San Francisco weighs takeover of PG&E distribution assets

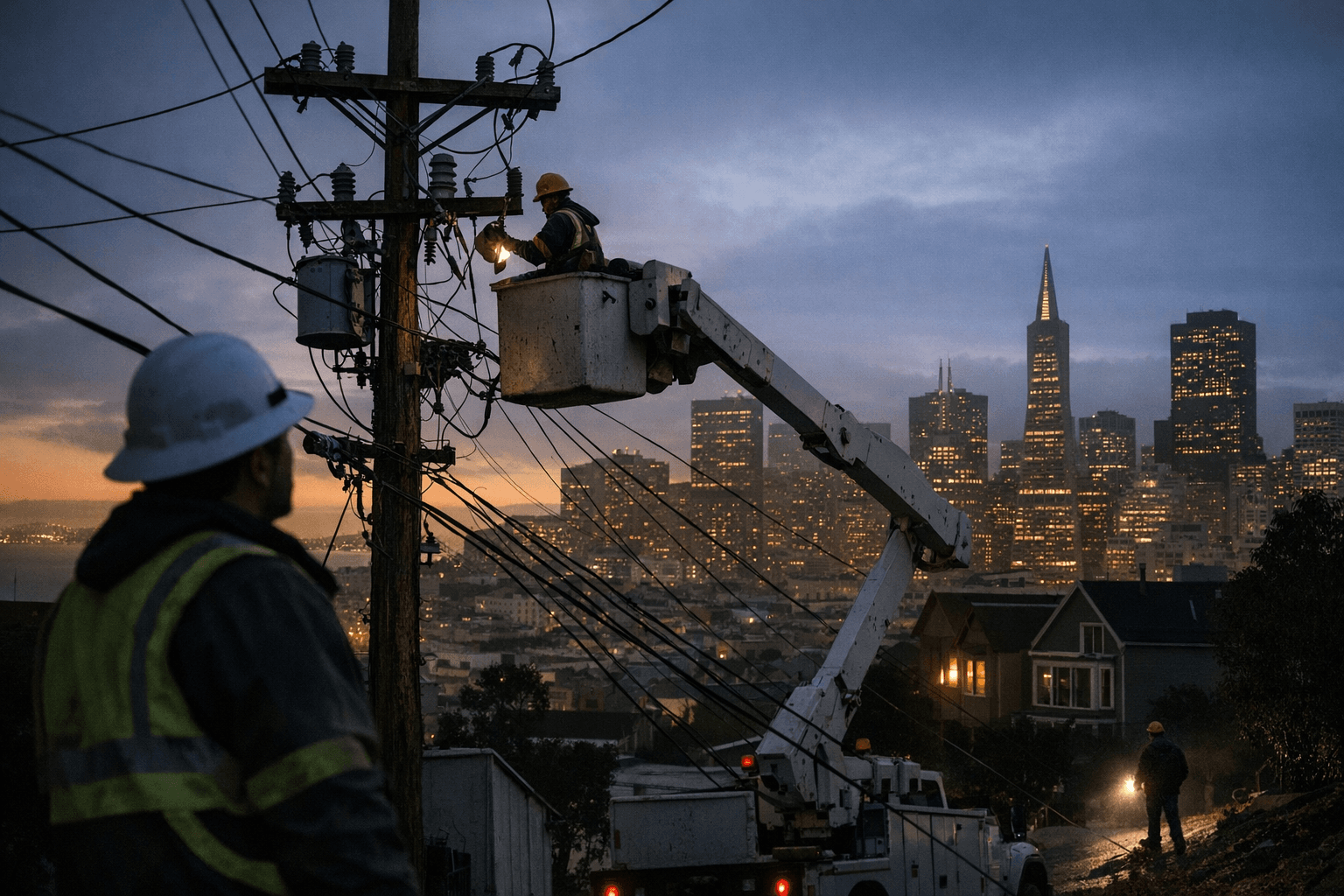

San Francisco moved to acquire PG&E distribution assets after December outages; the decision could affect local rates, reliability and public accountability.

San Francisco renewed its long-running effort to acquire the Pacific Gas and Electric Company electric distribution assets serving the city, a push that accelerated after widespread local outages in December. City leaders argue municipal control could deliver lower rates, targeted reinvestment and clearer local accountability; opponents point to steep up-front costs, legal complexity and risks to remaining PG&E customers. The debate now centers on valuation, regulatory approval and likely court fights that could stretch the process over years.

At the center of the dispute is how to price the distribution system in a way both the city and PG&E would accept. Setting a valuation involves technical appraisals and competing legal theories about fair compensation. Any acquisition would also require a complex regulatory process at the California Public Utilities Commission and leave room for litigation in state or federal courts. Those procedural hurdles make separation administrative as well as political.

San Francisco has a record of prior offers and formal petitions seeking municipal ownership of its distribution network. The renewed interest followed a period of heightened frustration after December outages that catalyzed community concern about reliability and decision-making concentrated in a large investor-owned utility. Proponents frame municipalization as a path to reinvest grid revenues locally, accelerate clean energy investments tuned to the city’s needs, and make elected officials directly accountable for service. Opponents counter that buying the assets would require massive upfront payments that could raise borrowing needs or require difficult trade-offs in city finance, and that costs could be shifted to other PG&E customers in the region while legal uncertainty drags on.

For San Francisco residents the stakes are immediate. Network ownership could change who customers call after an outage, who sets long-term service priorities, and who profits from or reinvests utility revenues. Municipal control would not be an instant fix for reliability problems; constructing a municipal utility, negotiating interconnection agreements and building administrative capacity would take years. Meanwhile, rate impacts remain uncertain: advocates predict savings over time, while critics warn of near-term rate pressure to cover acquisition costs or litigation.

Beyond San Francisco, the outcome could influence other California cities weighing similar moves and could prompt a broader reassessment of PG&E’s investor-owned model. Municipal acquisition would set precedent on valuation standards, regulatory pathways and the political appetite for local control of essential infrastructure at a time when cities worldwide are rethinking how utilities respond to climate-driven disruption.

The takeaway? This will be a long, technical and contentious process with material consequences for your bill and outage response. Our two cents? Track upcoming CPUC filings and city hearings, bring questions to your district supervisors, and expect months of negotiation before anything changes — stay engaged so local priorities shape the next steps.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip