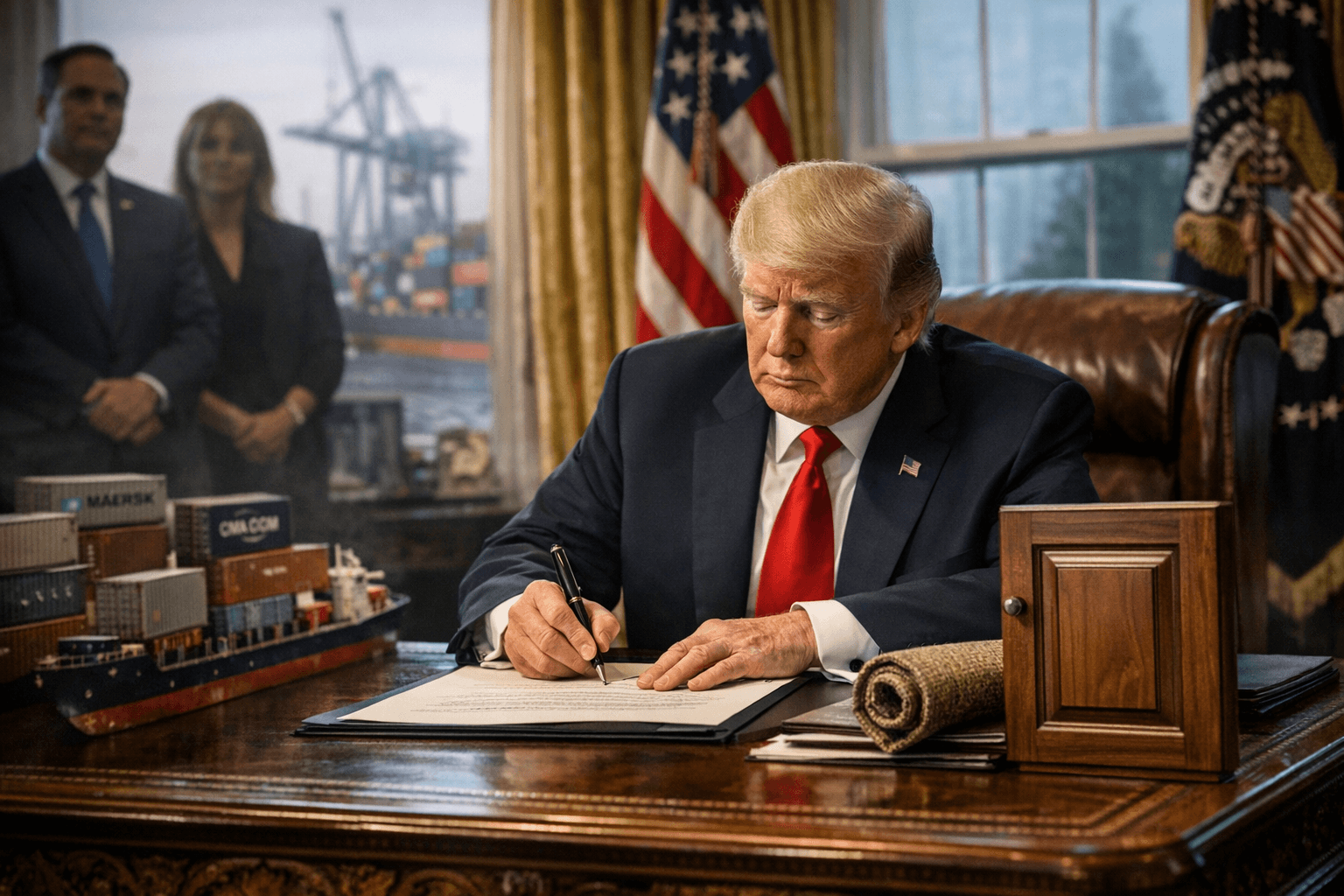

Trump Delays Furniture and Cabinet Tariff Hikes for One Year

President Donald Trump signed a Dec. 31, 2025 proclamation postponing planned increases in tariffs on imported upholstered furniture, kitchen cabinets and bathroom vanities, keeping the 25% rate in place through 2026. The delay buys time for negotiations with trade partners and reduces immediate price pressure for consumers and importers, while leaving the ultimate policy outcome contingent on talks and future presidential action.

President Donald Trump signed a proclamation on Dec. 31, 2025, that delayed for one year planned increases to tariffs on imported upholstered furniture, kitchen cabinets and bathroom vanities. The move preserved the 25 percent tariff level the administration imposed in September 2025 and, in effect, deferred a scheduled rise to 30 percent on certain upholstered wooden products and a jump to 50 percent on cabinets and vanities that had been set to take effect Jan. 1, 2026. Those higher rates are now slated to be implemented around Jan. 1, 2027 unless the president or negotiators change course.

The White House framed the delay as a tactical step to advance diplomacy on wood-product imports, issuing a fact sheet that said: “Given the ongoing productive negotiations regarding the imports of wood products, the President is delaying the tariff increase to allow for further negotiations to occur with other countries.” A related administration statement added that “the United States continues to engage in productive negotiations with trade partners to address trade reciprocity and national security concerns with respect to imports of wood products.” The administration has defended the levies generally as measures to “bolster American industry and protect national security.”

For importers, retailers and consumers, the immediate effect is predictable: goods in the affected categories will continue to face a 25 percent duty rather than the steeper increases that threatened to raise retail prices and squeeze supply chains at the start of the new year. Businesses that had accelerated imports to beat the Jan. 1 deadline will now face different planning considerations, while those that delayed purchases amid uncertainty gain a temporary reprieve. Manufacturers of domestic wood products and related industries will watch negotiations closely; any agreement that further postpones or alters the levies could shift competitive dynamics and investment decisions.

The postponement is the latest adjustment in a sequence of tariff actions since the president returned to office in 2025. That pattern of rapid announcements, delays and reversals has contributed to uncertainty for firms that import components and finished goods and for consumers facing higher prices. The administration links the measures to broader goals of trade reciprocity and national security, and it has signaled that the tariff timeline remains contingent on diplomacy and bargaining outcomes.

Politically, the step reduces near-term pressure from rising costs that had become a voter concern in some regions. It also leaves open the possibility of future leverage in talks with trading partners: by setting higher rates as a potential default for 2027, the administration maintains bargaining power while offering a concession that may be traded for commitments on wood-product exports or other concessions.

Going forward, the policy direction will depend on the progress of negotiations and any subsequent presidential action. Importers and buyers should prepare for the possibility that higher tariffs could be reinstated in 2027 or altered as part of negotiated agreements, while observers of trade policy will watch whether this delay presages more durable settlements or further episodic adjustments.

Know something we missed? Have a correction or additional information?

Submit a Tip