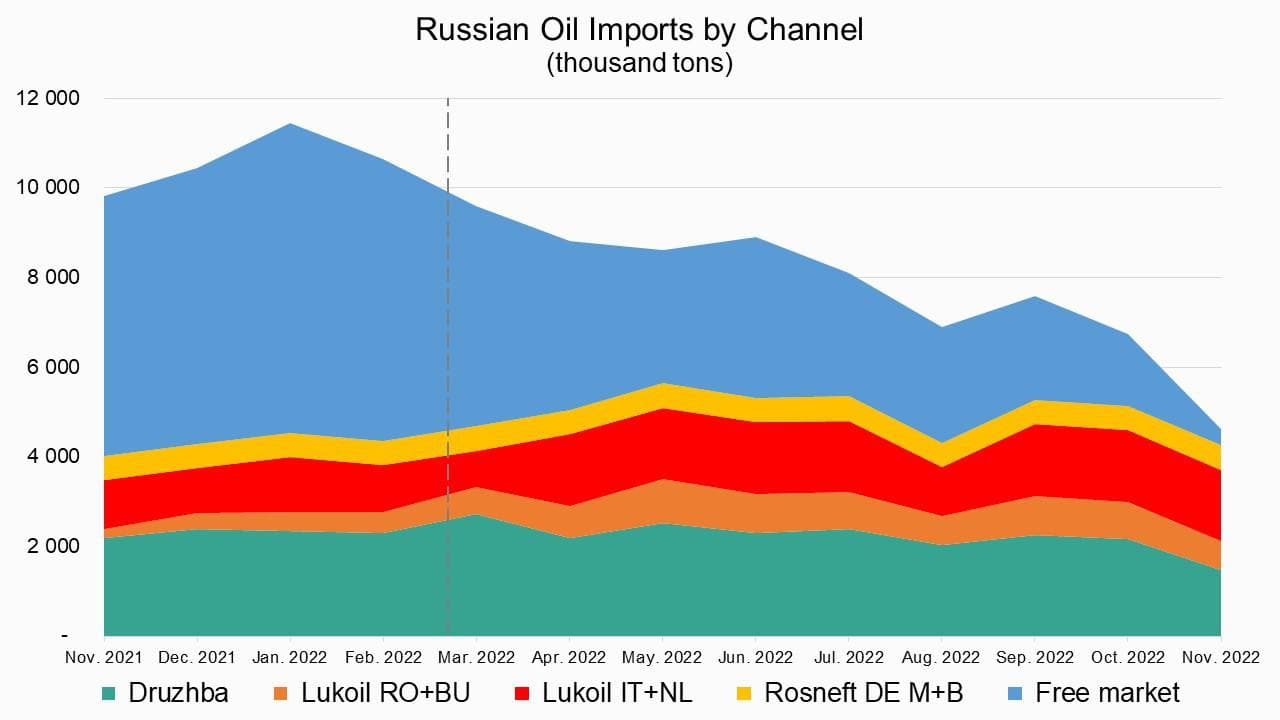

The International Energy Agency reported on Thursday that Russia's revenues from exports of crude oil and refined products dropped to $10.97 billion in November, the weakest monthly intake since the start of the war in Ukraine in February 2022. The IEA attributed the fall to a combination of lower export volumes and softer prices, driven by a rise in Ukrainian drone attacks on refineries and pipelines and the intensification of Western sanctions aimed at major producers such as Rosneft and Lukoil.

Total oil and fuel exports fell by roughly 400,000 barrels per day to 6.9 million barrels per day in November, a sizeable retrenchment from about 7.3 million bpd the previous month. Russia's oil production declined to 9.03 million bpd in November, around 500,000 bpd below the November quota set by the OPEC+ alliance, implying an effective quota near 9.53 million bpd. The gap between production and export volumes points to a combination of lower shipments abroad and greater use of crude in domestic refineries or strategic adjustments in the face of logistical and insurance constraints.

The slump in export revenues matters on multiple fronts. For Moscow, energy export receipts remain a core funding source for the federal budget and foreign exchange buffers. A sustained fall in receipts complicates fiscal calculations ahead of next year's budget, narrowing the space for defense and social spending and raising incentives to seek alternative buyers or to deepen commercial concessions. For markets, the reduction in Russian shipments has ambiguous effects. Lower Russian exports tighten available global supply, a factor that tends to support benchmark oil prices. At the same time, the slide in Urals crude prices suppressed Moscow's income, and buyers have increasingly sought non Russian supplies or demanded steeper discounts to absorb higher logistics and compliance costs.

Sanctions targeted at large Russian producers have constrained the ability of those firms to trade freely with some Western insurers and counterparties. This has added friction to crude loadings and sales, and Ukrainian strikes on refining and pipeline infrastructure have intermittently cut throughput. These operational risks have amplified price weakness for Urals crude, the reference grade for much of Russia's exports, which in turn compressed export proceeds even as global benchmarks remained volatile.

Looking longer term, the IEA data continue a pattern of structural pressure on Russian oil revenues since 2022, driven by restricted access to Western capital and technology, the need to reroute trade flows, and rising geopolitical risk. Moscow has repeatedly sought to offset these headwinds by deepening ties with buyers in Asia and offering substantial discounts. Whether those strategies can sustain export volumes and revenue streams at previous levels will depend on infrastructure resilience, the endurance of sanctions, and how quickly global markets reallocate supply.

Policymakers in consuming countries will watch November's figures closely. The combination of lower Russian exports and persistent geopolitical risk could complicate price forecasts ahead of the winter heating season and shape deliberations over strategic stock releases and engagement with alternative suppliers. The IEA figures underline that Russia's oil sector remains a focal point where military, economic, and market pressures intersect, with implications for global energy security and the Kremlin's fiscal calculus.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip