Trump urges Treasury inquiry into Biden autopen use for Fed appointments

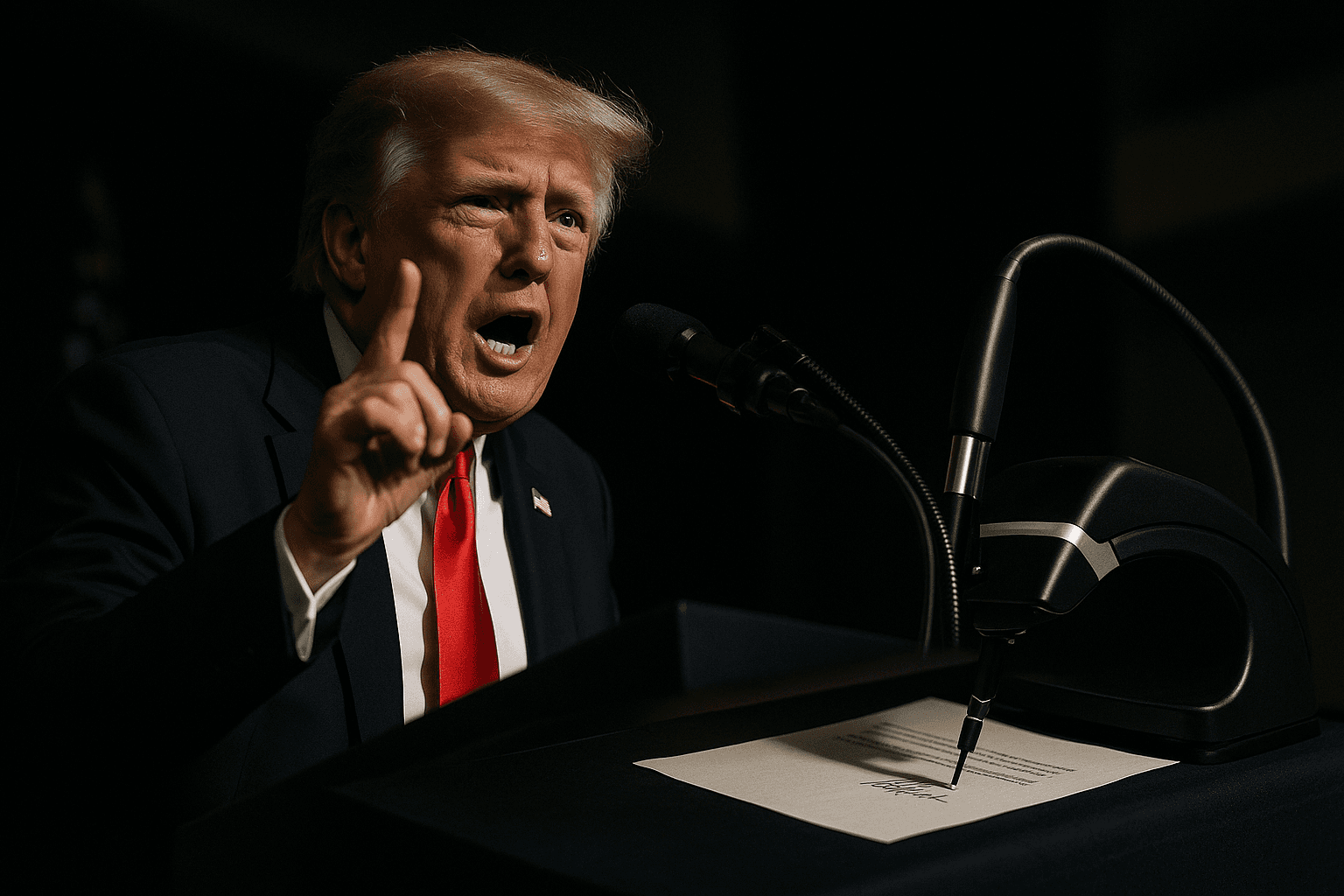

At a December 9 rally in Mount Pocono, President Donald Trump asked Treasury Secretary Scott Bessent to investigate whether President Joe Biden used an autopen to sign Federal Reserve Board of Governors appointments, suggesting the moves could be legally challengeable. The claim revives a recurring controversy over mechanical signatures, while legal experts say the autopen is an accepted tool and that successful challenges face substantial legal obstacles.

At a campaign rally in Mount Pocono, Pennsylvania on December 9, President Donald Trump publicly asked Treasury Secretary Scott Bessent to open an inquiry into whether President Joe Biden used an autopen, a mechanical signature reproduction device, to sign appointments to the Federal Reserve Board of Governors. Trump framed the request as raising potential legal questions about the validity of those appointments and suggested they could be challenged in court.

The request continues a pattern in which autopen use has surfaced in political debate. Trump previously raised similar concerns about autopen use in the context of presidential pardons and other documents. The autopen issue has periodically drawn attention as administrations have relied on mechanical signature devices to execute routine paperwork when the president is unavailable.

Legal scholars and practitioners who have publicly analyzed autopen controversies say the device has long been an accepted tool for presidential signatures and that pursuing successful litigation will be difficult. Challenges to the validity of executive actions based on signature method must meet substantial procedural hurdles, including establishing concrete legal injury or standing, and overcoming precedent that treats autopen signatures as authentic for the purpose of effectuating official acts. Those obstacles make immediate, high stakes litigation unlikely to succeed.

The Treasury request, as voiced by Trump, raises institutional questions about the appropriate venue and authority for such an inquiry. Appointments to the Federal Reserve Board involve nomination by the president and confirmation by the Senate. The legal effect of a signature on formal commission paperwork is rarely litigated, and questions about signature authenticity typically involve legal adjudication rather than administrative investigation. It is unclear what investigatory remit the Treasury Department would assert or how any findings would translate into judicial or congressional action.

The stakes are not only legal but institutional. Federal Reserve Board members set monetary policy and their participation in votes can shape interest rate decisions, oversight, and regulatory priorities. If appointees were found to lack valid commissions, the result could create procedural uncertainty for past votes or future policy actions, potentially disrupting market confidence and complicating governance at the central bank. Those outcomes remain hypothetical, since legal experts emphasize the difficulty of overturning confirmed appointments on the basis of signature technique alone.

Politically, the episode underscores ongoing tensions between the executive branches and the role of public questions about procedural propriety in high profile appointments. The public request to the Treasury adds a new dimension to partisan scrutiny of administrative practices, and it may prompt Republican oversight efforts or Democratic defenses in Congress and the courts. For observers of governance and civic processes, the dispute highlights how procedural claims can be mobilized to contest institutional legitimacy and to pressure administrative actors.

In the days ahead, the White House, the Treasury Department and potentially the Justice Department may clarify whether any formal investigation will proceed and what standards of review would apply. Given the established uses of autopen technology and the legal barriers to successful challenges, analysts expect the matter to play out more as a political flash point than as a likely source of immediate judicial overturning of Federal Reserve appointments.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip