SpaceX Eyes 2026 IPO, Could Seek More Than Twenty Five Billion

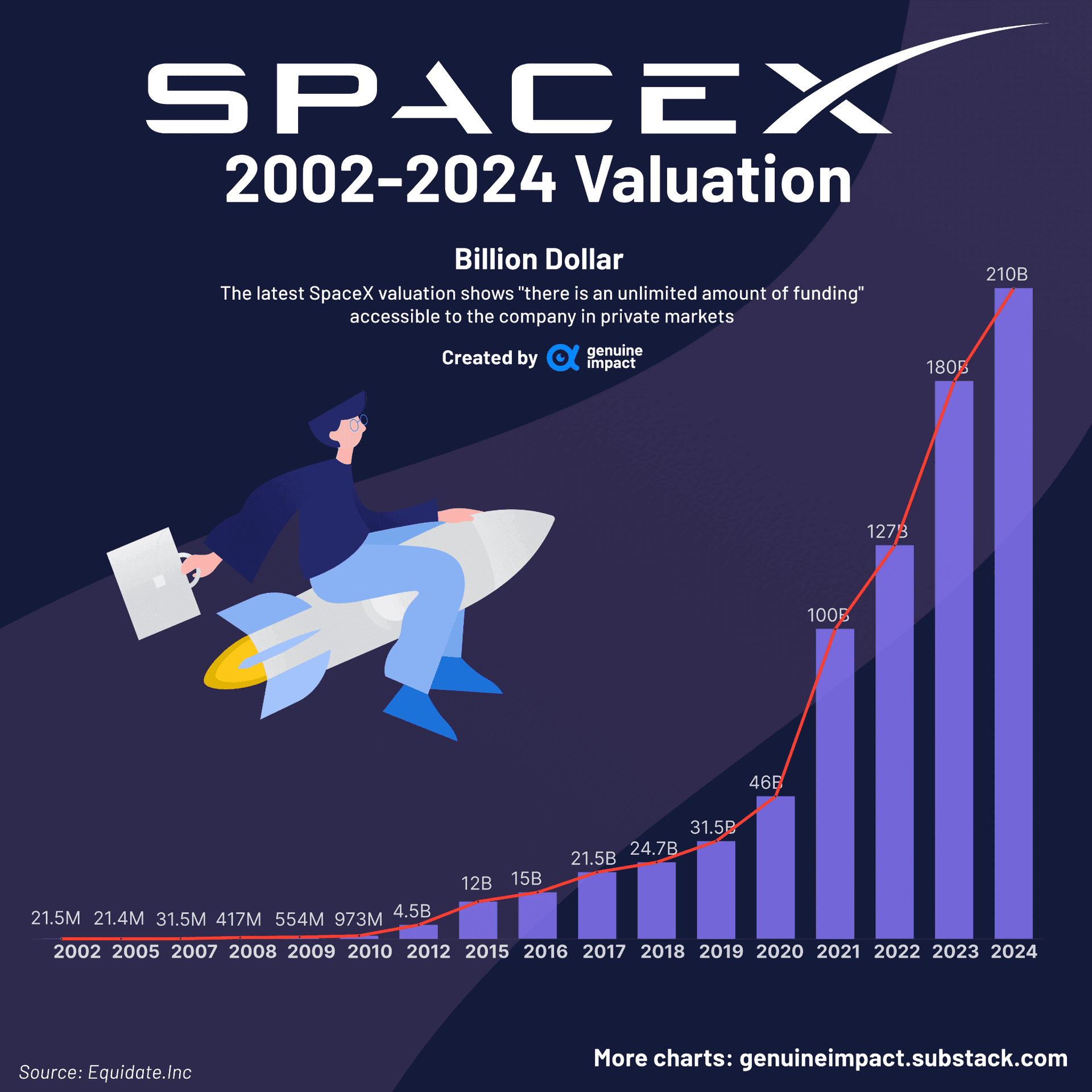

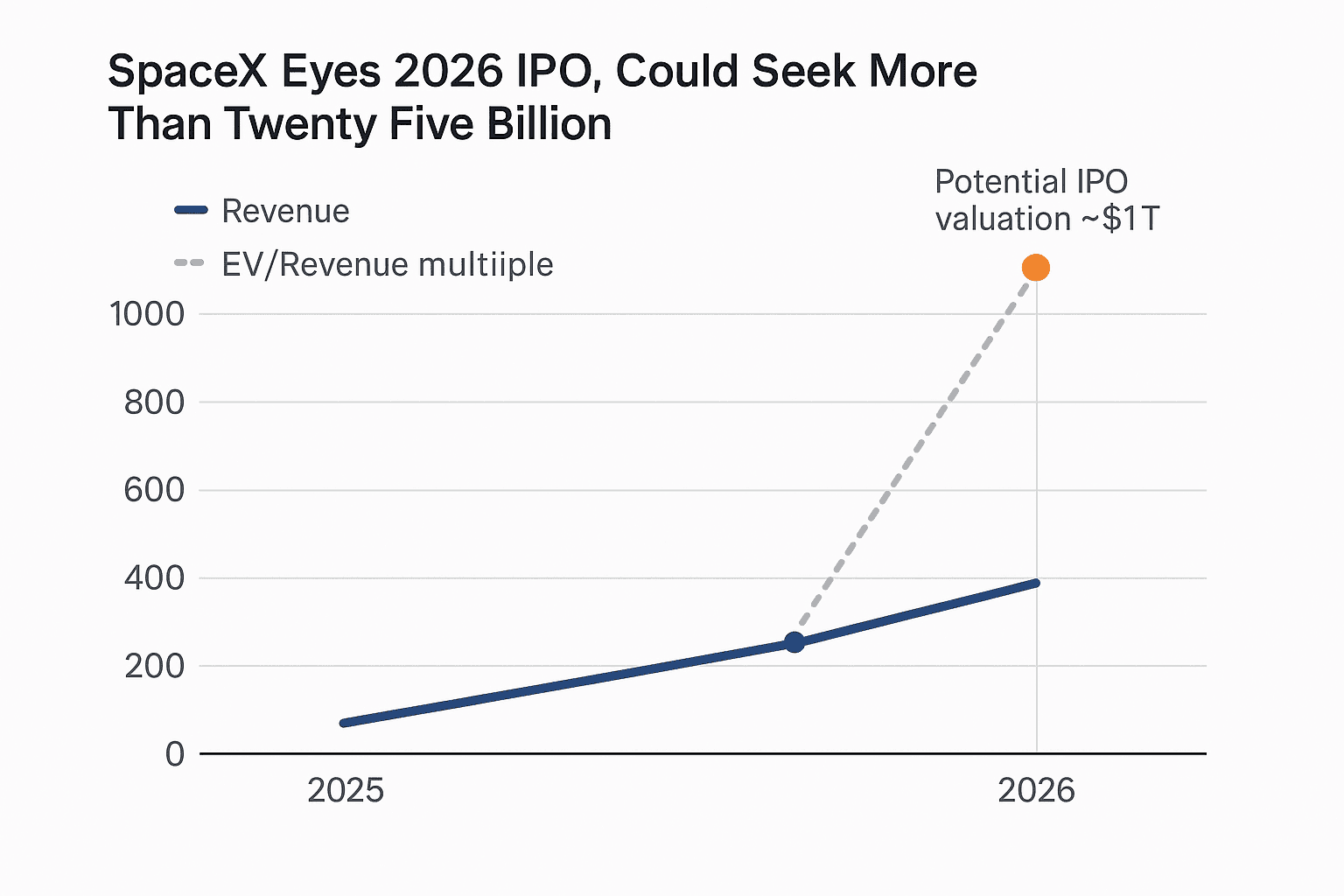

Multiple media reports say SpaceX has begun preparations for an initial public offering in 2026 that could raise more than twenty five billion dollars and value the company at roughly one trillion dollars or higher. The move would hinge on Starlink revenue momentum and market and regulatory conditions, with timing eyed for mid to late 2026.

Multiple media reports, including a Reuters story published Dec. 9, 2025, said SpaceX has started preparations to pursue an initial public offering in 2026 that could raise more than twenty five billion dollars and could value the company at roughly one trillion dollars or higher. Discussions with investment banks are reported to be underway, with timing being eyed for mid to late 2026 though plans remain fluid and contingent on market and regulatory conditions.

The prospective IPO would be among the largest ever if it reaches the sums under discussion. Central to the proposal is Starlink, the satellite broadband arm whose rapid revenue expansion has become the clearest path to public markets for the company. Reuters noted projected Starlink revenue climbing from roughly fifteen billion dollars in 2025 to between twenty two and twenty four billion dollars in 2026. At a one trillion dollar valuation, that implies an enterprise value to revenue multiple in excess of forty times on 2026 sales, highlighting investor expectations for sustained high growth and significant margin improvement.

SpaceX has also flagged ambitions beyond connectivity, including plans for space based data center projects that would leverage its satellite and launch capabilities to address cloud computing demand in novel ways. Those projects, if advanced at scale, would be capital intensive and provide context for a large IPO raise as a means to fund both Starlink expansion and longer term infrastructure investments.

Market implications would be broad. A public offering of this magnitude would reshape the landscape for technology and aerospace investment by creating a new, highly visible public vehicle for space commerce. It would also provide liquidity to early investors and employees and recalibrate private market valuations for late stage venture and private equity positions in aerospace and satellite communications. The potential raise of more than twenty five billion dollars would rival some of the largest capital market transactions in history, while a roughly one trillion dollar valuation would place SpaceX among the select group of companies with trillion dollar value in public markets.

Timing and structure remain open. Elon Musk has previously signaled that parts of SpaceX, notably Starlink, could be floated once revenue stabilizes. Sources emphasized that any plan is subject to change and must clear regulatory reviews, which for satellite and national security related activities can add complexity. Market conditions in 2026, including investor appetite for long duration growth stories and the interest rate environment, will also be decisive.

For policymakers and regulators, the potential listing raises questions about oversight of critical infrastructure and foreign investment in satellite networks, even as it promises to accelerate private sector investment in orbital capabilities. For investors, the proposed IPO presents a high risk high reward proposition that would test appetite for stretched growth multiples in a nascent commercial space economy.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip