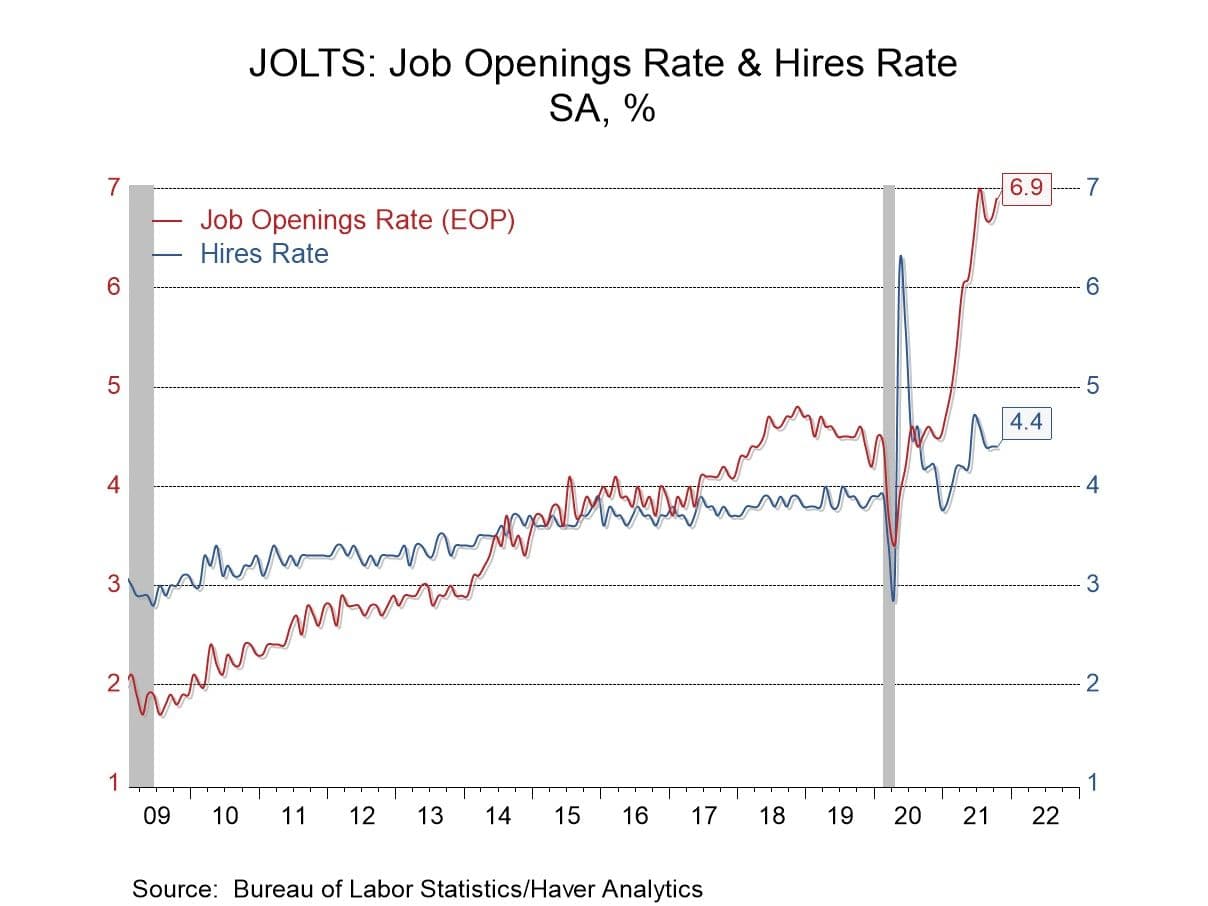

U.S. job openings edge up, hiring falls, signaling cooling labor market

The Labor Department reported a modest rise in job openings to 7.670 million in October while hires plunged, underscoring a softer labor market. The pattern of rising vacancies but weaker hiring and fewer quits matters to workers, markets, and Federal Reserve policymakers as they weigh the path for interest rates.

The Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey showed job openings rose by 12,000 to 7.670 million in October, while the number of hires fell by 218,000 to 5.149 million, according to the report released on December 9. Economists had expected a smaller openings figure, and the data reflected a broader cooling pattern in the labor market after the surge in vacancies that followed the pandemic.

The October numbers included delayed September data that had been held up by the recent federal government shutdown, a timing issue that analysts said complicated month to month comparisons but did not alter the larger signal. Taken together the October results point to weaker flows from vacancy to hire, with roughly 0.67 hires for every job opening based on the two series. That ratio highlights a looser matching process between employers and workers than in the tightest phases of the recovery.

Fewer quits, which the report also registered, reinforced the picture of reduced worker mobility and lower bargaining leverage. Quits are a key indicator of worker confidence in finding new jobs, and a decline tends to precede slower wage growth. Employers appear to be more cautious about filling roles, while workers are more cautious about leaving current jobs, creating what many observers describe as a no hire no fire equilibrium across large parts of the economy.

The report is consequential for financial markets and monetary policy. The Federal Reserve has tracked labor market momentum closely as it considers whether to ease policy from the restrictive stance implemented over the past two years. A slowdown in hiring and declining quits can reduce inflationary pressure via softer wage growth, potentially diminishing the urgency for rate increases. At the same time, persistent vacancies, even at lower levels than their pandemic era highs, mean the labor market is not yet clearly slack enough to guarantee a swift fall in inflation.

For businesses, the mix of sustained openings and weaker hiring raises operating questions. Firms facing unfilled roles may invest more in automation or task reallocation, while others may slow expansion plans. For workers, the shift could mean fewer opportunities to trade up quickly and a longer runway for employers to demand higher productivity in exchange for pay gains.

Long term, the data fit into a multi year trend away from the extraordinary hiring dynamics of 2021 and 2022 toward a more normalized labor market. Policymakers will monitor upcoming employment reports, including payroll gains and the unemployment rate, as well as continued JOLTS releases, to assess whether the current cooling is temporary or the start of a sustained easing in labor market tightness.

Sources:

Know something we missed? Have a correction or additional information?

Submit a Tip